You are here: SKB Home » HRMS Payroll » Procedure Guide » monthlytask_mnsexports

This is an old revision of the document!

Monthly MNS NPF Return

As per the MNS announcements published in May 2018 concerning changes brought to NPF Return please find below the main sections whereby enhancement and validation rules have been applied. To download the announcements kindly visit the MNS and MRA websites for more info.

- Company Category

- Employee ID

- Contribution Rate Table

- Employee Rate Code

- Levy Flag

- Total Wage Bill and Levy Calculation

Below are the necessary steps which will guide you to perform the Monthly MNS NPF Return v3.0 (Jan 2018)

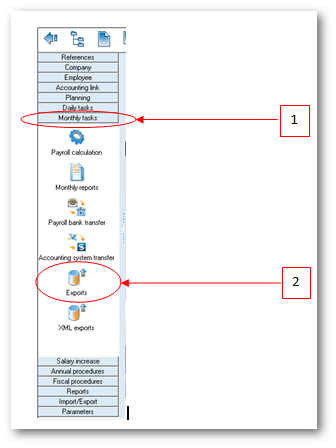

- Step 1: Go to Monthly Tasks

- Step 2: Click Exports icon

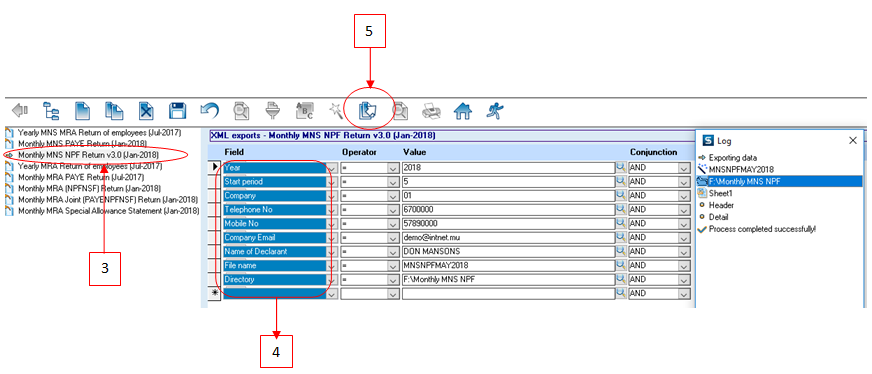

- Step 3: Double-click Monthly MNS NPF Return v3.0 (Jan 2018)

- Step 4: Insert the criteria as illustrated below:

- Company: Choose the company from the list

- Year: Choose the year from the list

- Start Period: Choose the month from the list;

- End Period: Choose the month from the list;

- Directory: Browse to select the folder to which you want to export the file

- File name: Insert file name

- Step 5: Click Export button on the toolbar

NB:(1) Should there be missing information the file will be incomplete. You will need to update the missing information and export the file again (2) The log window indicates anomalies on the export file, e.g Value is required wrongly inserted Name of Declarant, Telephone number, etc.

A sample of the csv file is shown below: