You are here: SKB Home » HRMS Payroll » Procedure Guide » Employee EDF

This is an old revision of the document!

Employee EDF

Applicable for the month of July 2023 only

- Changes in the Total Exemption Amount for the EDF can be performed using the following options:

- MRA E-EDF facility (after employees have filed their EDF on the website of the MRA, the employer downloads the EDFs and imports them through Sicorax Payroll)

- Manual input of the new Total Exemption Amount through Employee EDF

MRA E-EDF Import

- MRA E-EDF facility (after employees have filed their EDF on the website of the MRA, the employer downloads the EDFs and imports them through Sicorax Payroll)

- To perform the import of the MRA E-EDF Excel file, you must download the file from the the website of the MRA. Ensure the file is valid and contains the necessary information. Should you need assistance regarding the download of the MRA E-EDF Excel file kindly refer to the following link https://www.mra.mu/index.php/eservices1/corporate/employee-declaration-form-edf-employer or contact the MRA.

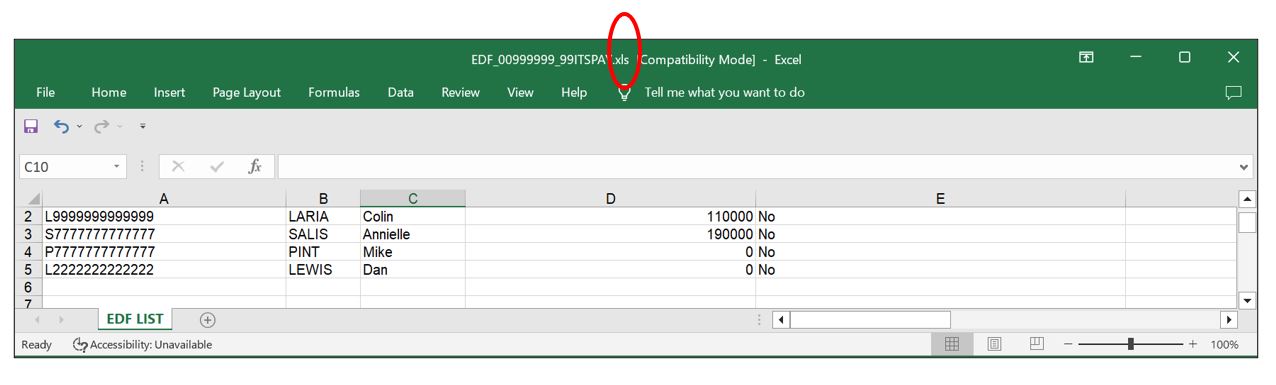

- The MRA E-EDF Excel file must be in xls format.

- An illustration of the file after download from the website of the MRA is shown below.

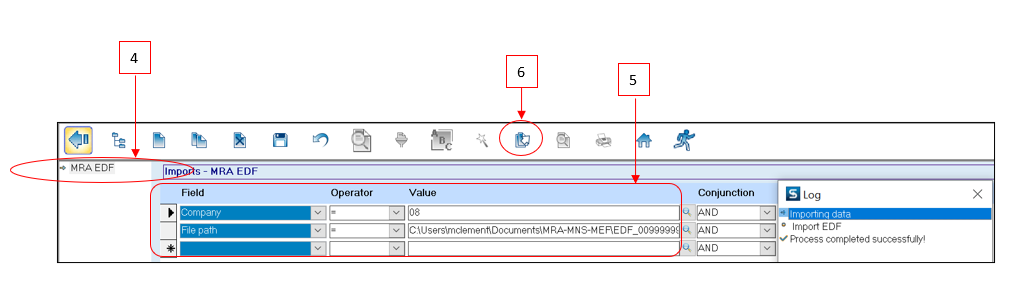

- Step 2: On Sicorax Payroll Go to Import/Export

- Step 3: Click Import icon

- Step 4: Double Click MRA EDF

- Step 5: Insert the criteria as illustrated below:

- Company: Choose the company from the list

- File Path: Browse the file location of the downloaded MRA E-EDF Excel file and select the file

