You are here: SKB Home » HRMS Payroll » Procedure Guide » End of Year Bonus (Leavers)

This is an old revision of the document!

End of Year Bonus (Leavers)

With reference to the Workers' Rights Act 2019 - Section D - 54. End of Year Bonus (Leavers)

The calculation and payment of the End of Year Bonus to leavers MUST BE CALCULATED MANUALLY AND PAID IN THE MONTH THAT THE EMPLOYEE IS LEAVING.

The payment of the End of Year Bonus is not applicable to employees who have left before October 2019 but only applies to the below cases:

(1) Employees who resign as from the month of October 2019 after having been employed for at least 8 consecutive months (2) Employees whose employment is terminated and for whom the End of Year Bonus calculation must be performed only on the number of working months

To calculate the End of Year Bonus Earnings you are requested to go through the steps below:

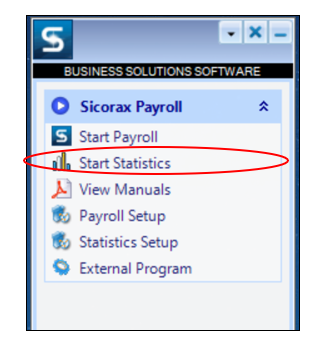

- Step 1: Go to Sicorax Payroll Suite

- Step 2: Click Start Statistics

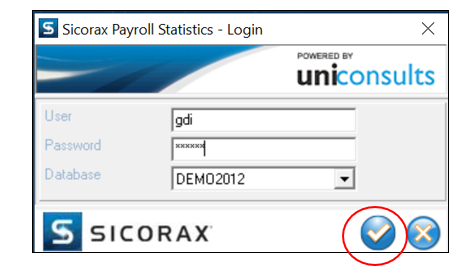

- Step 3: Insert your username and password and click Apply

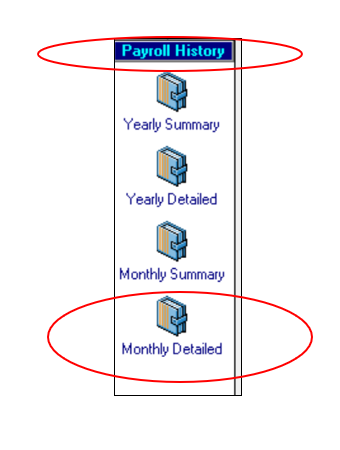

- Step 4: Click Payroll History

- Step 5: Click Monthly Detailed

End of Year Bonus Earnings

- Step 1: Choose the criteria as illustrated

- Step 2: Activate Summary by Employee

- Step 3: Click Result

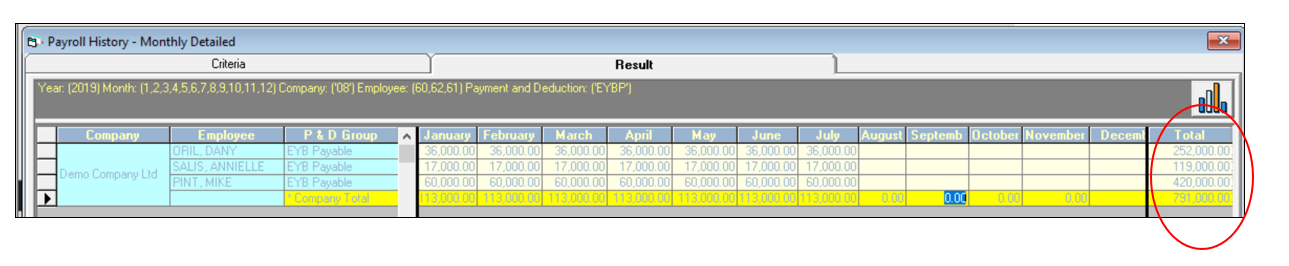

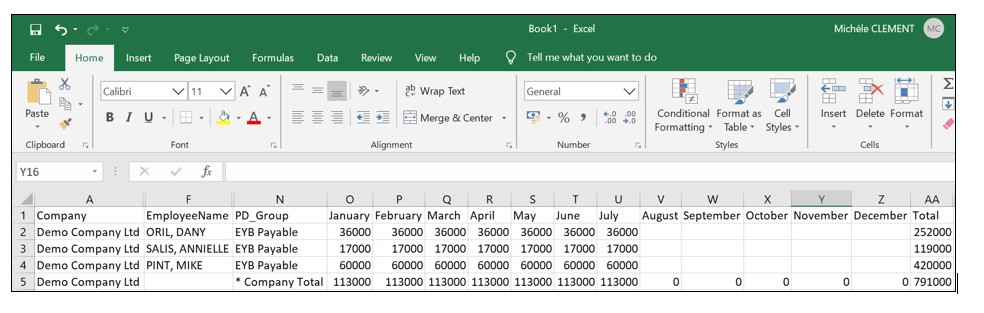

- Below is an illustration of the End of Year Bonus Earnings of the selected employees.

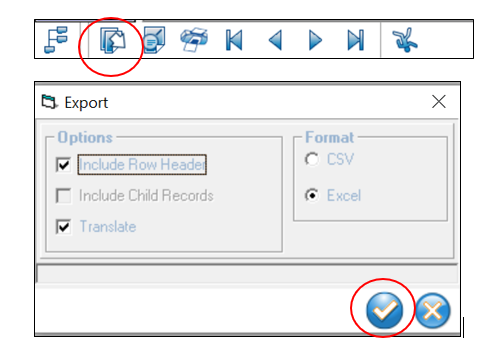

To facilitate the calculation, you may export the figures to Excel and apply the required calculation/formula to calculate the End of Year Bonus amount of the respective leavers as illustrated below:

End of Year Bonus (Manual Input)

To insert the End of Year Bonus amount per employee you are requested to go through the steps below:

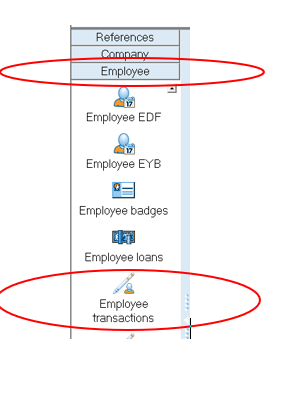

- Step 1: Log on Sicorax Payroll

- Step 2: Click Employees

- Step 3: Click Employees Transactions

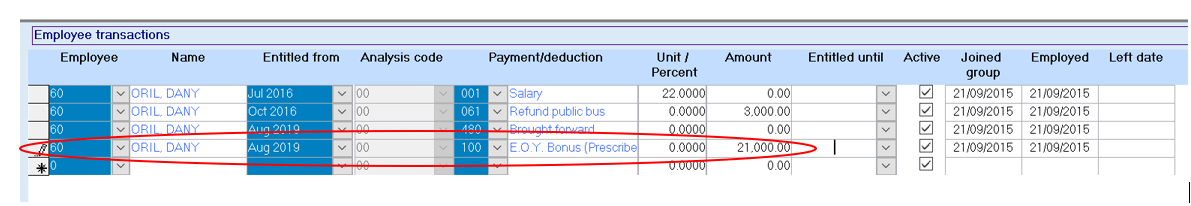

- Step 4: Choose the employee and insert the payment code 100 with the necessary amount as illustrated below