You are here: SKB Home » HRMS Payroll » hrmsprocguide » MRA PRGF Contribution Rates

MRA PRGF Contribution Rates

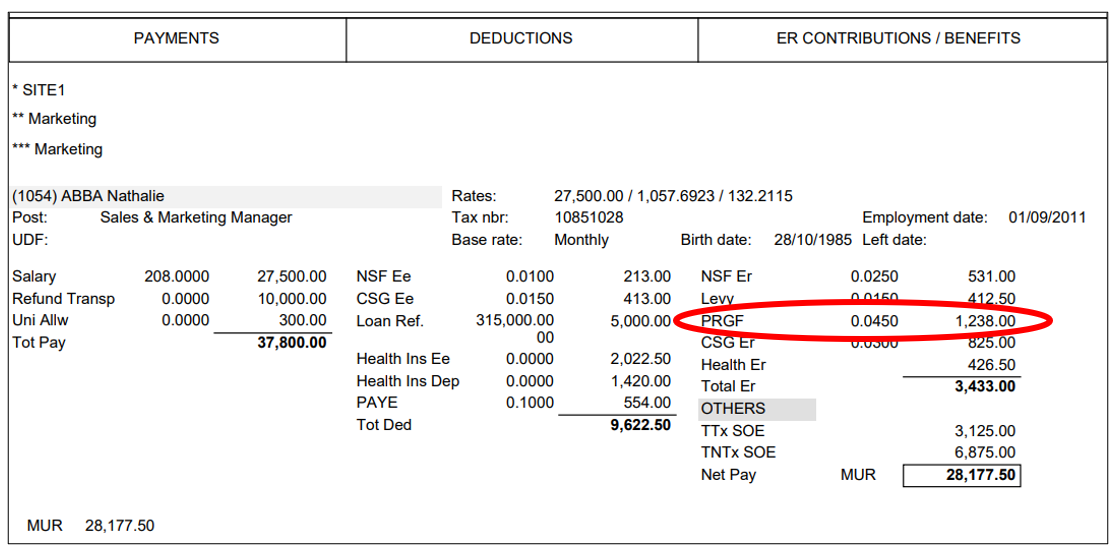

Employers are required to pay PRGF contributions at the rate of 4.5 % of the monthly remuneration of each worker. However, Small and Medium Enterprises (SME) will pay PRGF at a lower rate for the first three years, the difference being met by Government from a seed capital earmarked for that purpose. The PRGF rate, applicable on monthly remuneration, is based on the annual turnover of the SME. Visit the website of the MRA for more information.

Prerequisites for PRGF Returns on Sicorax HRMS Payroll

Sicorax HRMS Payroll automatically updates the PRGF Contribution Rate to 4.5% for all companies. Before exporting the PRGF Returns from Sicorax HRMS Payroll, it is compulsory to update the below before performing payroll calculation of the month.

After payroll calculation is performed, Sicorax HRMS Payroll will automatically calculate the PRGF contribution for the selected employees based on the Monthly Remuneration, where Monthly Remuneration is defined as the total sum paid monthly to a worker made up of:

- the monthly basic wage

- any productivity bonus

- any attendance bonus and

- any payment for extra work performed

The following must be updated before performing payroll calculation:

* Company PRGF Rate (Small and Medium Enterprises (SME) ONLY) * Employees PRGF Contribution flag and Pension scheme flag * Payments & Deductions PRGF mapping

Update Company PRGF Rate (Small and Medium Enterprises (SME) ONLY)

For Small and Medium Enterprises (SME), you are required to contact MRA to obtain the PRGF rate. The rate must be manually inserted as per the below instructions.

Note: As per MRA requirement, after a specific number of years this special rate is not applicable. Therefore, you must manually set the company PRGF Rate to zero therefore, the normal PRGF Contribution Rate of 4.5% will automatically apply.

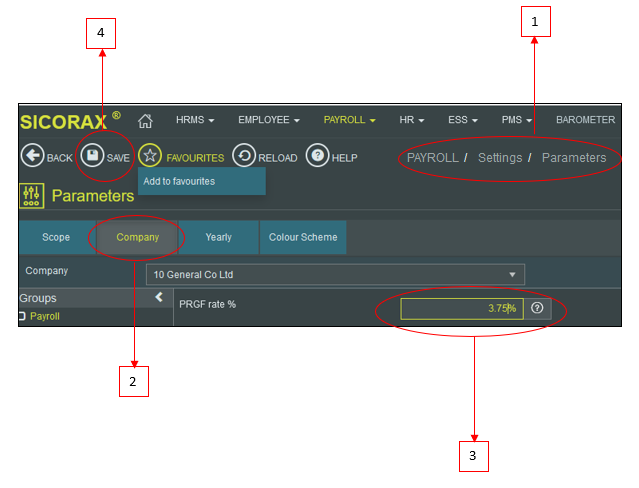

- Step 1: Go to Payroll/Settings/Parameters

- Step 2: Click Company Tab

- Step 3: Insert PRGF Contribution Rate % as per MRA requirement

- Step 3: Click Save

Automatic Employee PRGF Contribution Flag (for new recruits)

