You are here: SKB Home » HRMS Payroll » Procedure Guide » New Tax Rates (Fiscal Year 2023-2024)

This is an old revision of the document!

New Tax Rates (Fiscal Year 2023-2024)

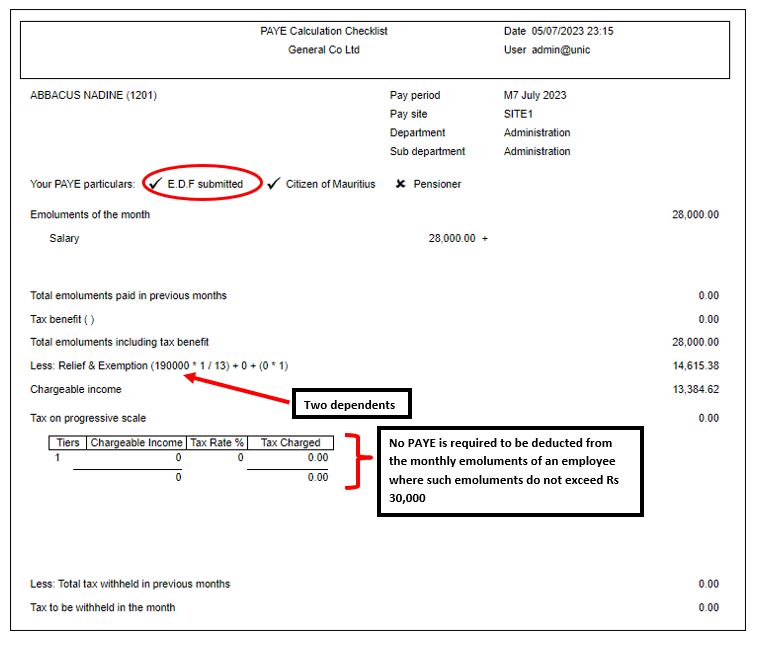

* (i) NO PAYE deducted from the monthly emoluments of an employee where such emoluments do not exceed Rs 30,000 (EXEMPT Employee) who submitted his EDF

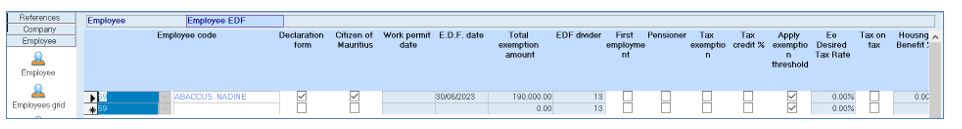

- Employee's EDF record

- Employee's PAYE calculation slip

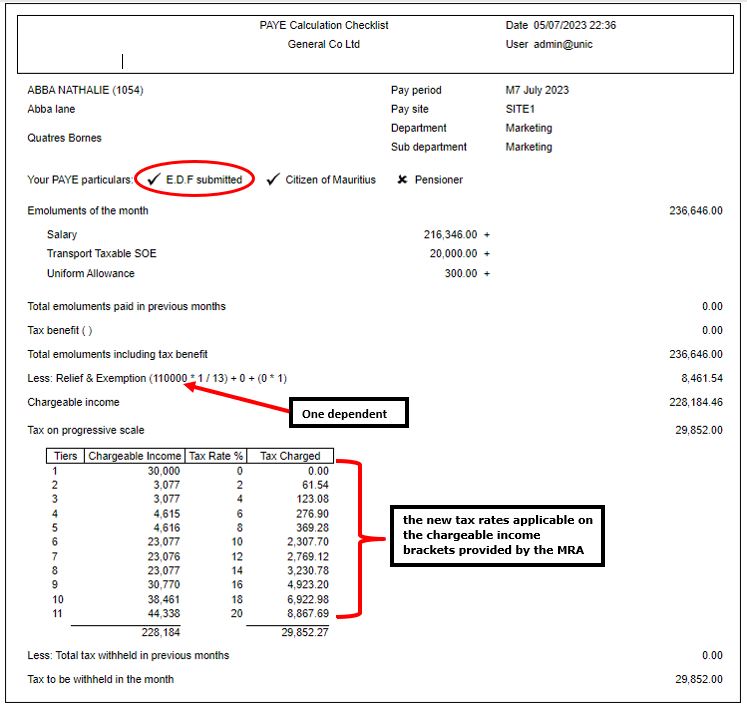

* (ii) New PAYE calculation on the chargeable income brackets provided by the MRA

