You are here: SKB Home » HRMS Payroll » hrmsprocguide » Solidarity Levy

Solidarity Levy

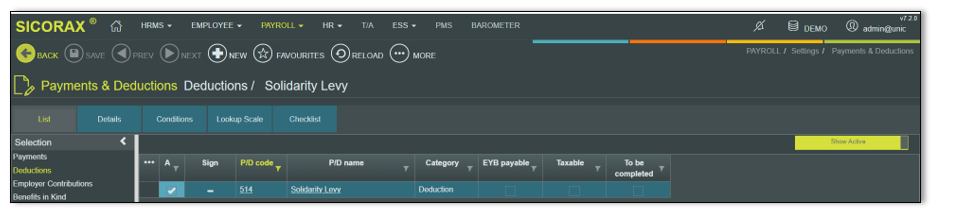

Solidarity Levy Tax deduction code as from September 2020

In September 2020, HRMS Payroll creates a new Solidarity Levy Tax deduction code to cater for the Solidarity Levy tax withholding based on the cumulative computation.

To view the new Solidarity Levy deduction code, follow the steps below:

- Step 1: Click Parameters

- Step 2: Click Payments/Deductions

- Step 3: Click Deductions

- Step 4: Click Solidarity Levy in the list

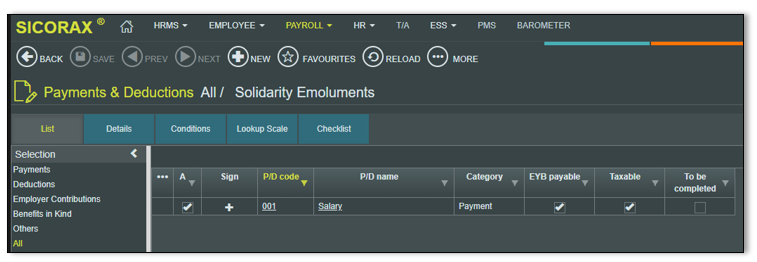

Solidarity Levy Emoluments

Create Solidarity Levy Emoluments pdcode(s)

HRMS Payroll automatically identifies the Solidarity Levy Emoluments based on the Emoluments of the month.

If the Solidarity Levy Emoluments pdcode(s) does not exist, Call our Support team to create the pdcode Below is an illustration of the pdcode Salary which is used as Solidarity Levy Emoluments

Insert Solidarity Levy Emoluments pdcode(s) and Solidarity Levy Tax pdcode in the Employee Payments Deductions

For the Payroll to cater for the Solidarity Levy tax withholding on the Solidarity Levy Emoluments, it is compulsory to insert the Solidarity Levy Emoluments pdcode(s) and the Solidarity Levy Tax pdcode in the Employee Payments Deductions.

To do so follow the steps below:

- Step 1: Click Monthly Procedures

- Step 2: Click Payments Deductions

- Step 3: Choose Employee

- Step 4: Insert Solidarity Levy Emoluments pdcode(s) - The below illustration refers to pdcode 001

- Step 5: Solidarity Levy pdcode unit and amount must remain zero

- After the above steps 1 to 5 have been completed, you may perform a Payroll Calculation

