You are here: SKB Home » HRMS Payroll » hrmsprocguide » CSG on End Of Year Bonus

This is an old revision of the document!

Table of Contents

CSG on End Of Year Bonus

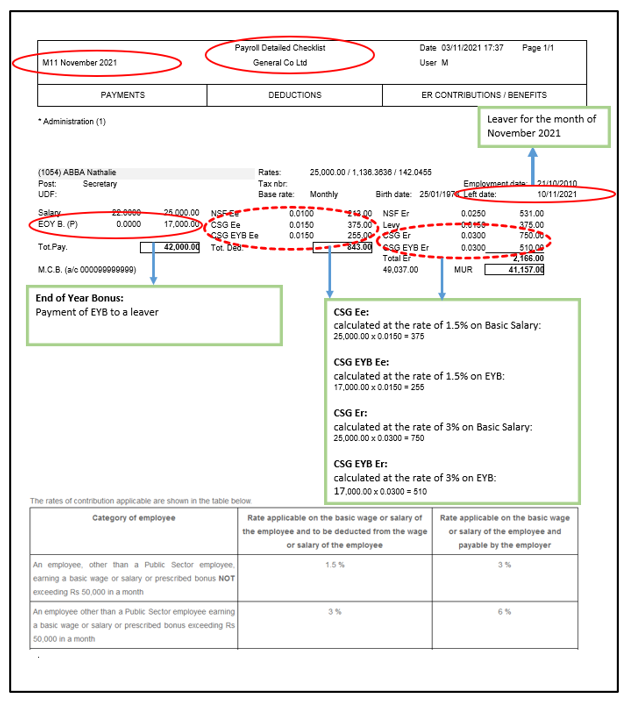

As from 01 September 2021, the provisions of the Social Contributions and Social Benefits Act 2021 shall apply as follows:

- Prescribed Bonus: Where an end of year bonus prescribed under an enactment is paid to a participant, the bonus shall be treated separately as remuneration for an additional month and the participant and the employer shall, in respect of that additional month, pay the social contribution at the appropriate rate.