- Step 6: Click Import button on the toolbar

View the imported MRA E-EDF records through Sicorax Payroll

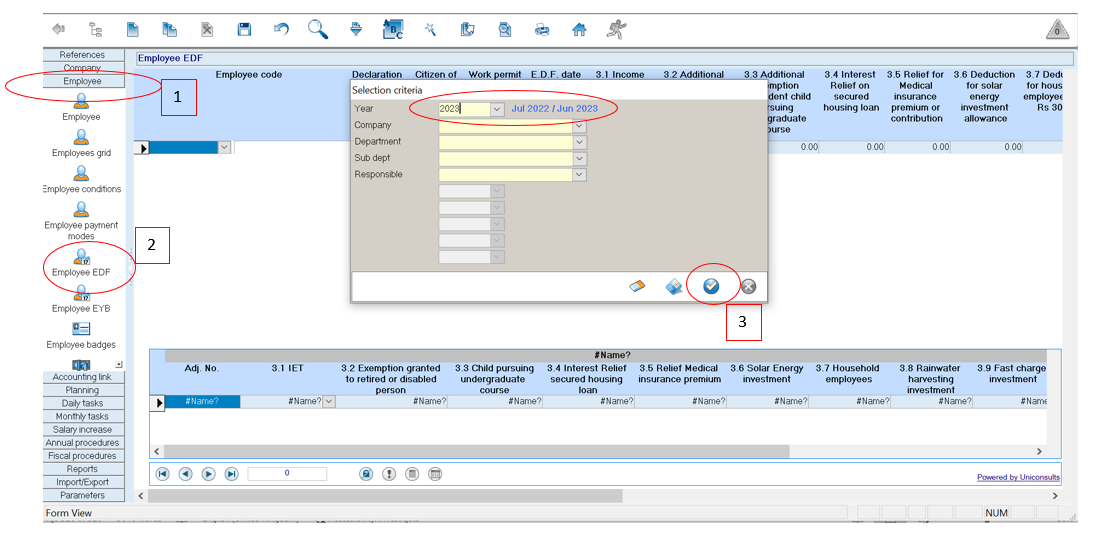

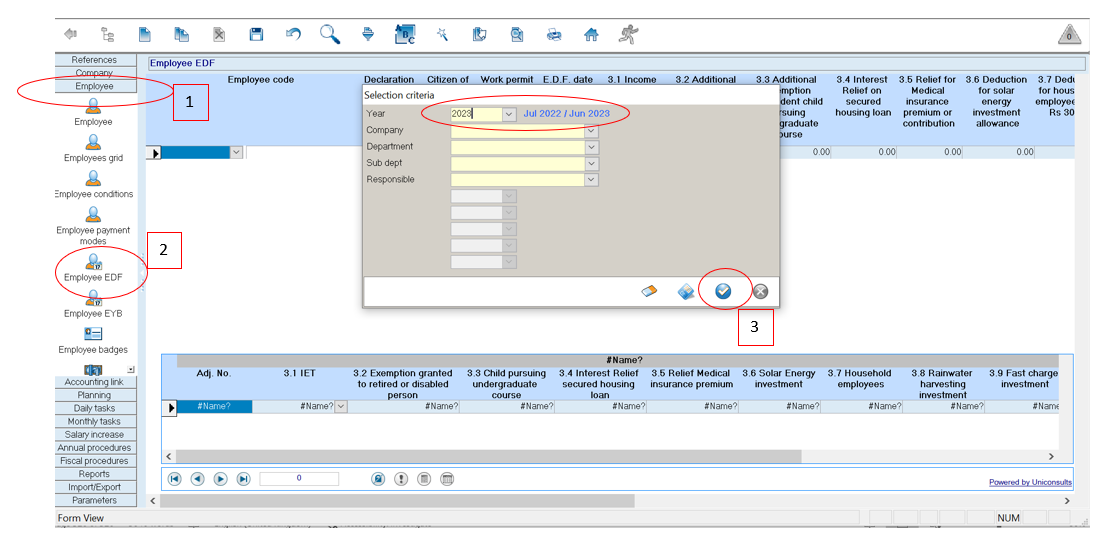

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