To auto-activate employee's PRGF Flag while creating new recruits, follow the steps below:

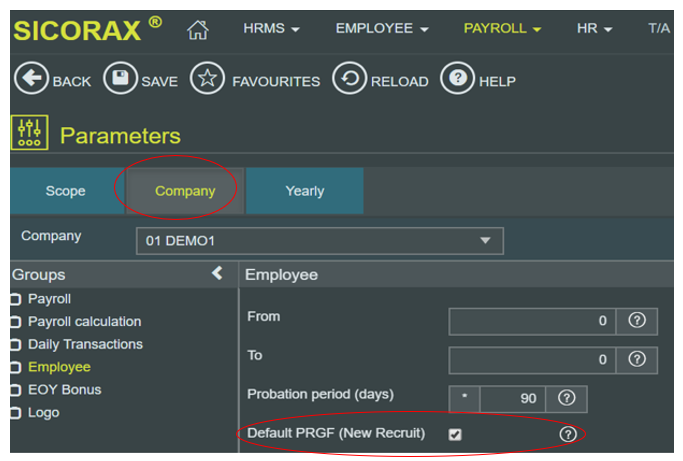

- Step 1: Go to Payroll/Settings/Parameters

- Step 2: Click Company Tab

- Step 3: Select Default PRGF (New Recruit) flag

- Step 4: Click Save

Update Employees PRGF Contribution flag and Pension Scheme flag (in bulk)

To update employees PRGF flag and Pension Scheme flag in bulk, use the steps below. (As per the MRA's requirement, employees Pension scheme flag must also be updated).

- Employee PRGF Flag, if activated, indicates that the employer contributes to the PRGF for the employee

- Pension Scheme Flag, if activated, indicates retirement benefits of the employee are payable under the Statutory Bodies Pension Funds Act; or in accordance with a private pension scheme.

