You are here: SKB Home » HRMS Payroll » hrmsprocguide » Prerequisites for Monthly MRA PRGF Return

Prerequisites for Monthly MRA PRGF Return

How to prevent exporting a non-Mauritian citizen worker or a migrant worker to the Monthly MRA PRGF Return

It is compulsory to update the below before performing payroll calculation of the month.

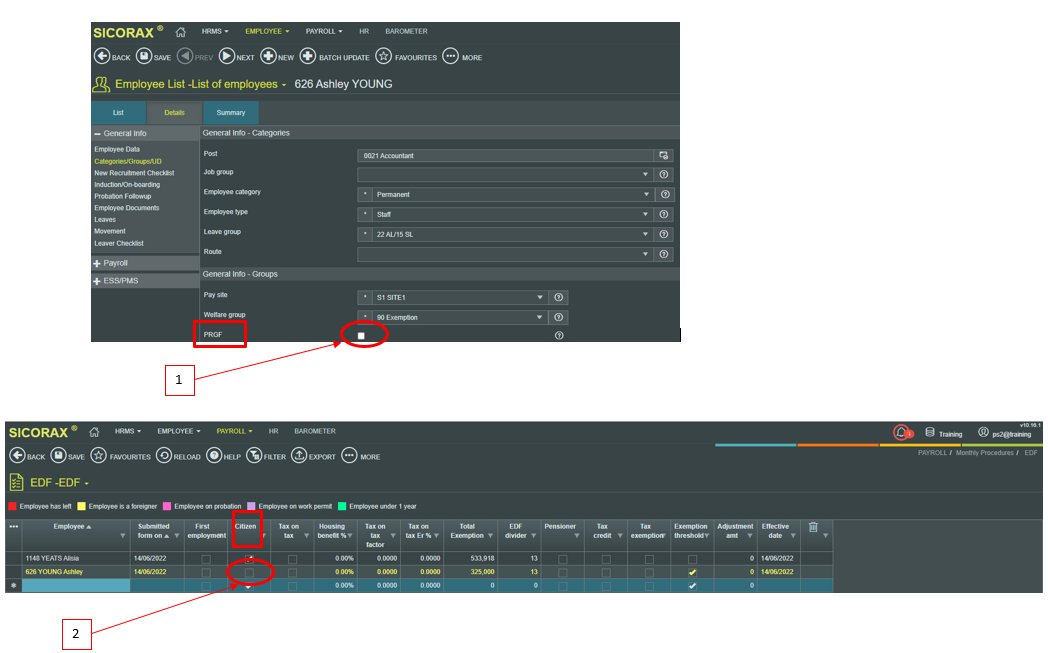

- Step 1: Untick PRGF flag in Employee

- Step 2: Untick Citizen Flag in Employee EDF.

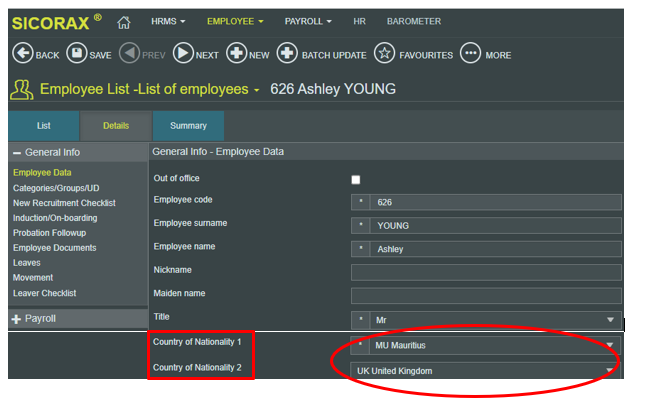

* However, to deactivate the Citizen flag, ensure the correct Country of Birth is chosen in the Employee masterfile, see below:

Update Reason no remuneration and commission paid for the month

Before exporting the Monthly MRA PRGF Return from Sicorax HRMS Payroll, it is compulsory to update the below before performing payroll calculation of the month.

