You are here: SKB Home » HRMS Payroll » hrmsprocguide » Addition of a taxable payment

This is an old revision of the document!

Addition of a taxable payment

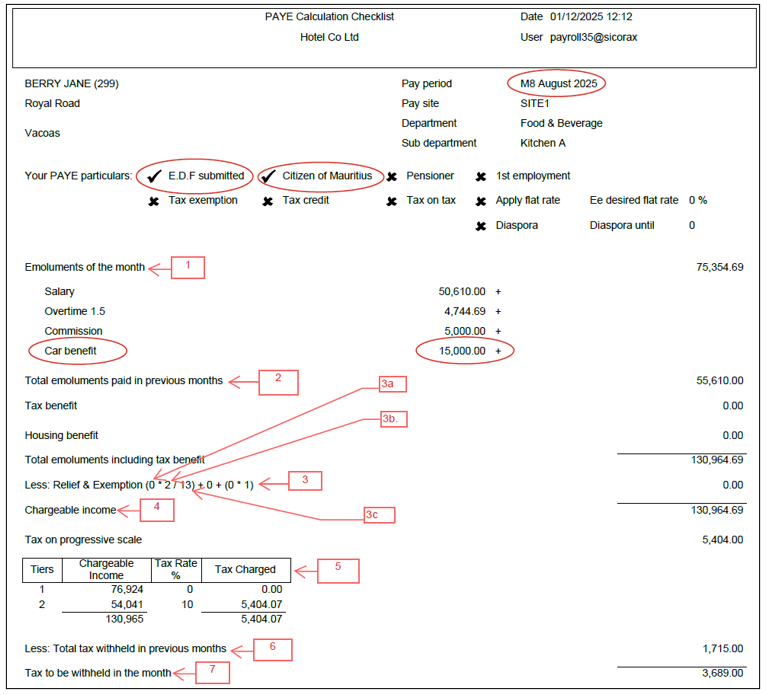

In this example, the employee receives a car benefit of Rs 15,000 as from the month of August. Since the car benefit is a taxable emolument, it is added to the total emoluments, increases the chargeable income, and therefore increases the PAYE.

Follow the steps below to verify the PAYE calculation checklist:

- Check the Pay Period: In this example, the PAYE Calculation Checklist is for the month of August

- Check the section “Your PAYE Particulars” : In this example, the employee has submitted an EDF and is a Citizen of Mauritius

- Step 1: Check the Emoluments for the month, for example: Salary, Overtime, Commission, and Car benefit.

- Step 2: Check the Total emoluments paid in previous months. In this example it refers to the July emoluments, since the PAYE Calculation Checklist is for the month of August.

- Step 3: Ensure that the employee’s Reliefs and Exemptions are correctly applied according to their EDF.

- (0 * 2 / 13) + 0 + (0 * 1) is illustrated via 3(a–c) and correspond to the following:

- 3a → 0 indicates that the EDF was submitted with Total Exemption 'Self'.

- 3b → 2 refers to the month of August, which is the 2nd month of the fiscal year.

- 3c → 13 represents the fiscal year from July to June, which includes 13 months because of the end-of-year bonus.

- Step 4: Ensure that the Chargeable Income corresponds to the difference between the total emoluments (including the taxable benefit) and the less reliefs and exemptions.

- Step 5: Check the Tax Charged (PAYE) from the Tax on Progressive Scale table.

- Step 6: Check the Tax paid in previous months In this example, it refers to the tax for July, since the PAYE Calculation Checklist is for August.

- Step 7: “Tax to be withheld in the month” represents the difference between the Tax Charged (PAYE) from the Tax on Progressive Scale table and the tax paid in previous months.