* Step 4: Select Employee

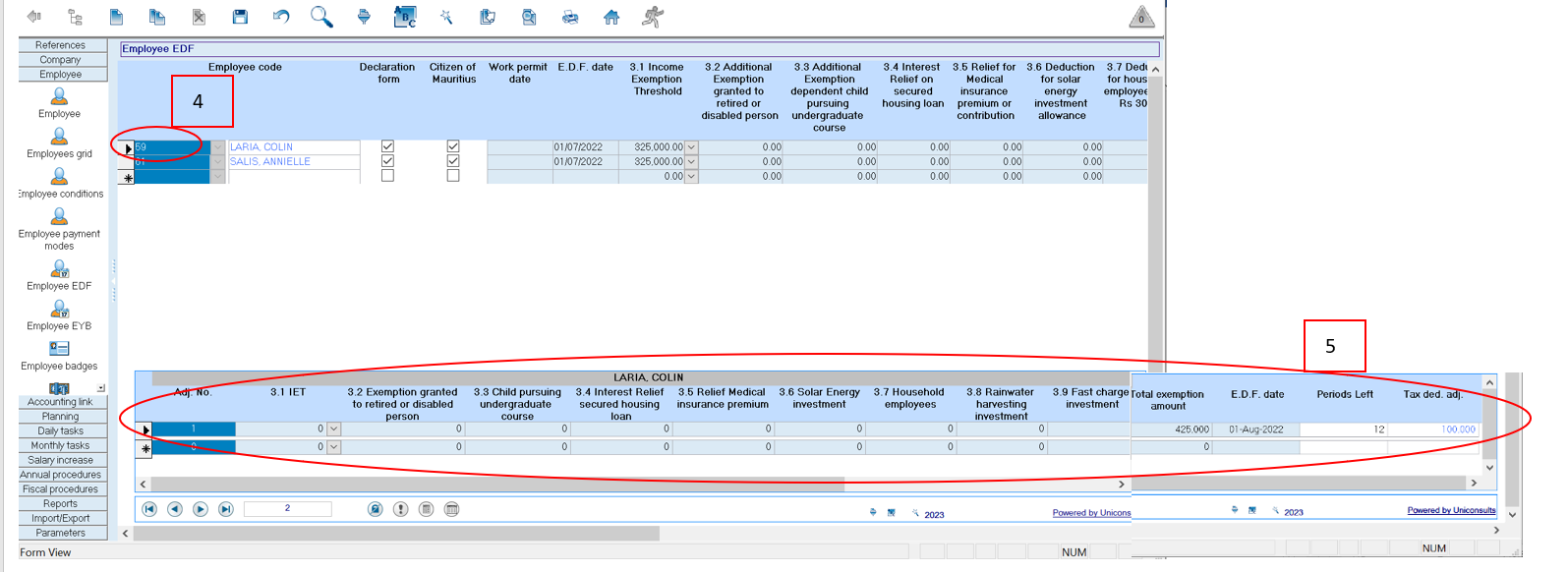

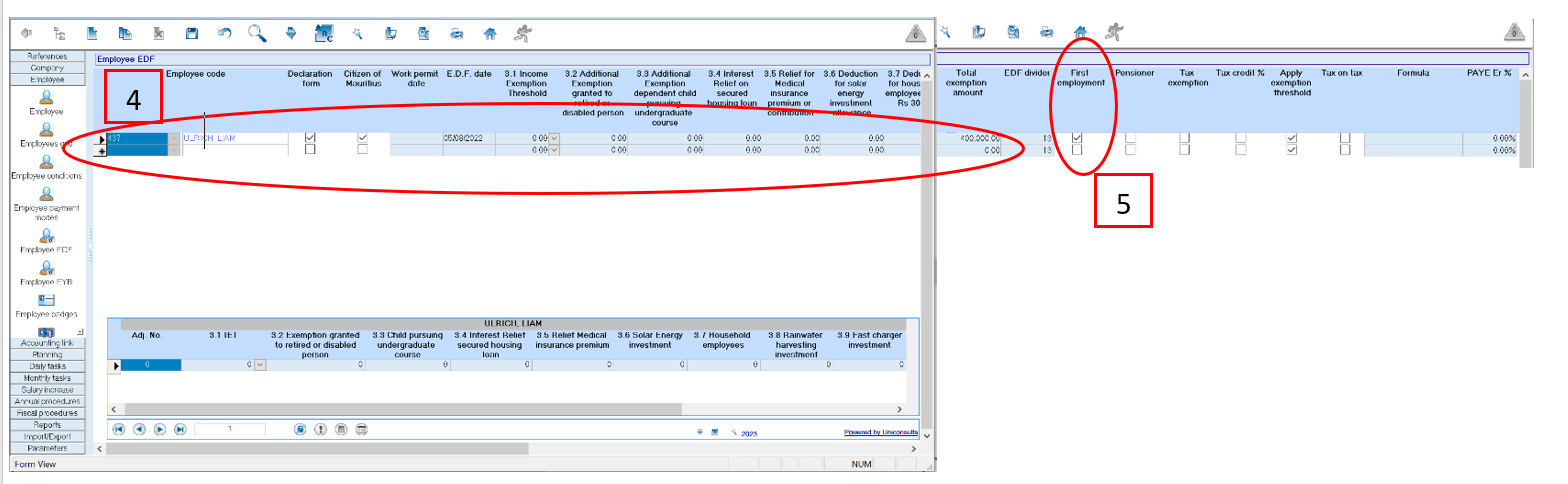

* Step 5: View the MRA EDF imported record as illustrated below - Scroll to the right-hand side of the adjustment menu to view till the end of the record