- Reason no remuneration and commission paid for the month (As per MRA, this is the reason why no remuneration was paid to the Employee) It is compulsory if total monthly remuneration = 0 and no Pension Scheme is applicable

List of possible values given by the MRA for Reason no remuneration and commission paid for the month:

- Leave without pay (L)

- Unauthorised Leave without pay (U)

- Exit(ed) (D)

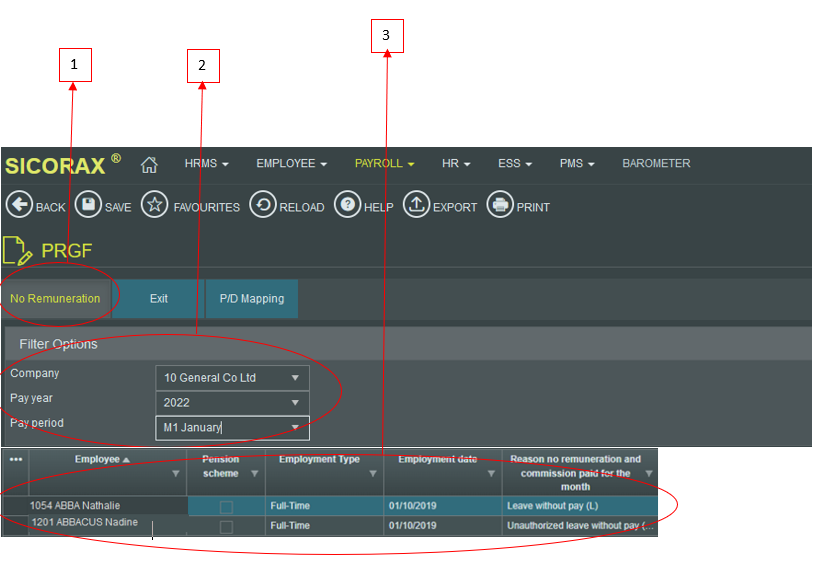

To update the reason, follow the steps below.

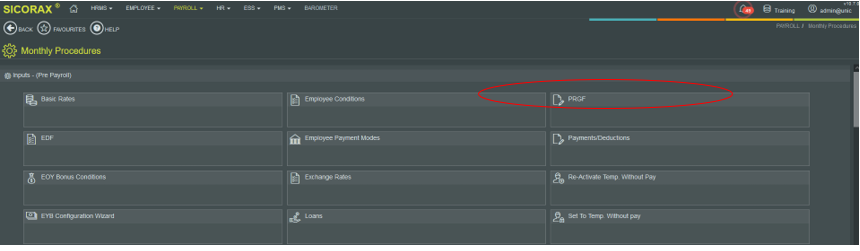

- Go to Payroll/Monthly Procedures/PRGF

- Step 1: Click No Remuneration Tab

- Step 2: Choose the criteria as illustrated

- Step 3: Choose from the drop-down list the employees who has no remuneration for the month and the Reason no remuneration and commission paid for the month

List of possible values given by the MRA for Reason no remuneration and commission paid for the month:

- Leave without pay (L)

- Unauthorised Leave without pay (U)

- Exit(ed) (D)

(Note: You must choose the Reason no remuneration and commission paid for the month for employees who are Temporarily Set Without Pay for the month)

Monthly MRA PRGF Return

To export the Monthly MRA PRGF Return after payroll closure, use the steps below.