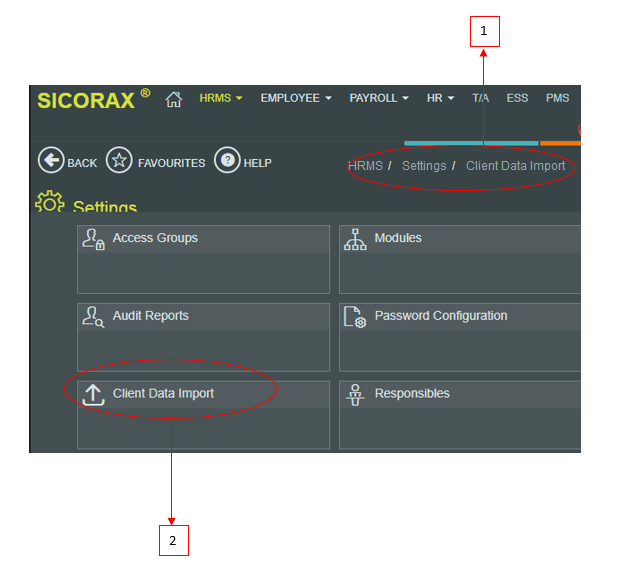

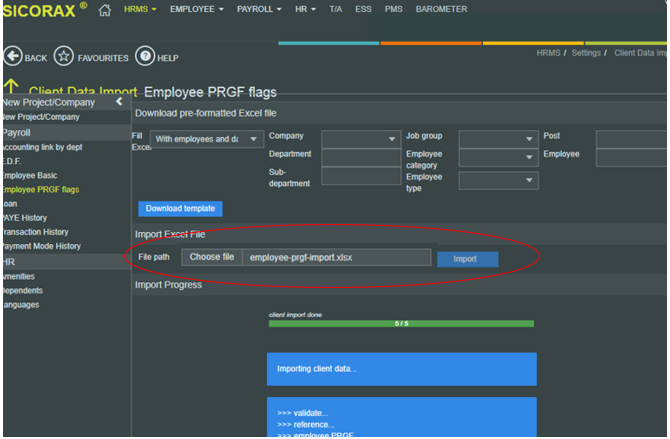

- Step 1: Go to HRMS/Settings

- Step 2: Click Client Data Import

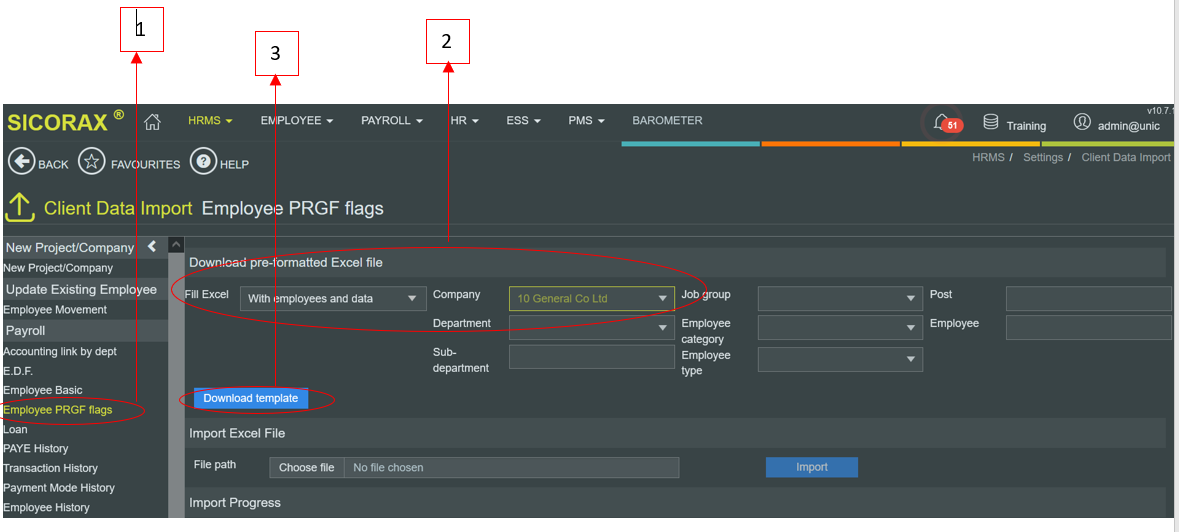

- Step 1: Click Employee PRGF Flag

- Step 2: Choose Fill Excel with Company Data and Choose Company from the drop-down list

- Step 3: Click Download template button

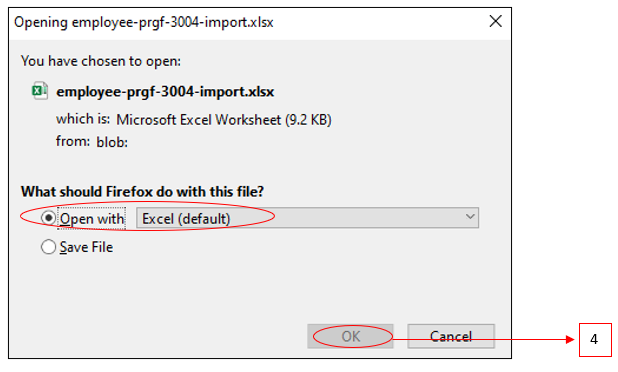

- Step 4: Click Ok to open the Excel template

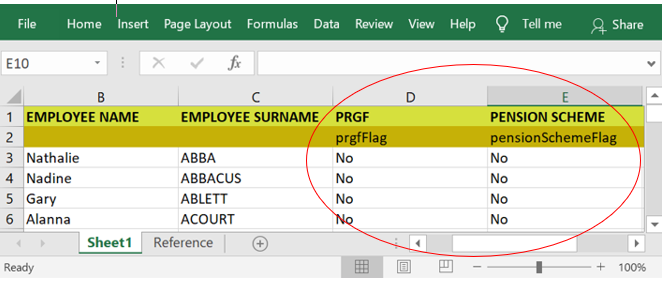

- Step 5:The above steps generate an Excel file which consists of a list of active and leavers of the month where the PRGF and Pension Scheme Flags of the employees must be updated.

- Save the Excel file to a location

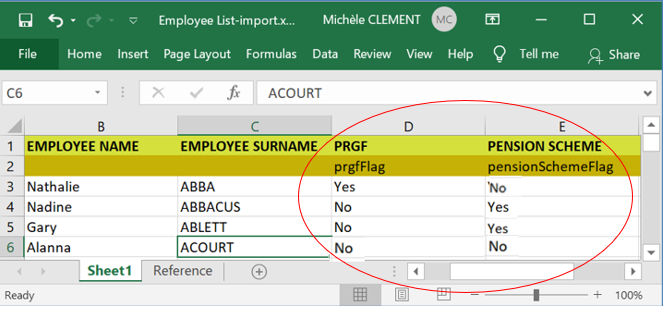

- Step 6:On the Excel file, update columns PRGF Flag and Pension Scheme Flag for the respective employees

- Pension Scheme Flag with values YES or NO - Where YES indicates that the retirement benefits of the employee are payable under the Statutory Bodies Pension Funds Act; or in accordance with a private pension scheme.