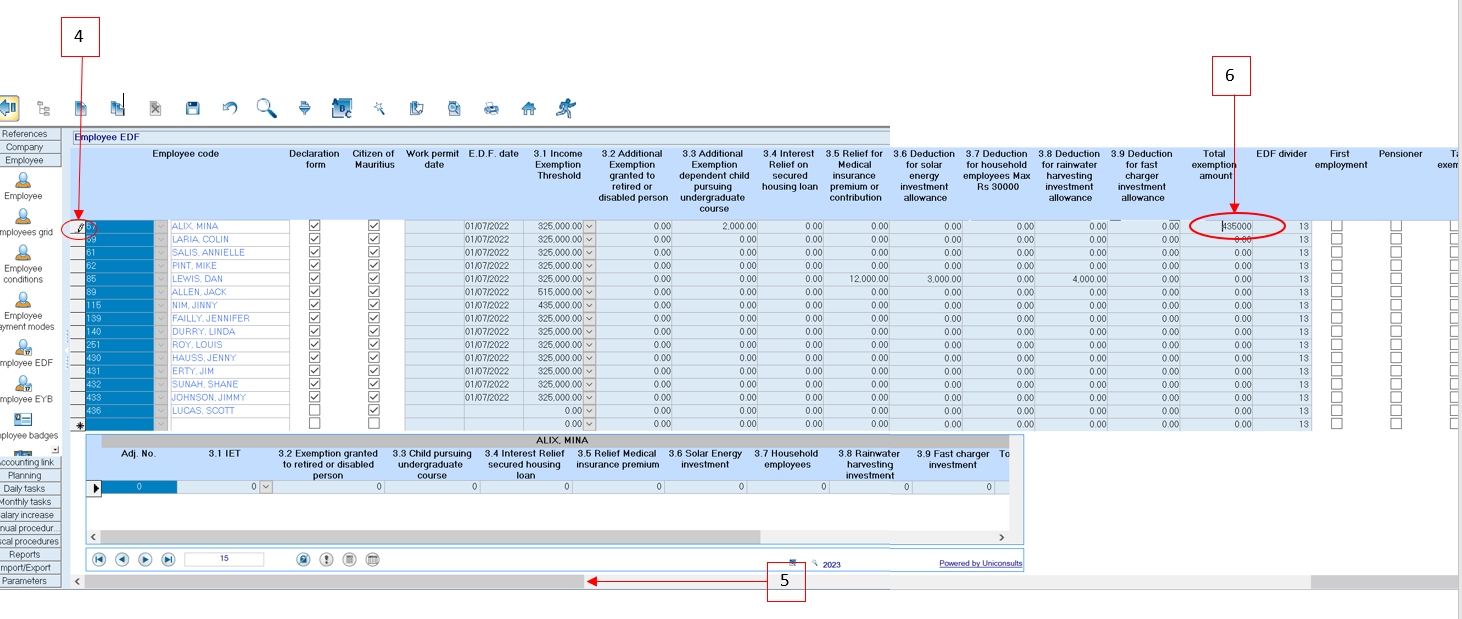

- Adj. No.: Displays the first EDF adjustment for the current fiscal year

- Total Exemption Amount: Displays the Total Exemption amount as per the MRA E-EDF file

- E.D.F Date: Date is automatically set by Sicorax Payroll during import (date falls within actual payroll calendar)

- Periods left: Displays the number of months left in the current fiscal year starting July, for which the Tax Deduction Adjustment will be applicable.

- Tax Ded. Adj.: Displays the difference between the Total Exemption amount and the Previous Total Exemption amount

The Tax Ded. Adj. can either be positive or negative depending on the difference between the Total Exemption amount and the Previous Total Exemption amount

MRA E-EDF Import(New Recruit)

New recruits created on Sicorax Payroll, may have their EDF input manually through Employee EDF or imported using the MRA E-EDF import procedure. After completion of the manual input or import, it is compulsory to go through the new recruit's EDF record