You are here: SKB Home » HRMS Payroll » Procedure Guide » Accounting System Transfer

Accounting System Transfer

This procedure exports journal entries for payments and deductions which have been associated with GL accounts. The data is exported in either text or excel format. This file or print-out can be used for integration in an accounting software.

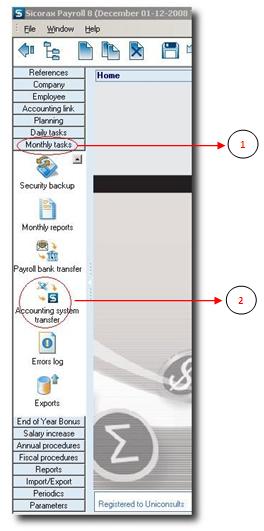

Step 1: Click on Menu Monthly Tasks

Step 2: Click on icon Accounting System Transfer

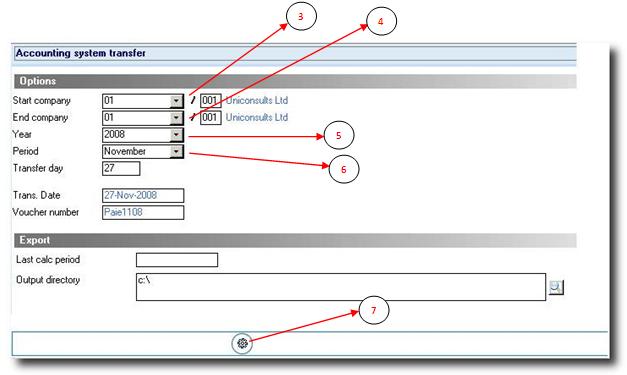

Step 3: Choose your Start company from the drop down list

Step 4: Choose your End company from the drop down list

Step 5: Choose the year from the drop down list

Step 6: Choose the period from the drop down list

Step 7: Click on Calculate button to start the calculation

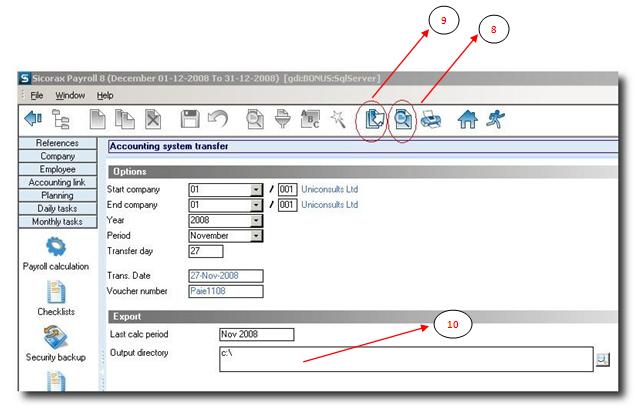

Step 8: Click on Preview to visualize the Accounting Transfer Report

Step 9: Click on Export to generate the text file to be integrated into the Accounting Software

Step 10: This represents the path where the text file has been exported

Related Links

Payments and deductions must be set to be transferable to GL

(How to configure accounting transfer in Payments and Deductions)

Payments and deductions must be set to be transferable to GL

(How to configure accounting transfer in Payments and Deductions)

Errors Log for Accounting System Transfer

This option enables a user to visualize the errors log while performing the Accounting System transfer. When the  button has been clicked and the system has finished analysing the different GL links, Sicorax Payroll notifies the user currently connected of possible errors detected - mostly of missing payment/deductions link.

button has been clicked and the system has finished analysing the different GL links, Sicorax Payroll notifies the user currently connected of possible errors detected - mostly of missing payment/deductions link.

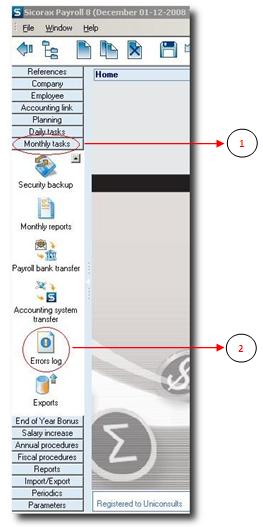

Step 1: Click on Menu Monthly Tasks

Step 2: Click on icon Errors Log

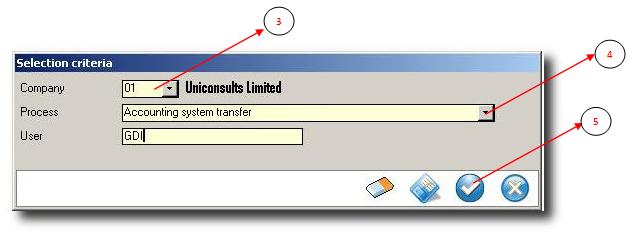

The Error Log criteria screen appears like this:

Step 3: Choose the company from the drop down list

Step 4: Choose the process Accounting System Transfer

Step 5: Click on Apply

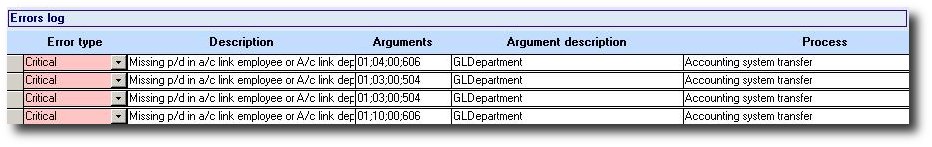

Upon clicking on APPLY button, Sicorax Payroll displays the different errors:

The first line of error for example indicates that the payment/deduction code 606 is not present in Accounting Link definition or has not been set “Transfered to GL”.

The first line of error for example indicates that the payment/deduction code 606 is not present in Accounting Link definition or has not been set “Transfered to GL”.

The error is a “Critical” one - thus will prevent the user from generating the text file.

The error is a “Critical” one - thus will prevent the user from generating the text file.