You are here: SKB Home » HRMS Payroll » User Manual » Employee End of Year Bonus

Employee End of Year Bonus

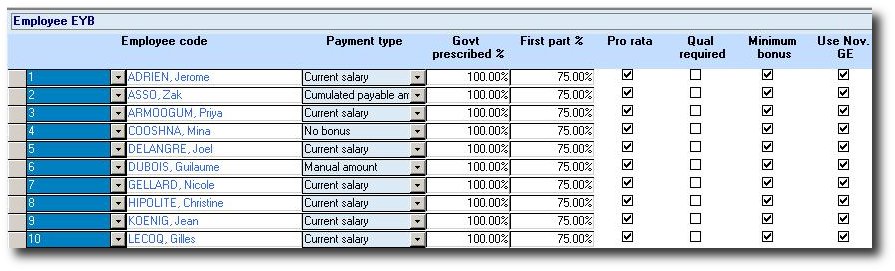

Each Employee must have a payment type for his/her End Of Year bonus. An entry is automatically created when a new employee is created.

Payment Type

- Current salary: The last basic salary of the employee will be considered as his/her bonus amount.

- Cumulated payable amounts: The total revenue (included in EOY bonus calculation) over the last 12 months divided by 12 will be considered as his/her bonus amount.

- Manual amount: A manual amount is specified for the bonus amount.

- No bonus: No bonus will be allocated.

Govt Prescribed %

This 100% indicates that the total of actual salary will be paid as Bonus. For example if the percentage must be changed - then 200% can be inserted - representing a double bonus amount.

First part %

This will calculate/pay the first part of EOY bonus according to the % chosen. (Applicable for those paying Bonus in 2 parts). More details about “Bonus Types” below.

Pro Rata

This option must be enabled if pro-rata is applicable for an employee (example: For new recruits during the current year)

Qual Required

This option is used if we want to compare % of presence before paying the bonus.

Minimum Bonus

If the EOY bonus calculated is less than the actual salary prevailing, then the actual salary will be considered as the EOY bonus. In this case, the employee is sure to receive a minimum bonus which is equal to his actual monthly basic salary (this is applicable for Cumulated Payable Amounts only) NOTE: For new-comers, bonus will be calculated on a pro-rata basis.