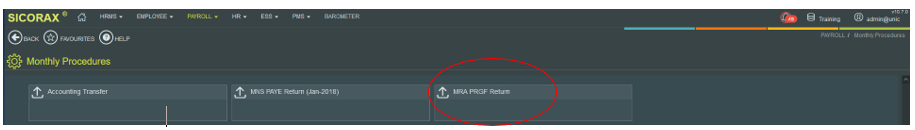

Step 1: Go to Payroll/Monthly Procedures

Step 2: Click MRA PRGF Return

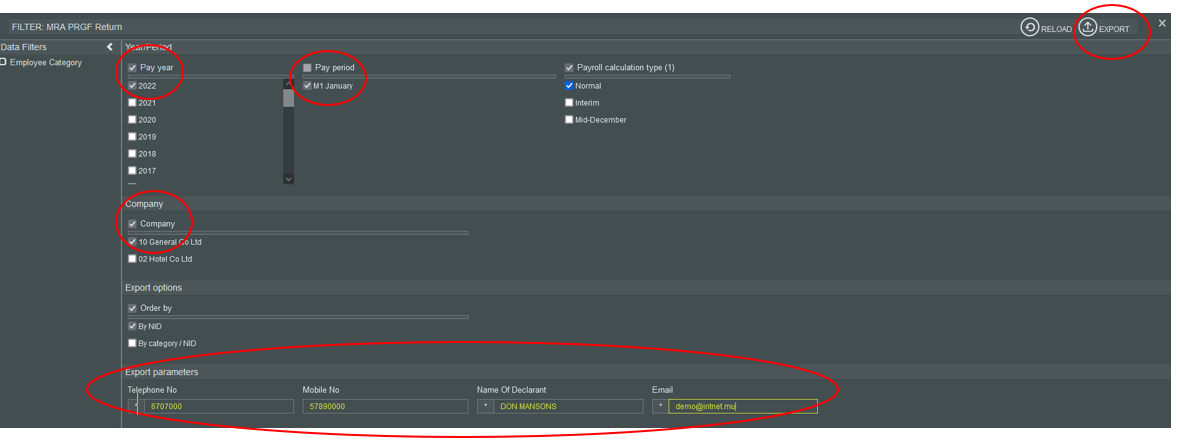

Step 3: Insert the criteria as per the above illustration:

- Year/Period

- Pay Year: Select calendar year from the list

- Pay Period: Select month from the list

- Company: Select company from the list

- Export Parameters:

- Telephone No: Insert number, it should be equal to 7 numeric characters

- Mobile No: Insert number, it should start with the figure 5 and should consist of 8 numbers;

- Name of Declarant: Insert the name, it should bear UPPER CASE letters and/or numeric characters (max 50 characters)

- Email: Insert the contact email address of the company

Step 5: Click Export button

- Browse your download folder and you may save the file to another location

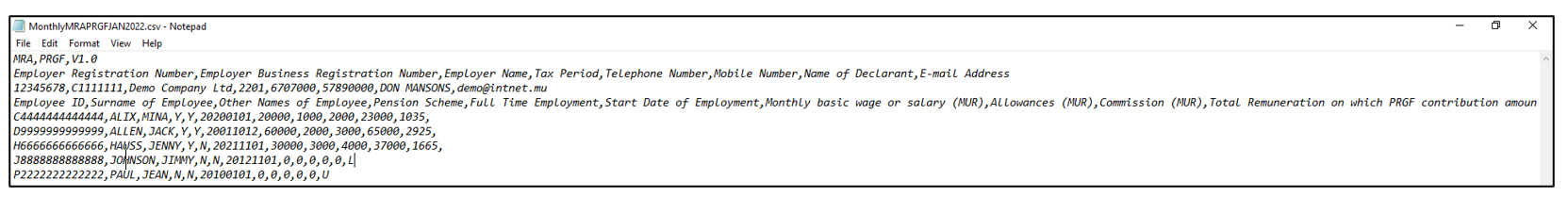

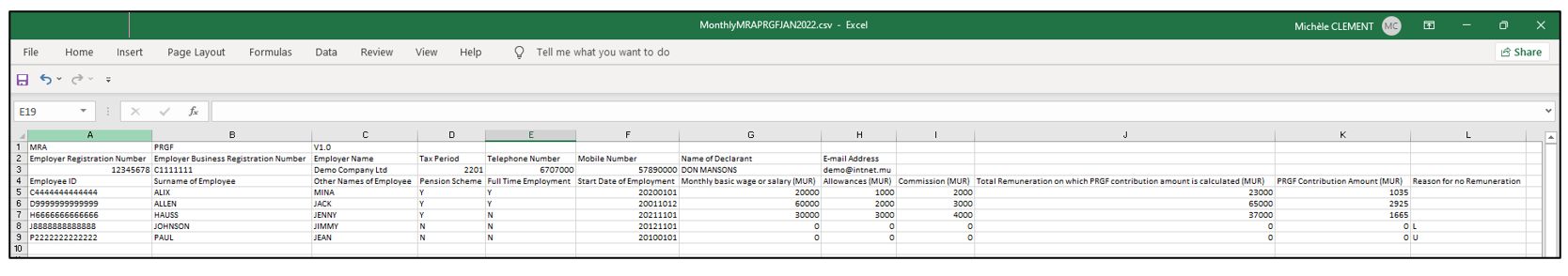

A sample of the csv file is shown below: