You are here: SKB Home » HRMS Payroll » Procedure Guide » Employee EDF

Employee EDF

Applicable for the month of July only

Note: The below illustrations are related to fiscal year 2023 (June 2022-July 2023) however, for fiscal year 2025 (June 2025-July 2026), use the same steps and replace 2023 with 2025 where applicable as shown below

- Changes in the Total Exemption Amount for the EDF can be performed using the following options:

- MRA E-EDF facility (after employees have filed their EDF on the website of the MRA, the employer downloads the EDFs and imports them through Sicorax Payroll) (as at 18/07/2025, this facility was not yet available on MRA)

- Manual input of the new Total Exemption Amount through Employee EDF

MRA E-EDF Import

- MRA E-EDF facility (after employees have filed their EDF on the website of the MRA, the employer downloads the EDFs and imports them through Sicorax Payroll)

- To perform the import of the MRA E-EDF Excel file, you must download the file from the the website of the MRA. Ensure the file is valid and contains the necessary information. Should you need assistance regarding the download of the MRA E-EDF Excel file kindly contact the MRA.

- The MRA E-EDF Excel file must be in xls format as shown at A below.

- An illustration of the file after download from the website of the MRA is shown below. The date in column Date on which EDF was Submitted must be for year 2025 as shown at B below

- Step 2: On Sicorax Payroll Go to Import/Export

- Step 3: Click Import icon

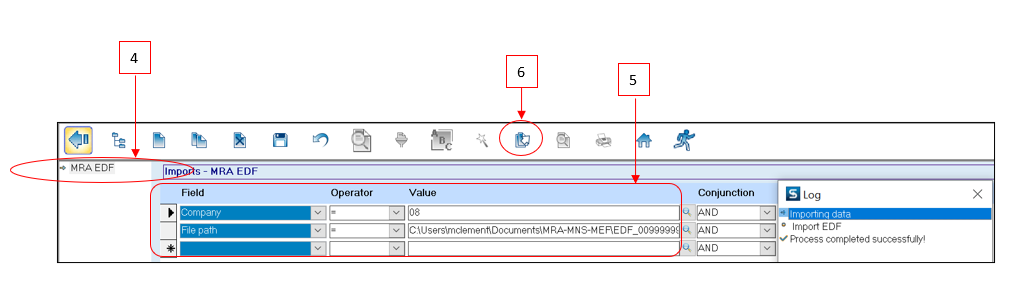

- Step 4: Double Click MRA EDF

- Step 5: Insert the criteria as illustrated below:

- Company: Choose the company from the list

- File Path: Browse the file location of the downloaded MRA E-EDF Excel file and select the file

- Step 6: Click Import button on the toolbar

View the imported MRA E-EDF records through Sicorax Payroll

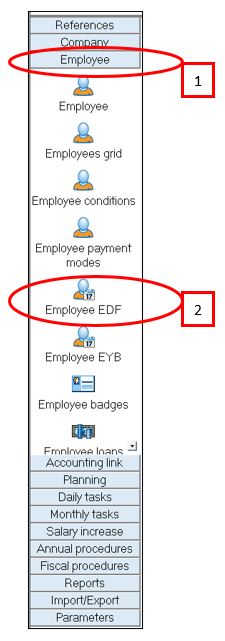

- Step 1: Go to Employee

- Step 2: Click Employee EDF

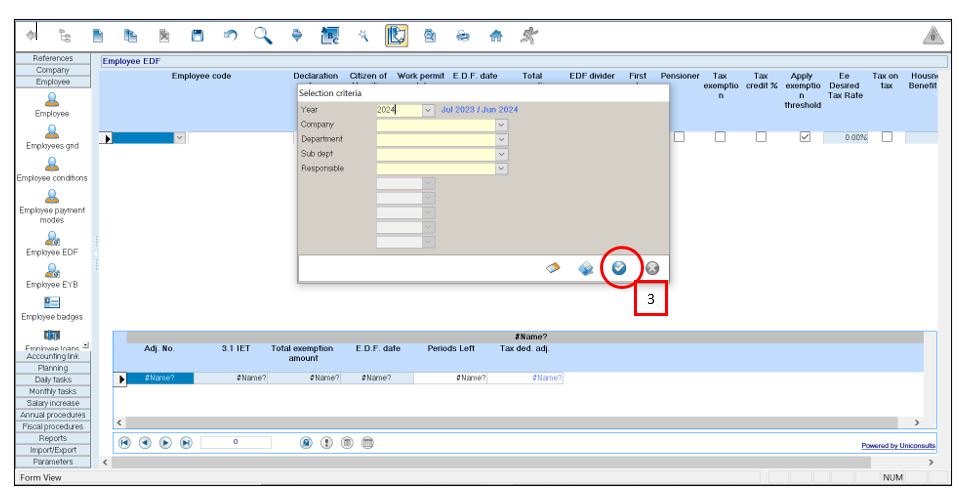

- Step 3: Click Apply In the selection criteria for Year, 2025 will be displayed for fiscal year Jul 2024-Jun 2025

- Column EDF Date will display dates as per EDF import

MRA E-EDF Import(New Recruit)

New recruits created on Sicorax Payroll, may have their EDF input manually through Employee EDF or imported using the MRA E-EDF import procedure. After completion of the manual input or import, it is compulsory to go through the new recruit's EDF record through Employee EDF to ensure additional flags are activated e,g First Employment Flag (Where a person, other than an exempt person, takes up employment for the first time in the current fiscal year).

To view the new recruit's EDF and activate the necessary flags, follow the steps below:

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

In the selection criteria for Year, 2025 will be displayed for fiscal year Jul 2024-Jun 2025 as shown at A below

- Step 4: Activate the First Employment Flag (if needed) First Employment: Where a person, other than an exempt person, takes up employment for the first time in the current fiscal year.

- Column EDF Date will show dates for year 2025 as per new import as shown at A below

Manual input of the new Total Exemption Amount through Employee EDF

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

- Step 4: Select the employee's record

- Step 5: Activate Declaration Form

- Step 6: Insert the EDF Date Insert date for year 2025

- Step 7: Modify the Total Exemption amount

- Step 8: Activate the first employment flag (if needed) First Employment: Where a person, other than an exempt person, takes up employment for the first time in the current fiscal year.