You are here: SKB Home » HRMS Payroll » Procedure Guide » Salary Increase Excel Import

This is an old revision of the document!

Salary Increase Excel Import

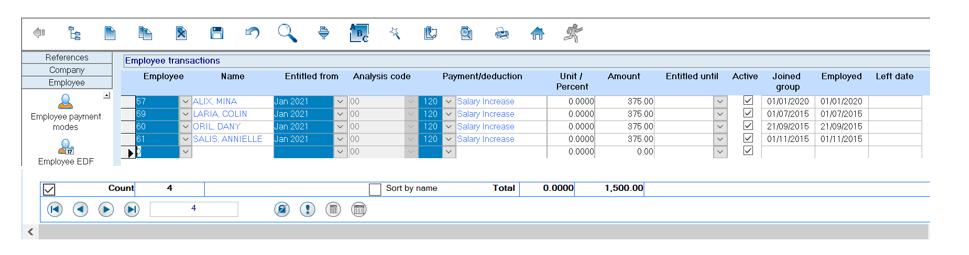

Salary increase amounts can also be imported through the Employee Transactions using an Excel file as shown below.

Government Salary Increase Excel Import

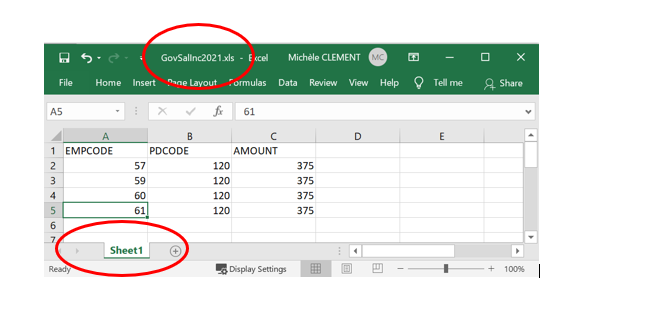

If you are importing from Excel for the first time, you must contact our Support Team for assistance concerning the import configuration. If the import configuration exists, make sure the Excel file name, the sheet name and the column names are as per the import definition

To import the Government Salary Increase Excel file, follow the steps below:

* NB: The file should be saved in Excel 97-2003 (.xls) format.