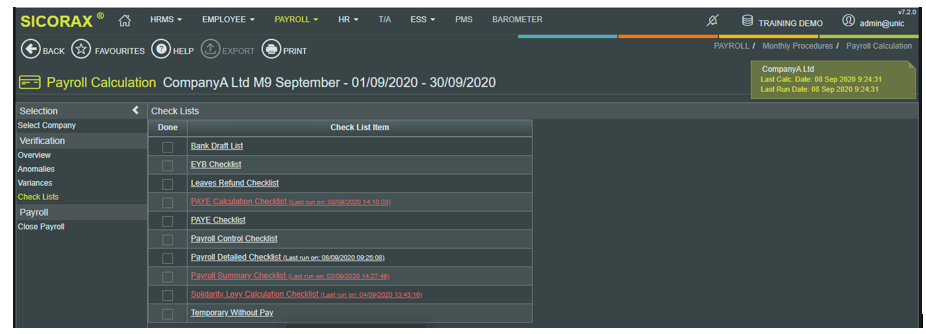

Payroll Calculation - Solidarity Levy Calculation

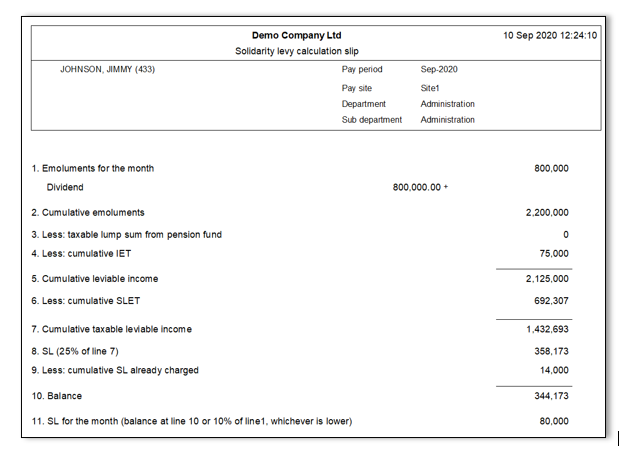

After the payroll calculation is performed, view the Solidarity Levy Tax Calculation Slip for verification purposes.

To view the Solidarity Levy Calculation, follow the steps below:

- Step 1: Click Checklist

- Step 2: Click Solidarity Levy Calculation Slip

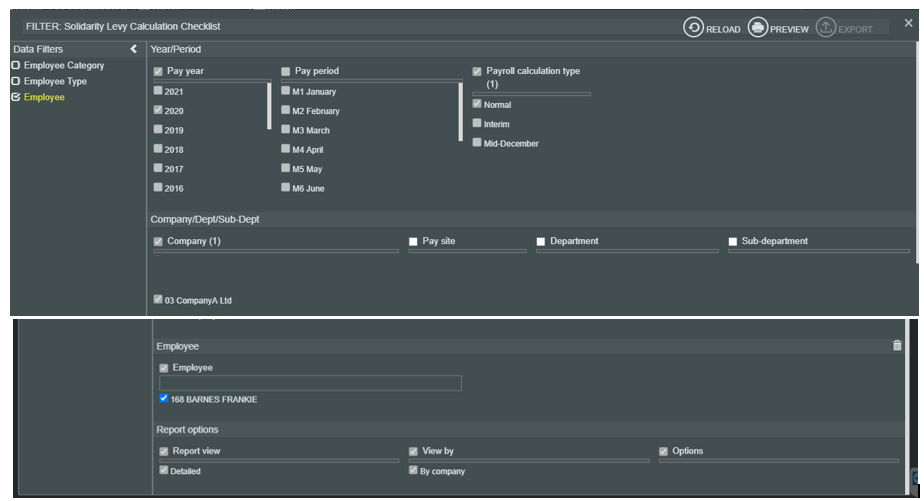

- Step 3: Choose and Insert the necessary criteria as shown below

- Step 4: Click Preview

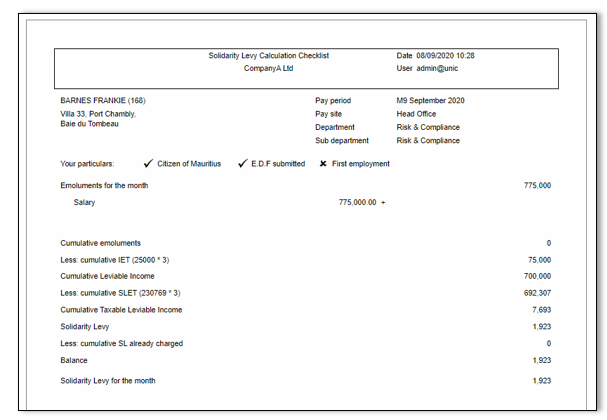

Solidarity Levy Calculation Slip

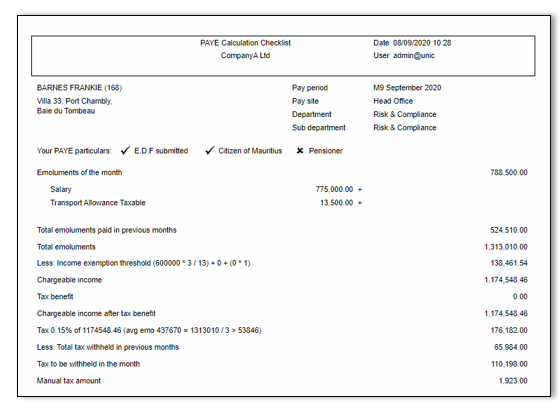

You will also find below an illustration of the PAYE Calculation Slip showing the Solidarity Levy Emoluments and the IET of the month

PAYE Calculation Slip

**Solidarity Levy Tax retained in July and August 2020**

In July and August 2020, some of you have recorded the Solidarity Levy Tax deduction on Sicorax HRMS Payroll using a manual Solidarity Levy Tax deduction pdcode.