* (iii) Illustration of tax calculation on the annual chargeable income of an individual:

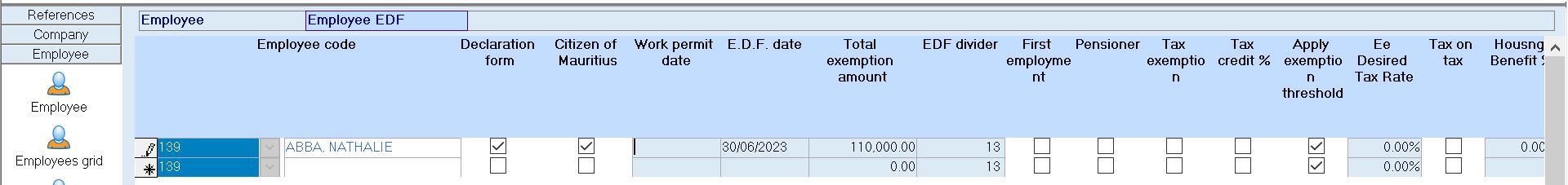

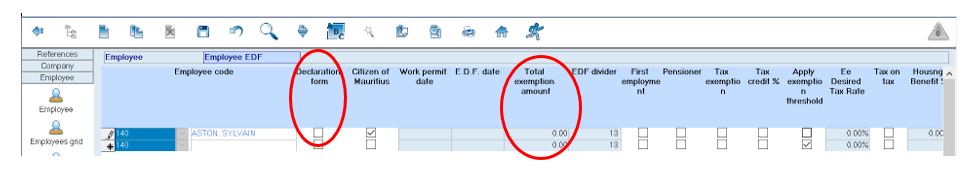

* Employee's EDF record

* Employee's EDF record

* Employee's PAYE calculation slip

* Employee's PAYE calculation slip

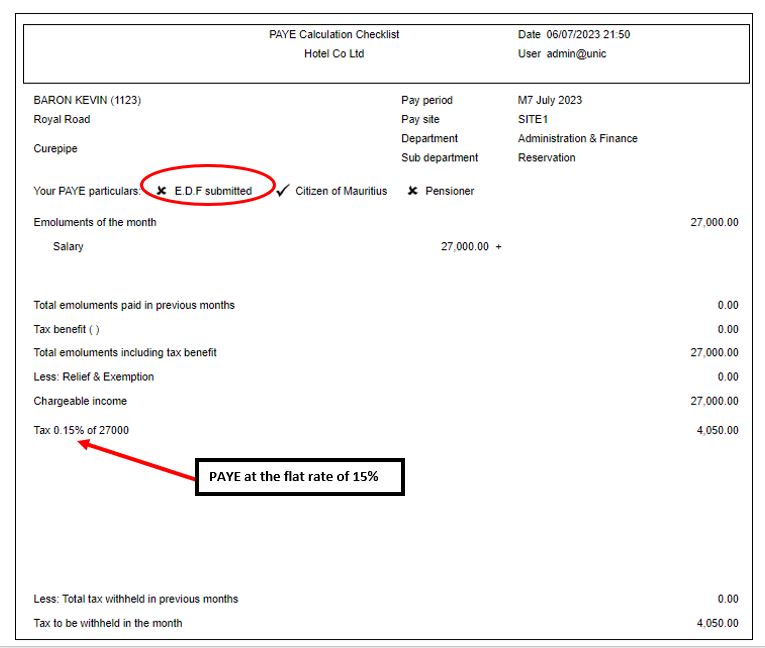

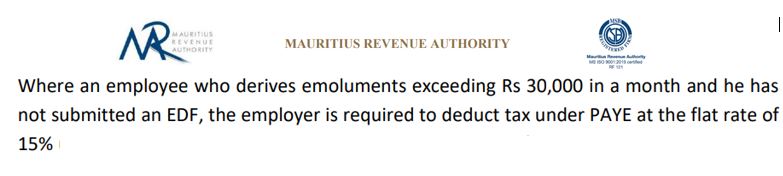

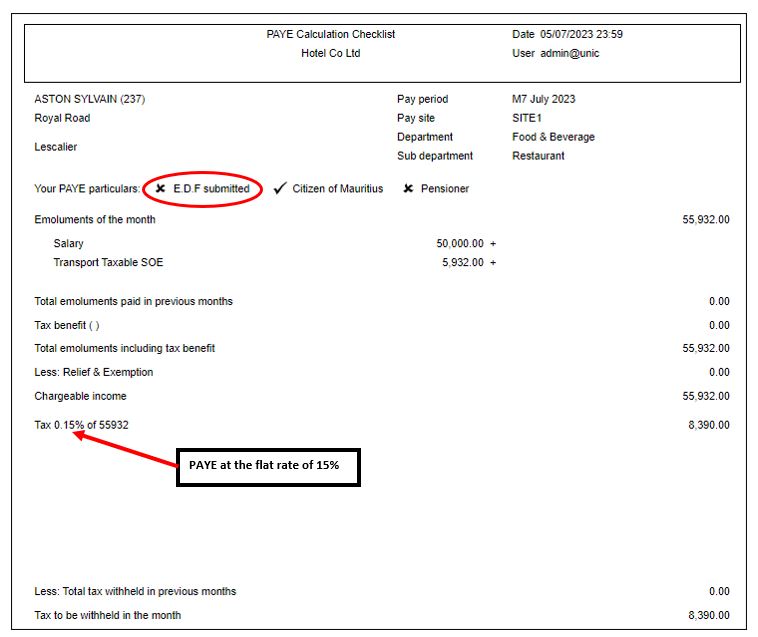

* (iii) PAYE at flat rate of 15% where NO EDF is submitted by an employee who derives emoluments exceeding Rs 30,000 in a month