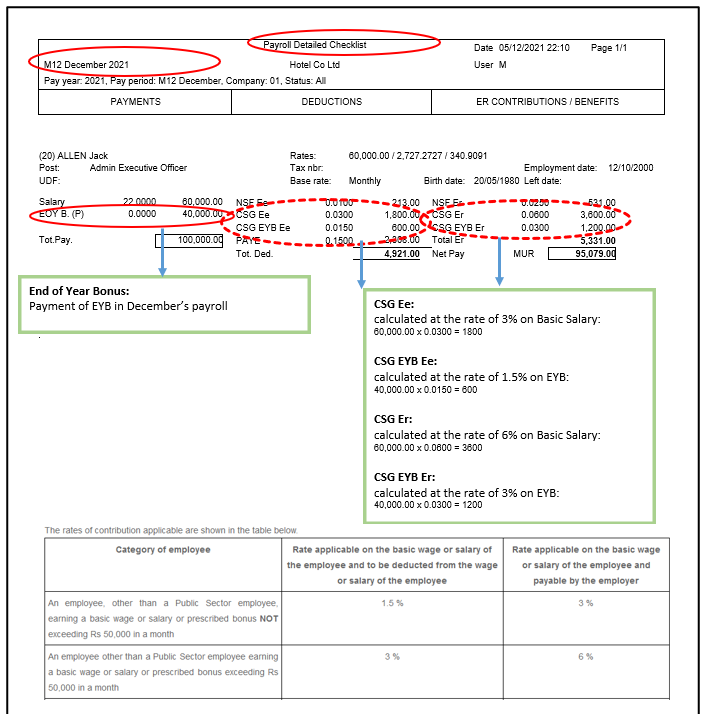

- Below are illustrations of the calculation of the CSG on the EYB

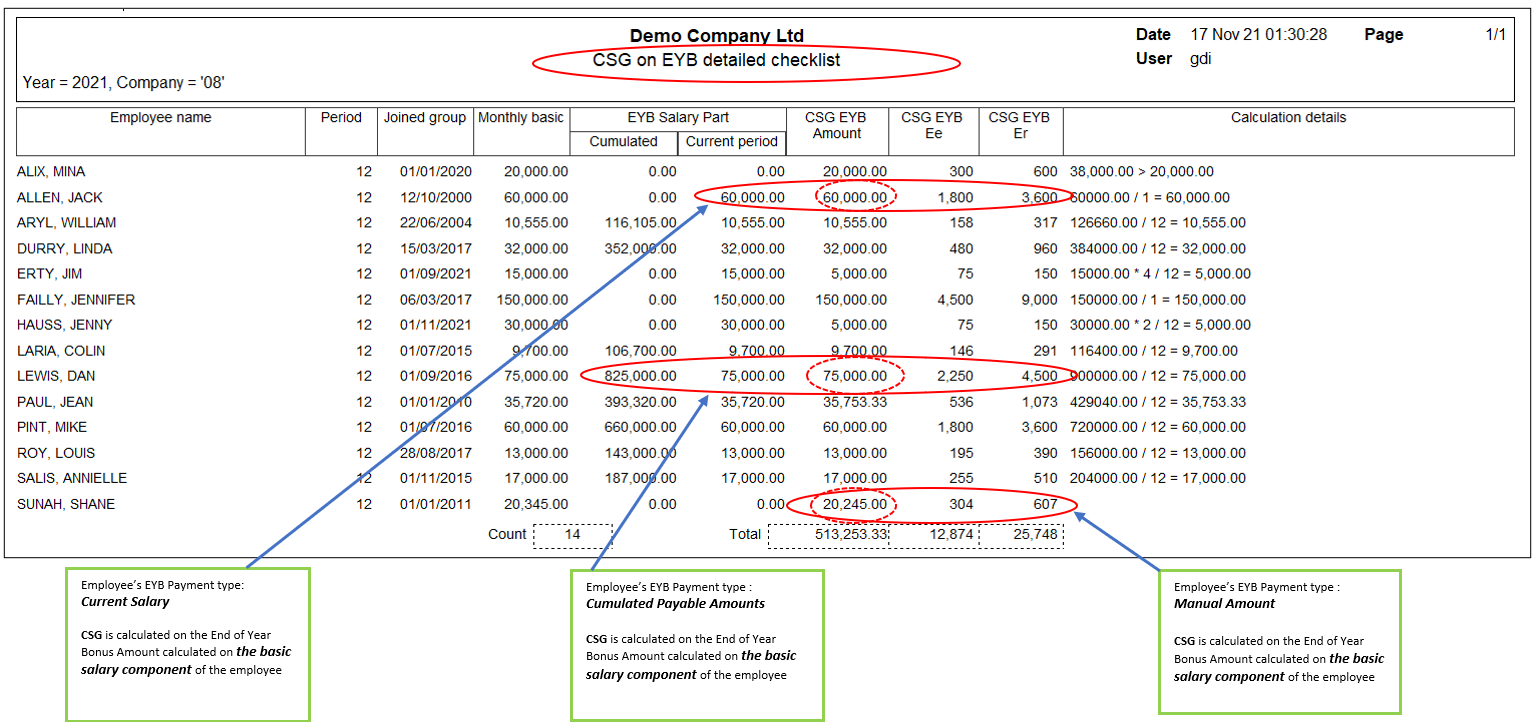

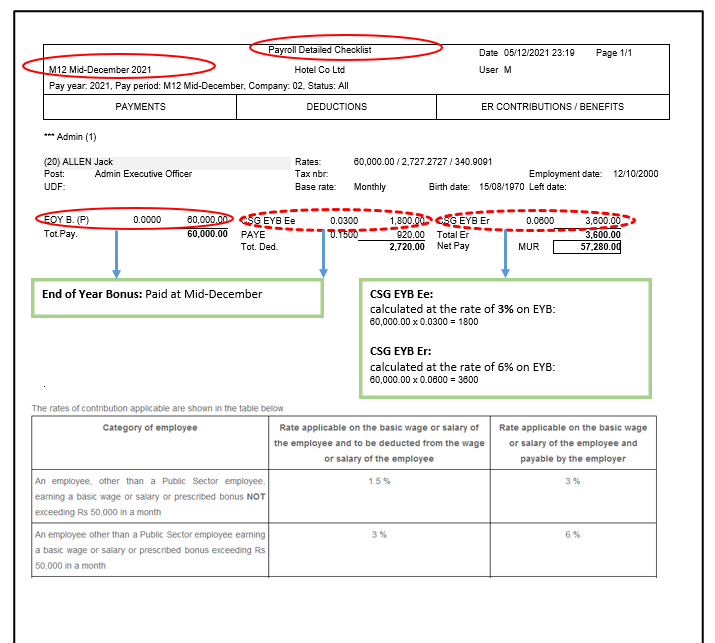

CSG on End Of Year Bonus where EYB paid at Mid-December

- After the EYB Configuration Wizard is completed and Payroll Calculation performed, go to checklist