However, the Solidarity Levy Tax deduction amount retained for those two months must be imported on Sicorax HRMS Payroll before closing September 2020 payroll. The import will result in the computation of the cumulative Solidarity Levy tax withholding.

Import Solidarity Levy Tax retained in July and August 2020

Before performing the import, you must download and fill the Solidarity Levy History Excel template, refer to the following steps to download and fill

Download and fill the Solidarity Levy History Excel template

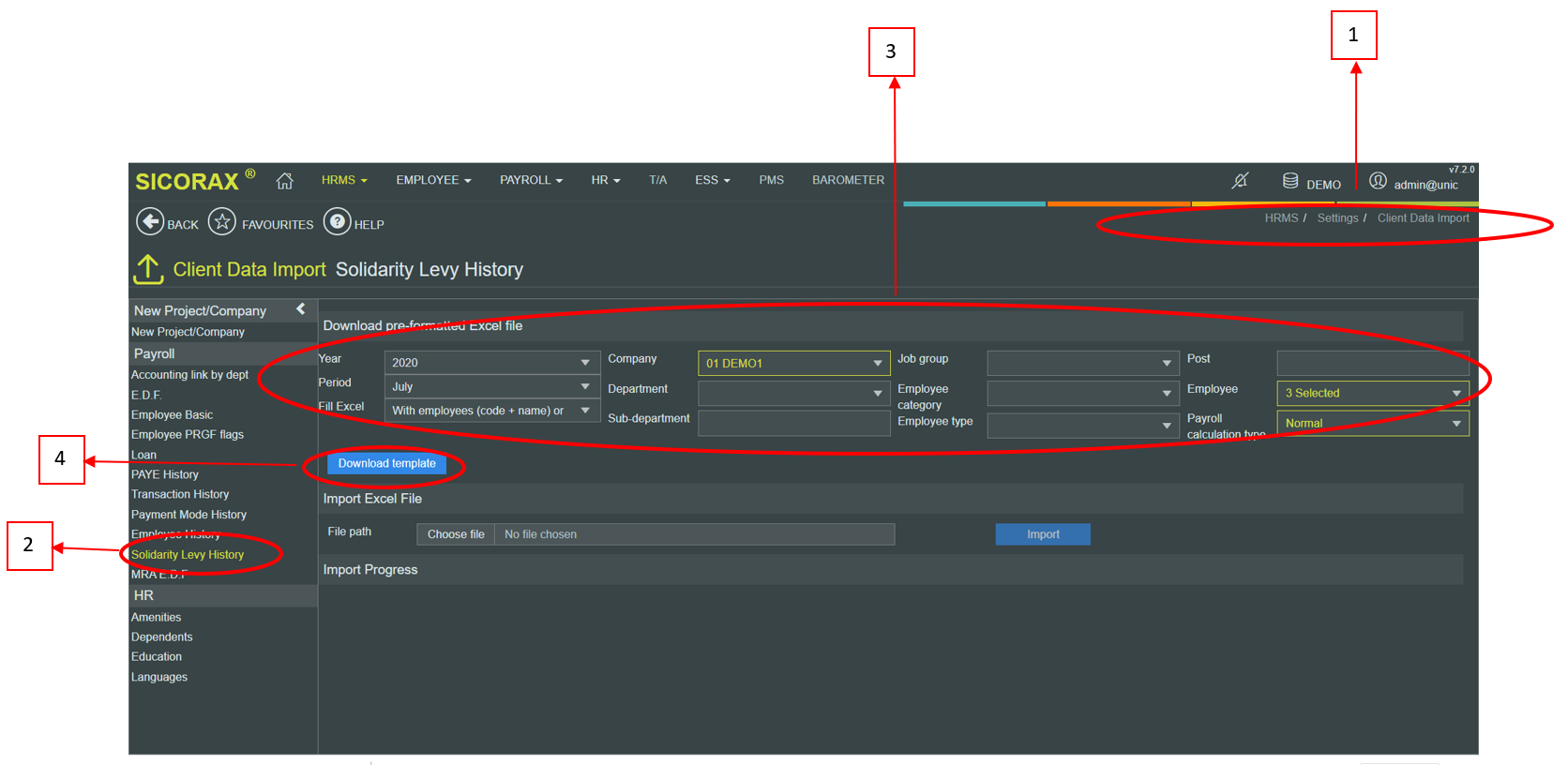

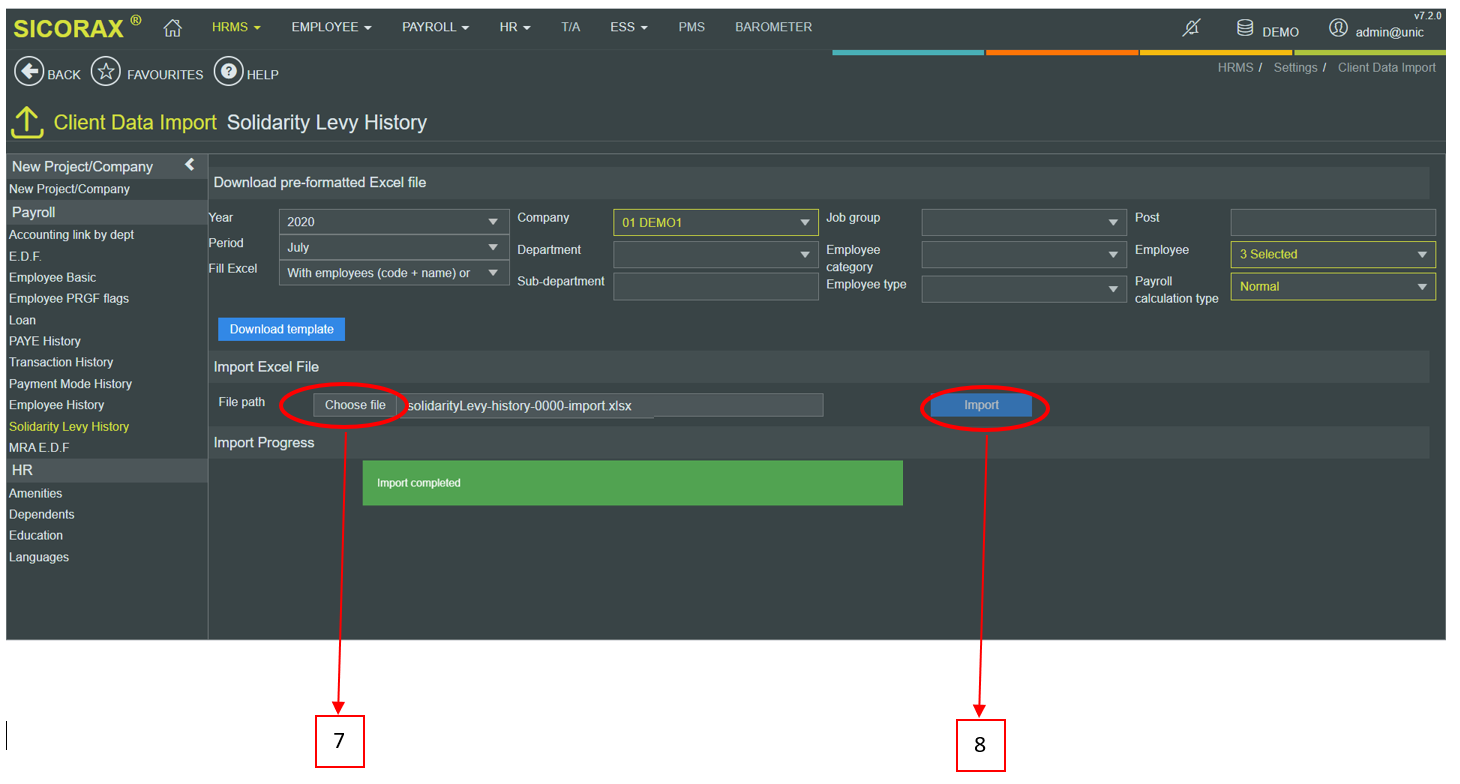

- Step 1: Go to HRMS - Click settings - Click Client Data Import - Note: Do not modify the file: No change must be done in the File name, Sheet Name, Column Name, File format