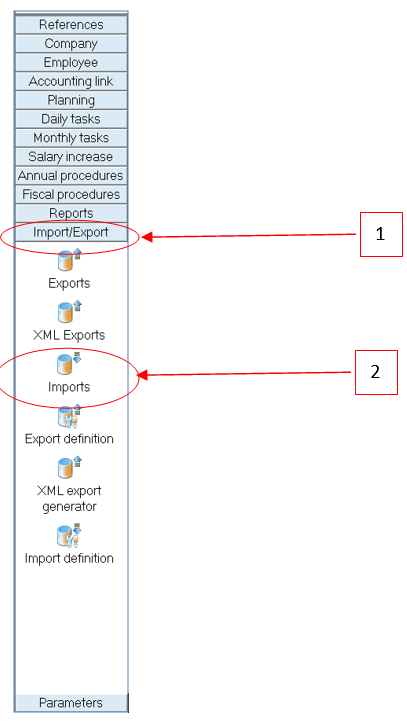

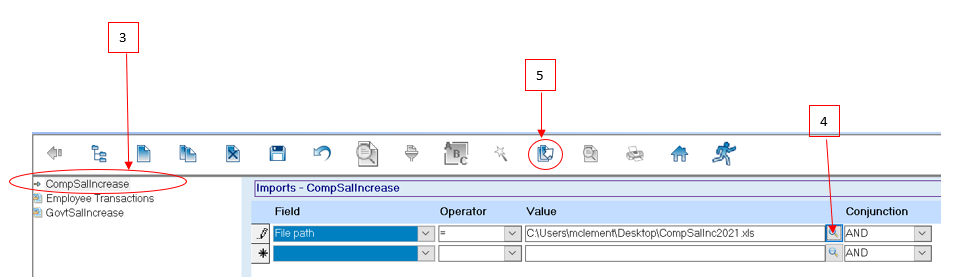

* Step 1: Click Imports/Exports

* Step 2: Click Import icon

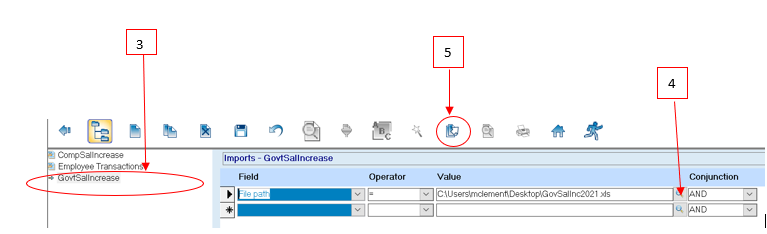

* Step 3: Double-click the Government Salary Increase Import from the list

* Step 4: Browse the Government Salary Increase Excel file

* Step 5: Click import button from the toolbar

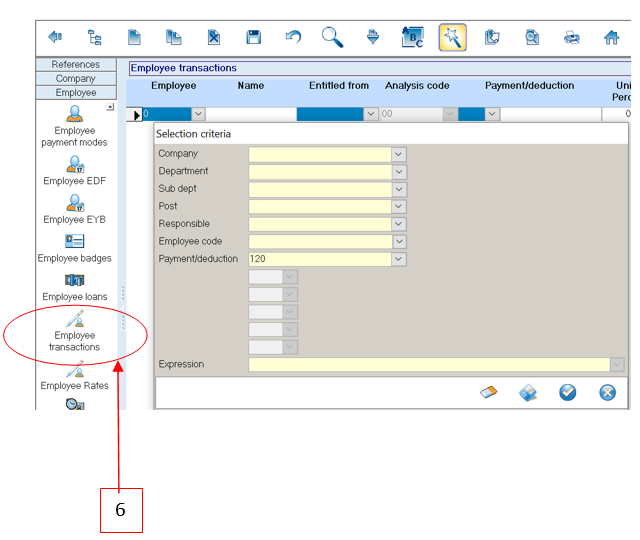

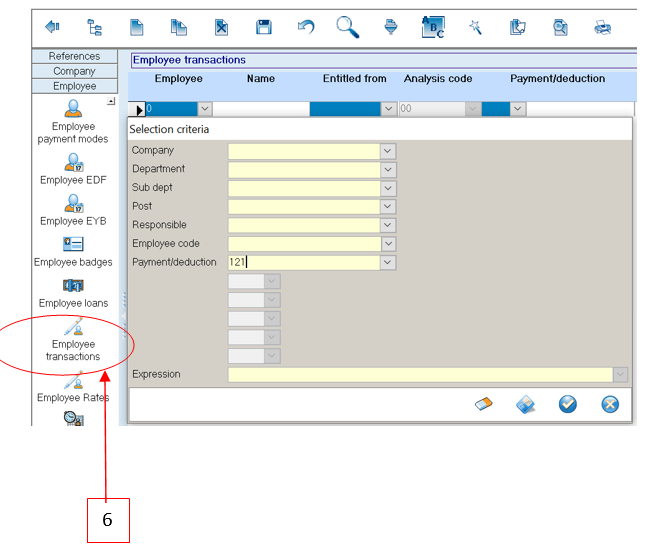

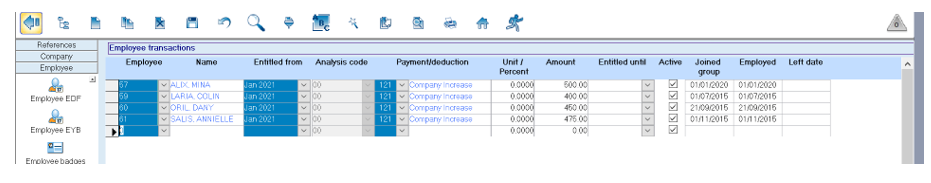

* Step 6: verify the number of records and the total amount imported through the Employee Transactions

Company Salary Increase Excel Import

If company increase is to be differentiated from government increase, you must use a different payment code e.g 121 (other than code 120). You must contact our Support Team for assistance concerning the import configuration of the company increase. Otherwise, payment code 120 can cater for the sum of government and company increase.

To import the Company Salary Increase Excel file, follow the steps below:

* NB: The file should be saved in Excel 97-2003 (.xls) format.

* Repeat Steps 1 & 2 of the Government Salary Increase Excel Import:

* Step 3: Double-click the Company Salary Increase Import from the list

* Step 4: Browse the Company Salary Increase Excel file

* Step 5: Click import button from the toolbar

* Step 6: verify the number of records and the total amount imported through the Employee Transactions