You are here: SKB Home » HRMS Payroll » hrmsprocguide » CSG on End Of Year Bonus

This is an old revision of the document!

Table of Contents

CSG on End Of Year Bonus

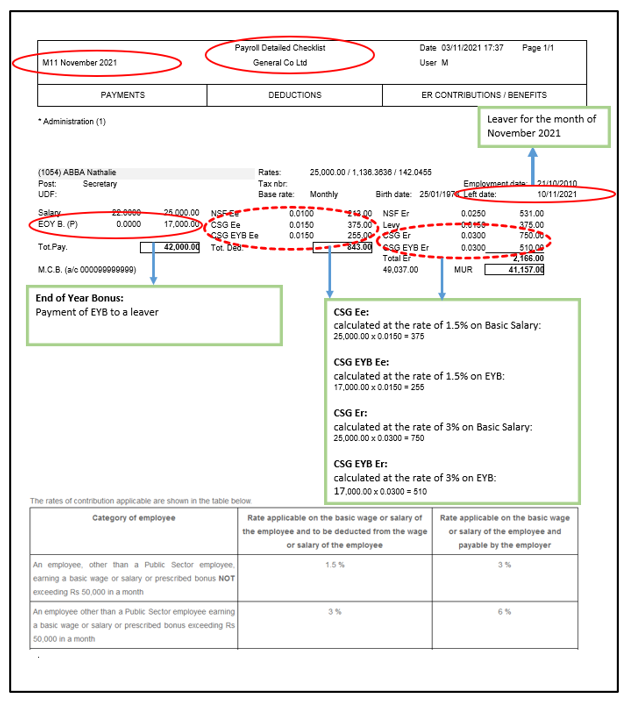

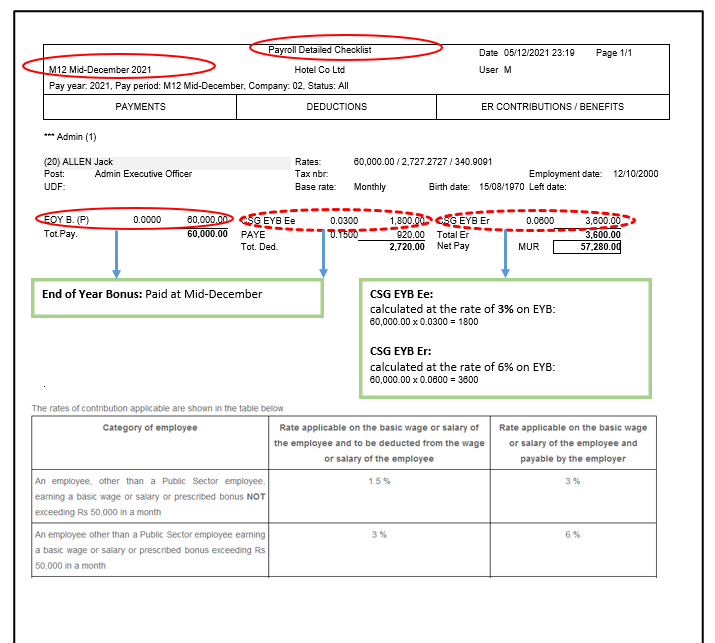

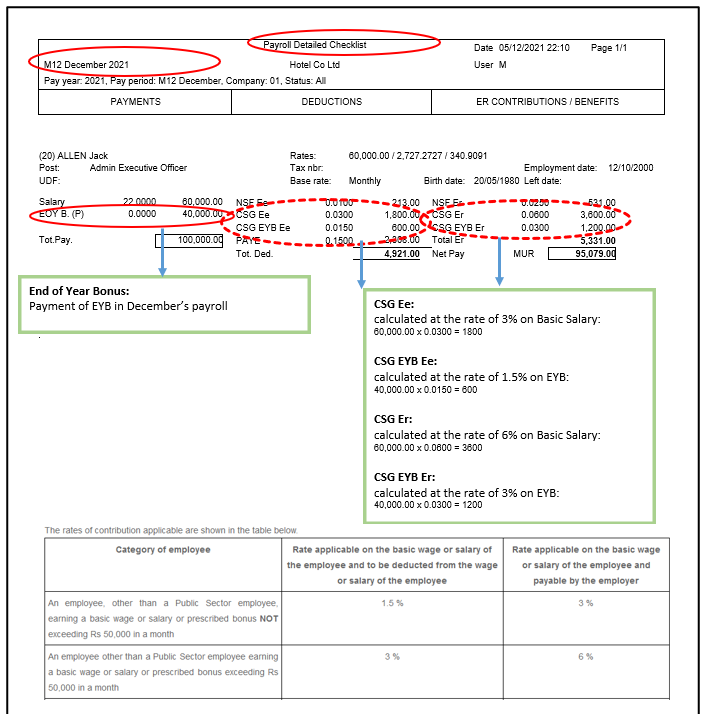

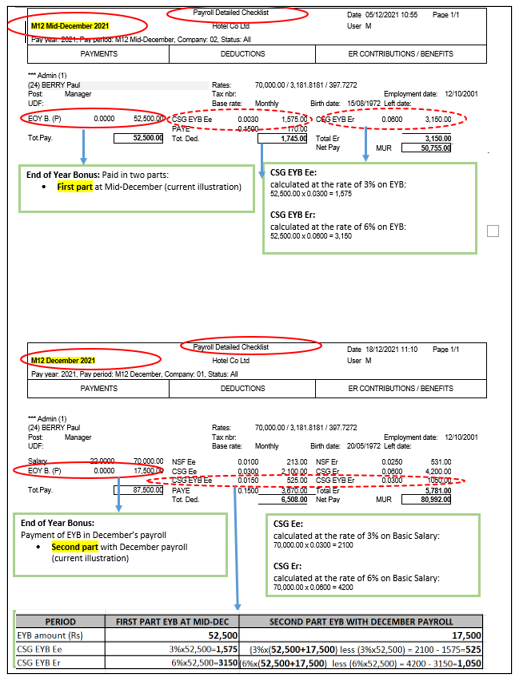

As from 01 September 2021, the provisions of the Social Contributions and Social Benefits Act 2021 shall apply as follows:

- Prescribed Bonus: Where an end of year bonus prescribed under an enactment is paid to a participant, the bonus shall be treated separately as remuneration for an additional month and the participant and the employer shall, in respect of that additional month, pay the social contribution at the appropriate rate.

- Below are illustrations of the calculation of the CSG on the EYB