through Employee EDF to ensure additional flags are activated e,g First Employment Flag (Where a person, other than an exempt person, takes up employment for the first time in the current fiscal year).

To view the new recruit's EDF and activate the necessary flags, follow the steps below:

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

- Step 4: Select Employee - The below illustrates a manual EDF input or an MRA E-EDF import

- Step 5: To activate the First Employment Flag (if needed) Scroll to the right-hand side of the menu to move till the end of the EDF record

First Employment: Where a person, other than an exempt person, takes up employment for the first time in the current fiscal year.

Manual input of the new Total Exemption Amount through Employee EDF

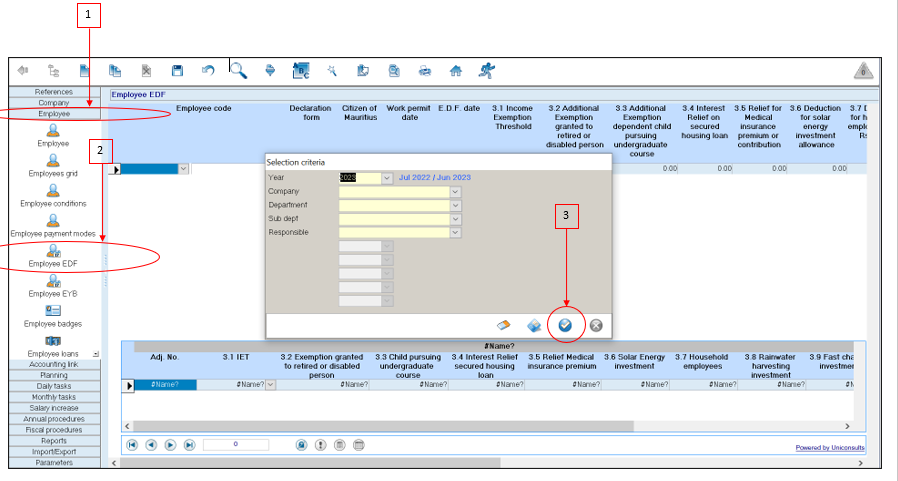

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

- Step 4: Select the employee's record

- Step 5: Use the scroll bar to go to the right-hand side of the screen

- Step 6: Modify the Total Exemption amount