You are here: SKB Home » HRMS Payroll » Procedure Guide » Annual Return of Employees (filing through MNS website)

====== Annual Return of Employees (ROE)======JUL 2024

- Filing the Annual Return of Employees (ROE) electronically by uploading a CSV file generated from Sicorax Payroll is a facility which is available to employers who have been granted access and allocated a password by MRA. Other employers should use the facility provided by the MNS.

- The below steps and illustrations will guide in exporting the Annual Return of Employees (ROE) from Sicorax Payroll for the filing through the MNS website or the MRA website

Annual Return of Employees (filing through MNS website)

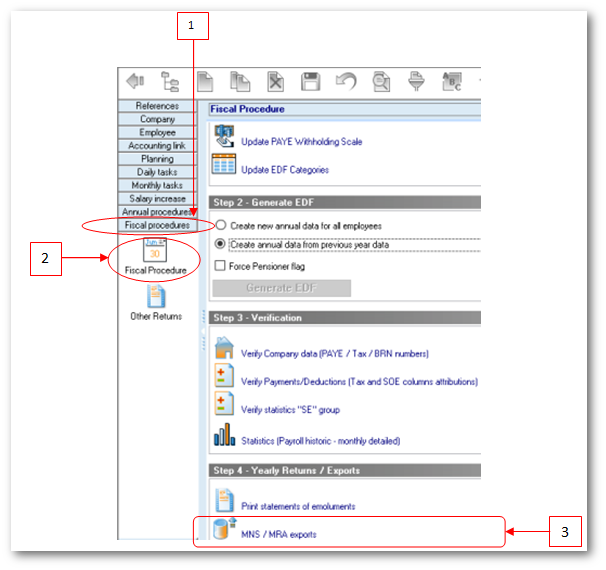

To proceed use the following steps:

- Step 1: Click Fiscal Procedure menu

- Step 2: Click Fiscal Procedure icon

- Step 3: Click MNS/MRA Exports option

To export the CSV file, use the following steps

- Step 1: Double Click Yearly MNS MRA Return of Employees (Jul-2024)

- Step 2: Fill in the criteria as explained below:

- Fiscal Year: Choose 2004 from the list for fiscal year (Jul-2023/Jun-2024);

- Company: Choose the company from the list

- Telephone number: should be = 7 numeric characters

- Mobile number: Should start with figure 5 and should consist of 8 numbers;

- Company Email address: Type the contact email address of the company

- Name of Declarant: Should bear UPPER CASE letters and/or numeric characters (max 50 characters)

- File name: Should be less than 21 characters long

- Directory: Browse to select the folder to which you want to export the file

- Step 3: Click Export button on the toolbar

NB: (1) The file contains tax payers and non-tax payers and for those whose National ID is missing in the system a message will be shown in the log indicating invalid NID and the export file will be incomplete. You will need to update the NID in the Employee master file and export the file again (2) The log window indicates anomalies on the export file, e.g Invalid NID, wrongly inserted Name of Declarant, Telephone number, etc.

A sample of the CSV file is shown below (to open for verification you must right-click the file and open with Notepad)

Annual Return of Employees (filing through MRA website)

To proceed use the following steps:

- Step 1: Click Fiscal Procedure menu

- Step 2: Click Fiscal Procedure icon

- Step 3: Click MNS/MRA Exports option

To export the CSV file, use the following steps

- Step 1: Double Click Yearly MRA Return of Employees (Jul-2024)

- Step 2: Insert the different criteria as explained below:

- Fiscal Year: Choose 2004 from the list for fiscal year (Jul-2023/Jun-2024);

- Company: Choose the company from the list

- Telephone number: should be = 7 numeric characters

- Mobile number: Should start with figure 5 and should consist of 8 numbers;

- Company Email address: Type the contact email address of the company

- Name of Declarant: Should bear UPPER CASE letters and/or numeric characters (max 50 characters)

- File name: Should be less than 21 characters long

- Directory: Browse to select the folder to which you want to export the file

- Step 3: Click Export button on the toolbar

NB: (1) The file contains tax payers and non-tax payers and for those whose National ID is missing in the system a message will be shown in the log indicating invalid NID and the export file will be incomplete. You will need to update the NID in the Employee master file and export the file again (2) The log window indicates anomalies on the export file, e.g Invalid NID, wrongly inserted Name of Declarant, Telephone number, etc.

A sample of the CSV file is shown below (to open for verification you should right-click the file and open with Notepad)