* (iii) PAYE at flat rate of 15% where NO EDF is submitted by an employee who derives emoluments exceeding Rs 30,000 in a month

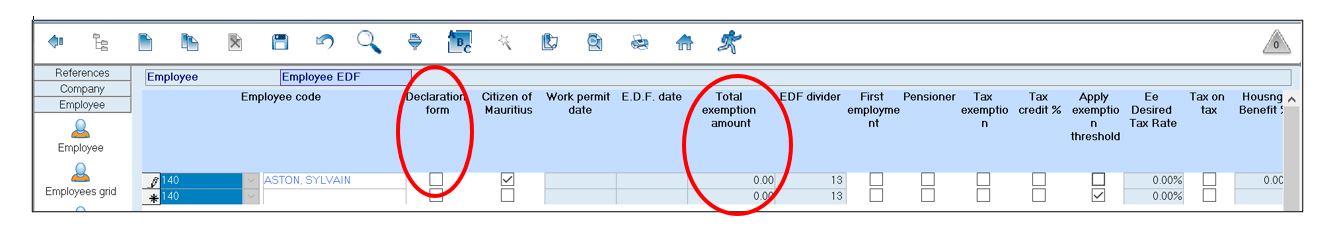

* Employee's EDF record

* Employee's EDF record

* Employee's PAYE calculation slip

* Employee's PAYE calculation slip

* (iv) PAYE at flat rate of 15% where NO EDF is submitted by an employee who derives emoluments not exceeding Rs 30,000 in a month**

* (iv) PAYE at flat rate of 15% where NO EDF is submitted by an employee who derives emoluments not exceeding Rs 30,000 in a month**

* Employee's EDF record

* Employee's PAYE calculation slip