- PRGF Flag with values YES or NO - where YES indicates that the employer contributes to the PRGF for the employee.

- After the Excel file is updated, Save and close the file

- Step 7: Choose the Excel File from it's location and Import

- To view the result of the import, go to Employee List as shown above.

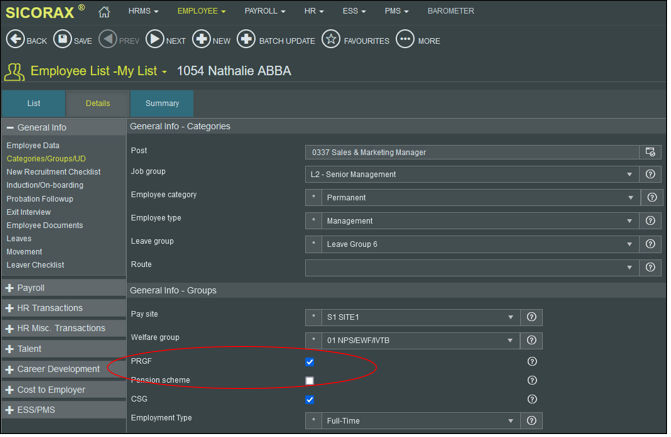

Update Employees PRGF Contribution flag (by employee)

To update employees PRGF flag and employees Pension scheme flag by employee, follow the steps below:

- Step 1: Go to Employee List, Activate PRGF Flag and Pension Flag (as per requirement)

- Step 2: Click Save

- Step 3: Click Next (to update PRGF flag and employees Pension scheme flag for the next employee)

Criteria for No PRGF Contribution

As per the MRA PRGF guide of March 2022, No PRGF contribution is applicable to the following:

* (a) A worker who has not attained the age of 16;

- Based on the employee's date of birth, the payroll system automatically caters for no PRGF contribution hence, employee will automatically not appear on the Monthly PRGF Return

* (b) A public officer or a local government officer;

- On the masterfile, the payroll user must deactivate employee's PRGF flag hence, no PRGF contribution will be calculated and employee will not appear on the Monthly PRGF Return

* © A worker who draws a monthly basic wage or salary of more than Rs. 200,000;

- Based on the employee's monthly basic wage or salary, the payroll system automatically caters for no PRGF contribution hence, employee will automatically not appear on the Monthly PRGF Return

* (d) A worker for whom the employer is contributing to a private pension scheme approved by the Financial Services Commission (FSC);

- On the masterfile, the payroll user must deactivate employee's PRGF flag and activate employee's Pension Scheme flag hence, no PRGF contribution will be calculated. However, only for the first month, the employee will automatically appear on the Monthly PRGF Return with remuneration zero and PRGF amount zero and value 'Y' (yes) for private pension scheme

* (e) A worker whose retirement benefits are payable under the Statutory Bodies Pension Funds Act or the Sugar Industry Pension Fund Act;

- On the masterfile, the payroll user must deactivate employee's PRGF flag hence, no PRGF contribution will be calculated and employee will not appear on the Monthly PRGF Return

* (f) A person under a contract of apprenticeship regulated under the Mauritius Institute of Training and Development Act;

- On the masterfile, the payroll user must deactivate employee's PRGF flag hence, no PRGF contribution will be calculated and employee will not appear on the Monthly PRGF Return

* (g) A person taking part in a training scheme set up by the Government or under a joint public-private initiative with a view to facilitating the placement of jobseekers in gainful employment;

- On the masterfile, the payroll user must deactivate employee's PRGF flag hence, no PRGF contribution will be calculated and employee will not appear on the Monthly PRGF Return

* (h) A non-Mauritian citizen worker or a migrant worker;

- On the masterfile, the payroll user must deactivate employee's PRGF flag and deactivate Citizen Flag on Employee's EDF hence, no PRGF contribution will be calculated and employee will not appear on the Monthly PRGF Return

* Note: PRGF Contributions are payable as from the month in which a worker takes up employment whether on a part-time, full time or casual basis and whether on probation or not. PRGF contributions are also payable for a person performing atypical work as well;

- On the masterfile, the payroll user must activate employee's PRGF flag hence, PRGF contribution will be calculated and employee will appear on the Monthly PRGF Return

Update Payments & Deductions PRGF mapping

It is compulsory to update the mapping of all payments & deductions which are related to the PRGF and which are based on the Monthly Remuneration, where monthly remuneration is defined as the total sum paid monthly to a worker made up of:

- the monthly basic wage

- any productivity bonus

- any attendance bonus and

- any payment for extra work performed, follow the below steps.

