You are here: SKB Home » HRMS Payroll » User Manual » Employee

Table of Contents

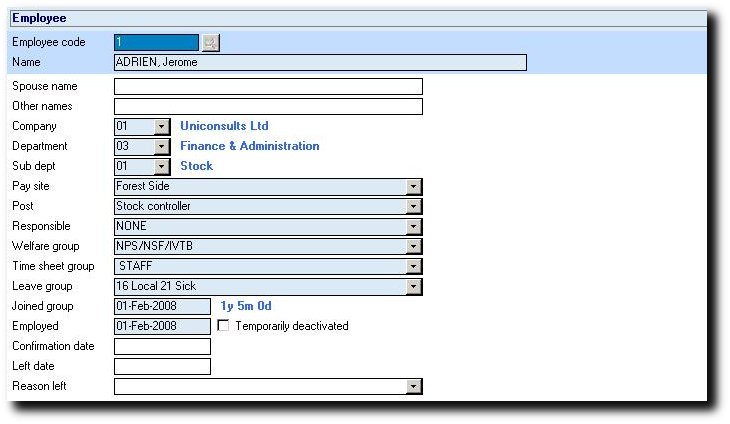

Employee

General

Employees record are created and maintained using the specifications below .

- Employee Code: Unique numeric value in the range 1 to 999999999.

- Employee Name: Must be in “SURNAME, OTHER NAMES” format, where the comma and space between surname and other names are compulsory.

- Spouse Name: Alphanumeric and is not compulsory.

- Other Names: Alphanumeric and is not compulsory.

- Company: The company where the employee is employed.

- Department: The department where the employee is working.

- SubDepartment: The section where the employee is affected.

- Paysite: The location where the employee's payroll is processed .

- Post: The job title of the employee.

- Responsible: The head of department or supervisor.

- Welfare Group: Determines the calculation of NPF, NSF and Levy contribution for the employee

- Time Sheet Group: Affects the calculation of the daily and hourly rates.

- Leave Group: Determines the leaves entitlement for the year

- Joined Group: Date that the employee has joined the group of companies.

- Employed: Date that the employee has started working at the company.

- Temporarily deactivated: When this option is checked the employee's record is skipped from payroll procesing. It is mainly used when an employee is on leave without pay and must be re-activated when the employee is back.

- Confirmation Date: Date that the employee has been confirmed.

- Left Date: Date that the employee has left the company.

- ReasonLeft: The reason for which the employee has left the company.

Personal

- Address: Address lines 1, 2 and 3 are alphanumeric.

- Title:

- Mr

- Mrs

- Miss

- Marital Status:

- Single

- Married

- Divorced

- Widow

- Sex:

- Male

- Female

- Birth date: The Date of birth is compulsory and it affects the NPF calculation.

- Pension fund no: Applicable to pensioners.

- Tax nbr: Applicable to tax/ P.A.Y.E payers and is compulsory for returns.

- Social security nbr: Not applicable.

- National ID No: Applicable to employees who contribute to the NPF and is compulsory for returns.

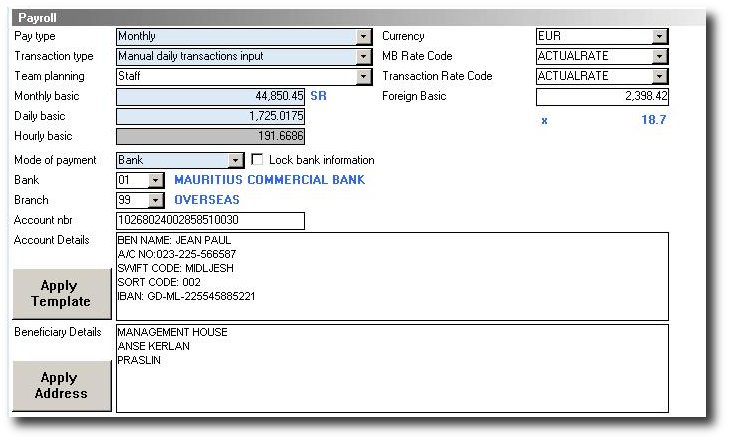

Payroll

- Pay type: The basis on which the employee is paid.

- Monthly: The employee is paid according to a fixed no. of days per month.

- Daily: The employee is paid according to the no. of days of days worked per month.

- Transaction type: The way in which Payments and Deductions are recorded.

- Manual input: Payments and deductions are input manually.

- Manual daily transactions input: Payments and deductions, and daily transactions such as overtime, absence, traveling bus, etc are input manually.

- Work attendance sheet input: Daily transactions such as overtime, absence, traveling bus, etc are generated according to attendance sheet obtained from site of work.

- Manual clockcard: Daily transactions such as overtime, absence, traveling bus, etc are generated according to manual input of time in and time out.

- Automatic clockcard: Daily transactions such as overtime, absence, traveling bus, etc are generated according to time in and time out obtained from clockcard machine.

* Team planning: .