- Step 1: Double-Click CSG on EYB Detailed

- Step 2: Click preview

- Below is an example of the detailed checklist at Mid-December

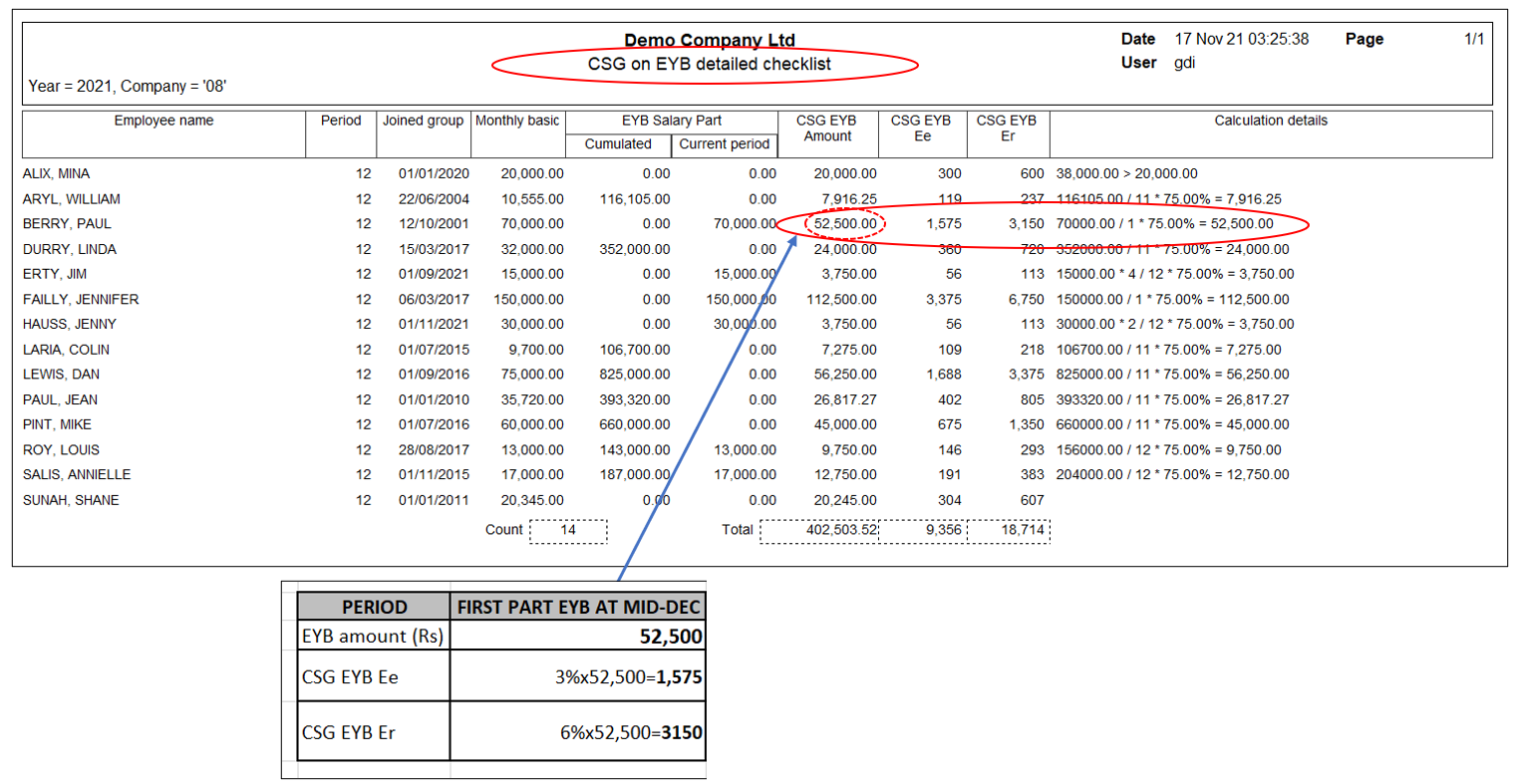

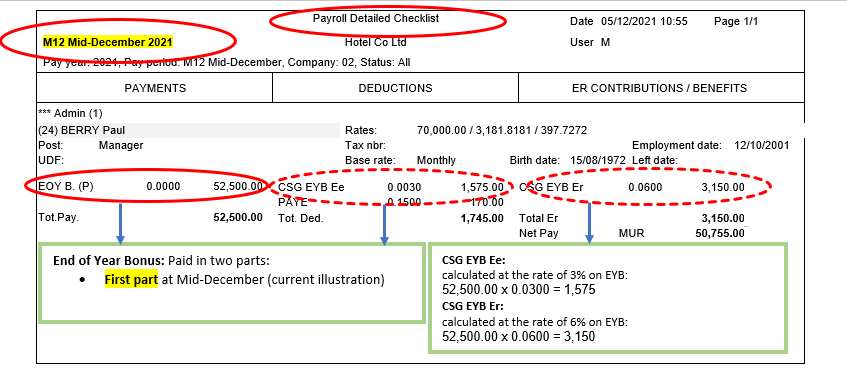

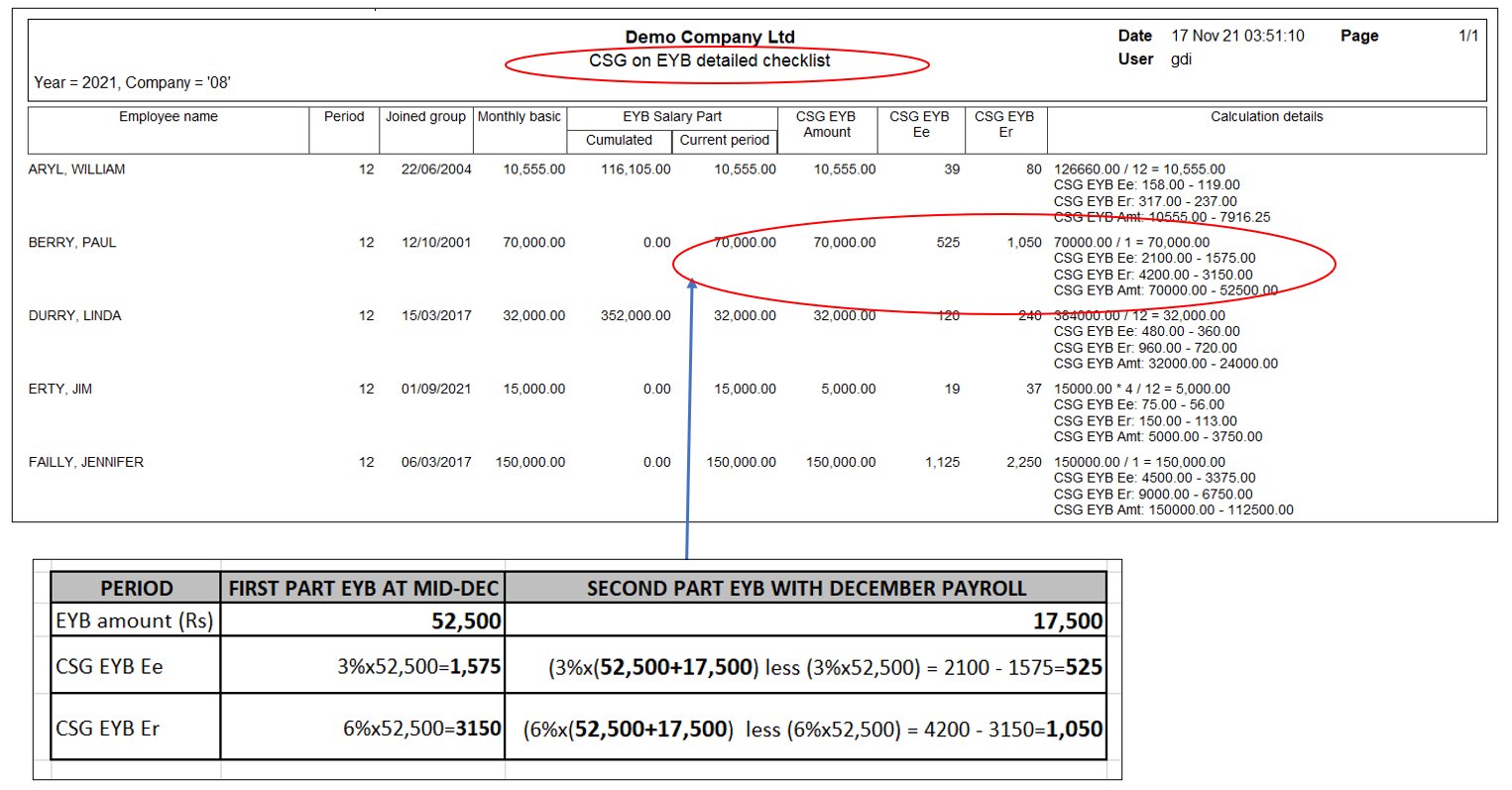

CSG on End Of Year Bonus where EYB is paid in two parts: First part at Mid-December and Second part with December's payroll