- For queries on PRGF payments & deductions mapping, please call the MRA

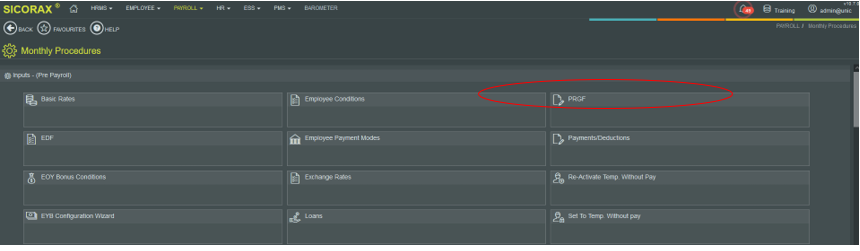

- Step 1: Payroll/Monthly Procedures

- Step 2: Click PRGF icon

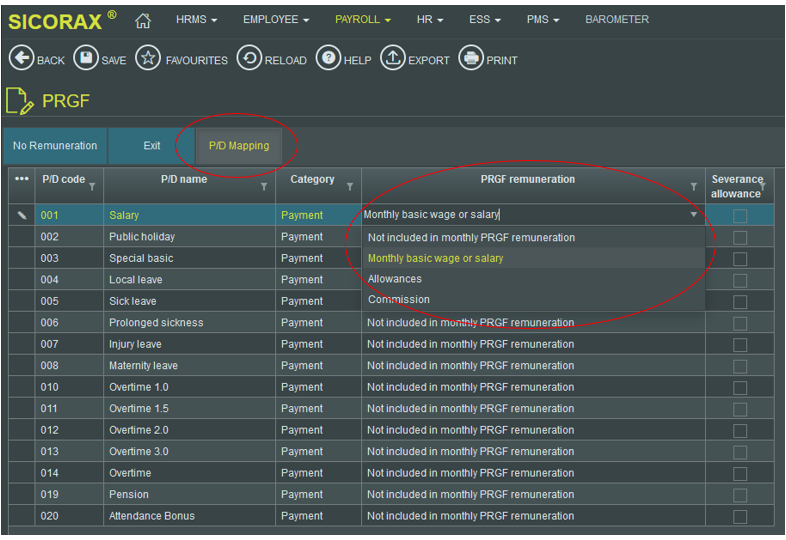

- Step 3: Click PD Mapping Tab

- Step 4: E.g for the payroll item Salary, choose the PRGF value from the list

- Step 5: Click save

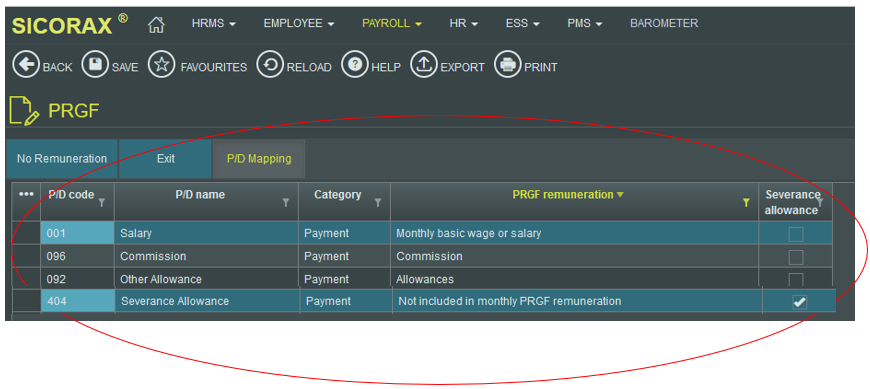

- It is compulsory to repeat steps 4 to 5 for all payments & deductions which are related to the PRGF * . You will find below additional illustrations for:

- Commission and

- Allowances and

- Severance Allowance

- Concerning Severance Allowance. (As per the MRA, this is the amount already paid to worker as severance allowance/compromise agreement excluding PRGF contributions under Sec 71(1) © of WRA)

PRGF Contribution on Payroll Checklist (After payroll calculation)

After payroll calculation is performed, PRGF Contribution will appear as follows on the payroll detailed checklist