- Step 2: Click Solidarity Levy History

- Step 3: Choose/Select criteria as shown below:

- Year: 2020

- Period: July

- Fill Excel: With employees (code + name) only

- Company: Select company from the list

- Employee: Select employee (s) from the list

- Step 4: Click Download template

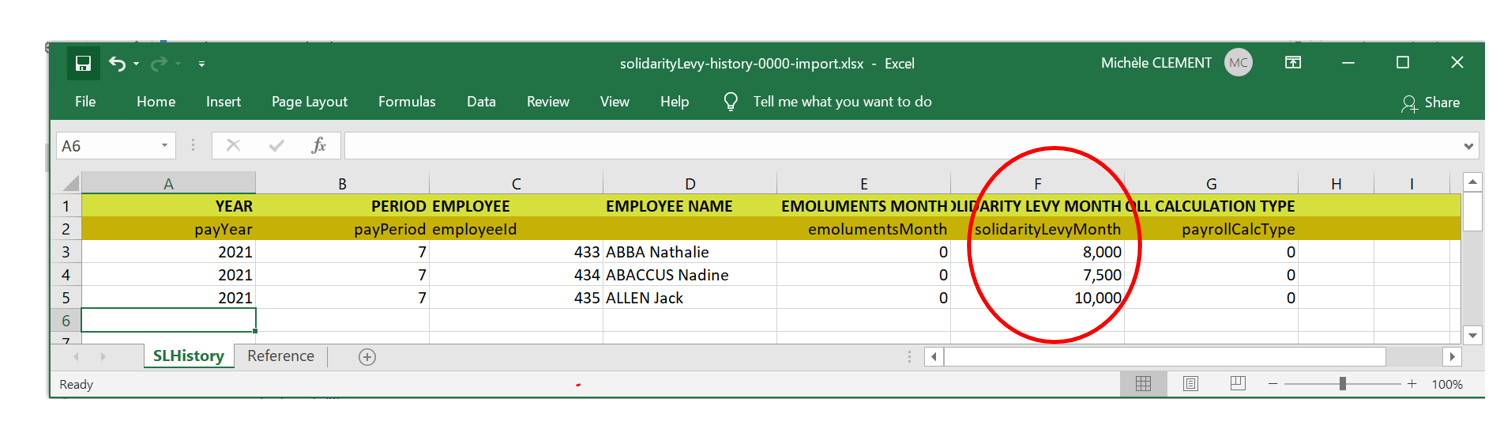

- Step 5: Open Excel template, fill column Solidarity Levy Month and Save file

Import Excel template Solidarity Levy History

- Step 6: Ensure criteria are chosen/selected

- Step 7: Choose file - Browse the file location of the downloaded Excel file and select the file

- Step 8: Click Import

Verify Solidarity Levy Tax

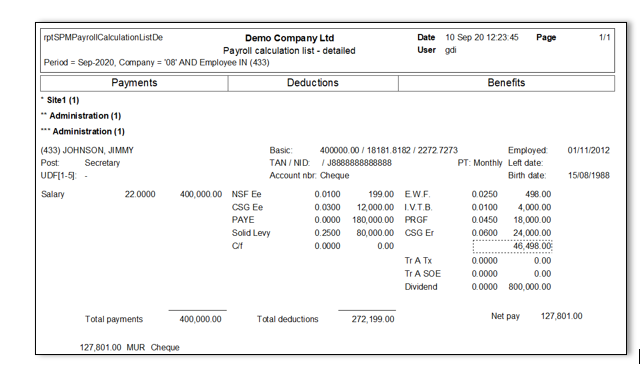

Payroll Calculation List - Detailed

- Step 1: Perform Payroll Calculation

- Step 2: Click Checklist

- Step 3: Click Payroll Calculation List - Detailed

- Step 4: Choose criteria and choose Employee(s)

- Step 4: Click Preview

Solidarity Levy Calculation Slip

- Step 3: Double-Click Solidarity Levy Calculation Slip

- Step 4: Insert criteria and choose Employee(s)

- Step 4: Click Preview on the toolbar

PAYE Calculation Slip

- Step 3: Double-Click PAYE Calculation Slip

- Step 4: Insert criteria and choose Employee(s)

- Step 4: Click Preview on the toolbar