You are here: SKB Home » HRMS Payroll » hrmsprocguide » Tax on Tax/Tax Benefit (Fiscal Year 2023-2024)

Table of Contents

Tax on Tax/Tax Benefit (Fiscal Year 2023-2024)

- Tax Benefit: An employee enjoys a tax benefit when his tax liability is borne by his employer. This tax benefit is treated as a fringe benefit and is valued according to the specific Regulations to the Act.

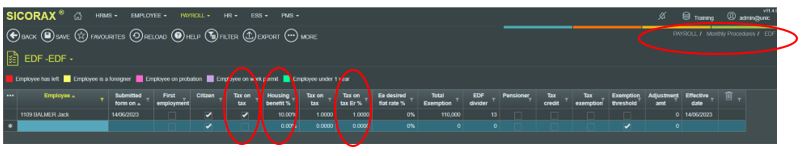

How to activate the required flags and % for the purpose of Tax Benefit for an employee who has submitted an EDF

- Step 1: Go to Payroll

- Step 2: Monthly Procedures

- Step 3: EDF

- Step 4: Choose the employee’s record

- Step 5: Activate Tax on Tax Flag

- Step 6: Insert the required % for Housing benefit

- Step 7: Activate Tax on Tax Er %

- Step 8: Click Save

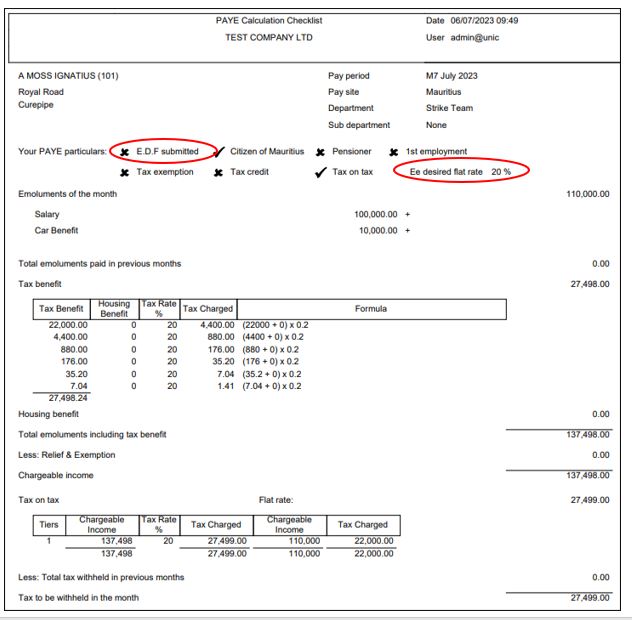

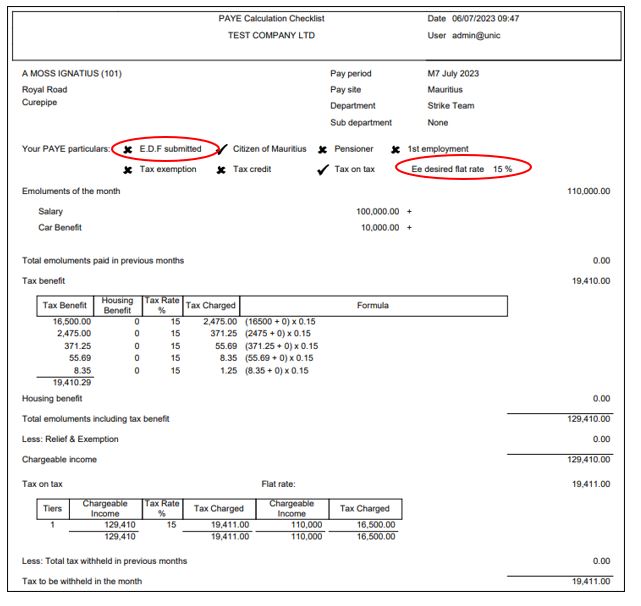

- Below are illustrations of Tax on Tax computation based on the new tax rates

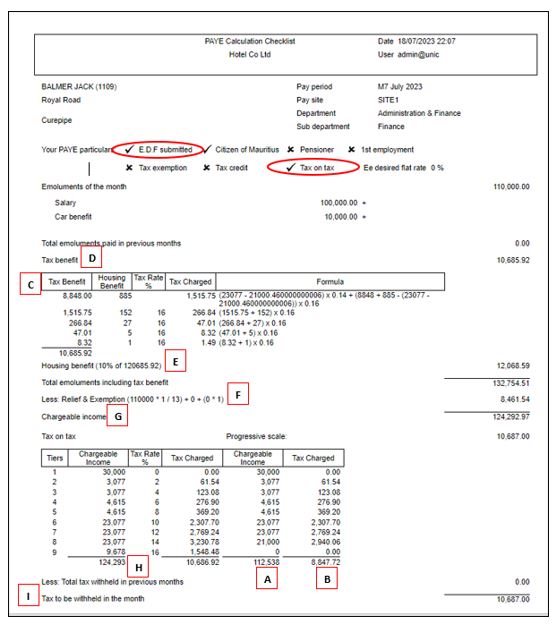

Illustration 1 - EDF Submitted - Tax on Tax/Housing Benefit/Tax benefit are applicable

- PAYE Calculation Slip

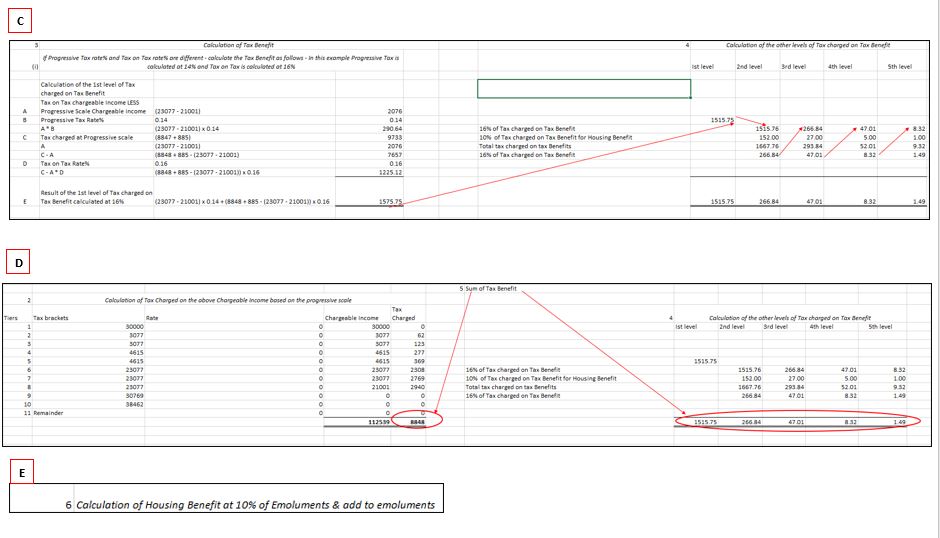

- Note: If Progressive Tax rate% and Tax on Tax rate% are different - the Tax Benefit is calculated as per the below illustration - In this example Progressive Tax is calculated at 14% and Tax on Tax is calculated at 16%

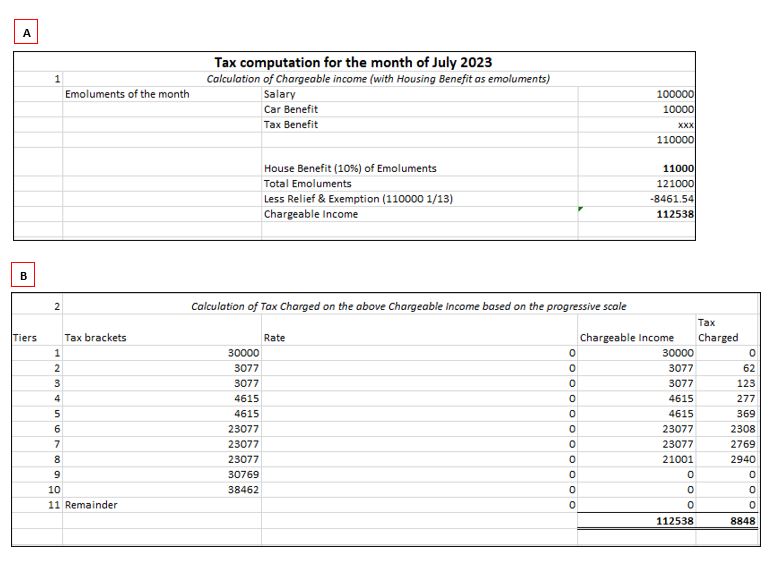

- A detailed breakdown of sections A to I are illustrated below