- After the EYB Configuration Wizard is completed for Mid-December and Payroll Calculation performed, go to Checklist

- Step 1: Click CSG on EYB Detailed

- Step 2: Click preview

- Below is an example of the EYB detailed checklist at Mid-December with CSG calculation details

- Below is an example of the detailed checklist at Mid-December

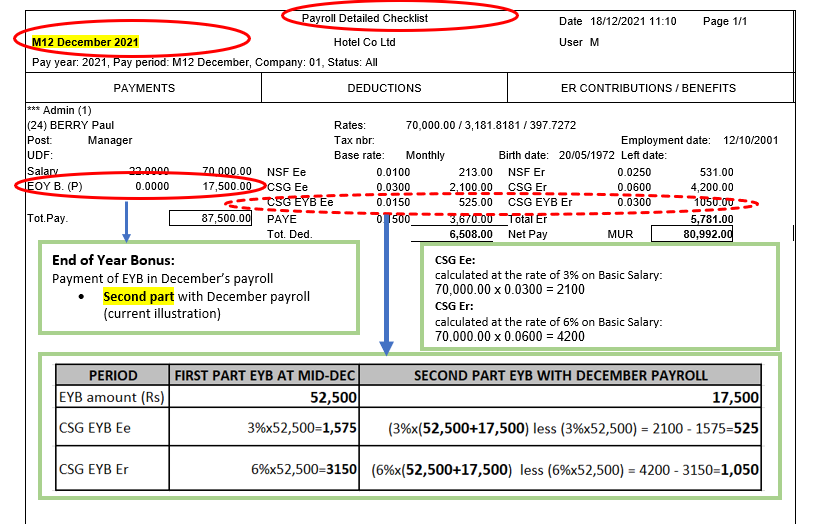

- After Mid-December is closed and Payroll calculation performed for December payroll

- Step 1: Click Checklist

- Step 2: Click CSG on EYB Detailed

- Step 3: Click preview

- Below is an example of the EYB detailed checklist at December with CSG calculation details

- Below is an example of the detailed checklist for the second part with December payroll