You are here: SKB Home » HRMS Payroll » hrmsprocguide » EDF submitted by an Expat after 183 days

This is an old revision of the document!

EDF submitted by an Expat after 183 days

In this example, the expatriate (non-citizen) submitted an EDF for the first time in August, after having stayed in Mauritius for 183 days. Therefore, for the month of July, he was taxed at the flat rate of 15% as he was not yet eligible to submit an EDF at that time. According to his contract the expatriate is not entitled to an end-of-year bonus. His IET is therefore 12 instead of 13, since the fiscal year (July to June) excludes this bonus.

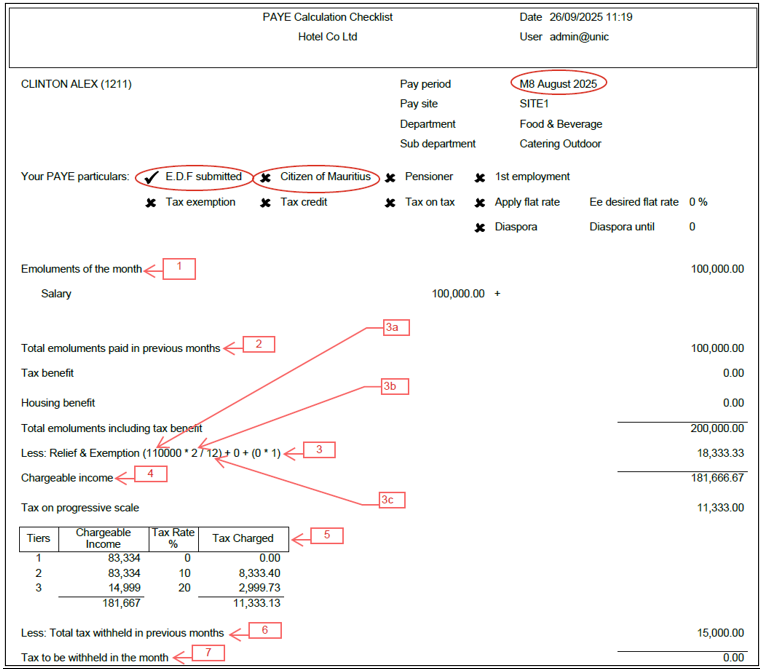

The illustration below shows how these exemptions are applied for August.

Follow the steps below to verify the PAYE calculation checklist:

- Check the Pay Period: In this example, the PAYE Calculation Checklist is for the month of August

- Check the section “Your PAYE Particulars” : In this example, the employee has not submitted an EDF and is not a Citizen of Mauritius

- Step 1: Check the Emoluments for the month, for example: Salary.

- Step 2: Check the Total emoluments paid in previous months. In this example refers to the July emoluments, since the PAYE Calculation Checklist is for the month of August.

- Step 3: Ensure that the employee’s Reliefs and Exemptions are correctly applied according to their EDF.

- (110,000 × 2 / 12) illustrated via Steps 3(a–c) and correspond to the following:

- 3a → 110,000 shows that a new EDF was submitted in August with a total exemption of Rs 110,000.

- 3b → 2 corresponds to August, which is the 2nd month of the fiscal year.

- 3c → 12 represents the fiscal year from July to June, excluding the end-of-year bonus, since in this example the expatriate is not entitled to the end of year bonus

- Step 4: Ensure that the Chargeable Income corresponds to the difference between the total emoluments (including taxable benefits) and the less reliefs and exemptions.

- Step 5: Check the Tax Charged (PAYE) from the Tax on Progressive Scale table.

- Step 6: Check the Tax paid in previous months. In this example refers to the tax for July, since the PAYE Calculation Checklist is for August.

- Step 7: The “Tax to be withheld in the month” is zero because, in this example, the Tax Charged (PAYE) from the Tax on Progressive Scale table is lower than the tax paid in previous months.