You are here: SKB Home » HRMS Payroll » Procedure Guide » Solidarity Levy (Tax on Tax)

Table of Contents

Solidarity Levy (Tax on Tax)

Tax on Tax for Solidarity Levy is applicable when Solidarity Levy is paid by the employer for the employee

Prerequisites for Tax on Tax for Solidarity Levy

- (1) Activate Tax on Tax flag through Employee EDF

- (2) Insert Solidarity Levy Er pdcode through Employee Transactions (The Solidarity Levy Er pdcode is automatically generated by the system in the payments & deductions list)

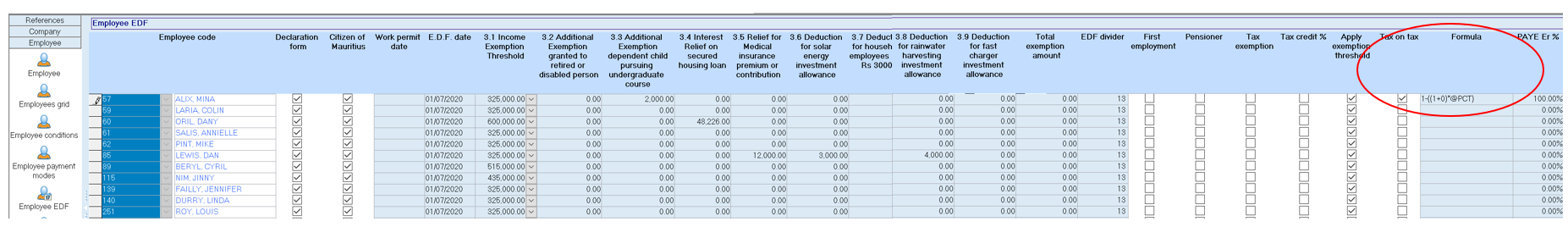

How to activate Tax on Tax flag through Employee EDF

- Step 1: Go to Employee menu

- Step 2: Click Employee EDF icon

- Step 3: Click Apply on Selection Criteria

- Step 4: Select the employee record

- Step 5: Scroll to the right of the Employee EDF menu

- Step 6: Activate Tax on Tax flag as shown below (Once the Tax on Tax flag is activated, the tax on tax formula will automatically appear)

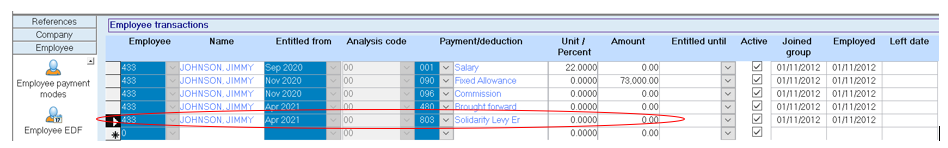

How to record Solidarity Levy Er pdcode through Employee Transactions

- Step 1: Go to Employee menu

- Step 2: Click Employee Transactions icon

- Step 3: Choose employee through Selection Criteria

- Step 4: Click Apply

- Step 5: Insert a new transaction as shown below (The Solidarity Levy Er pdcode is automatically generated by the system in the payments & deductions list)

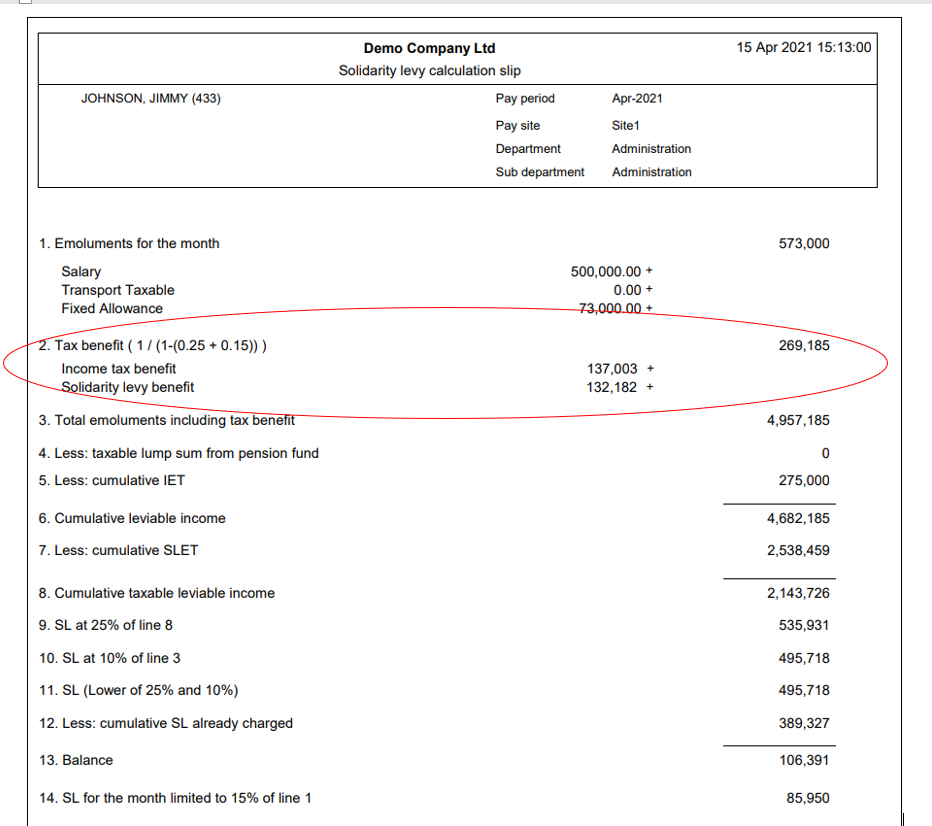

How to verify Tax on Tax/Tax Benefit calculation for Solidarity Levy

- Step 1: Perform Temporary Calculation for the employee

- Step 2: Click Payroll Checklist icon

- Step 3: Double-Click Solidarity Levy Calculation Slip

- Step 4: Click Preview on the toolbar

(Please note that we have been provided with the Tax on Tax Benefit formula/factor by the MRA as per below)

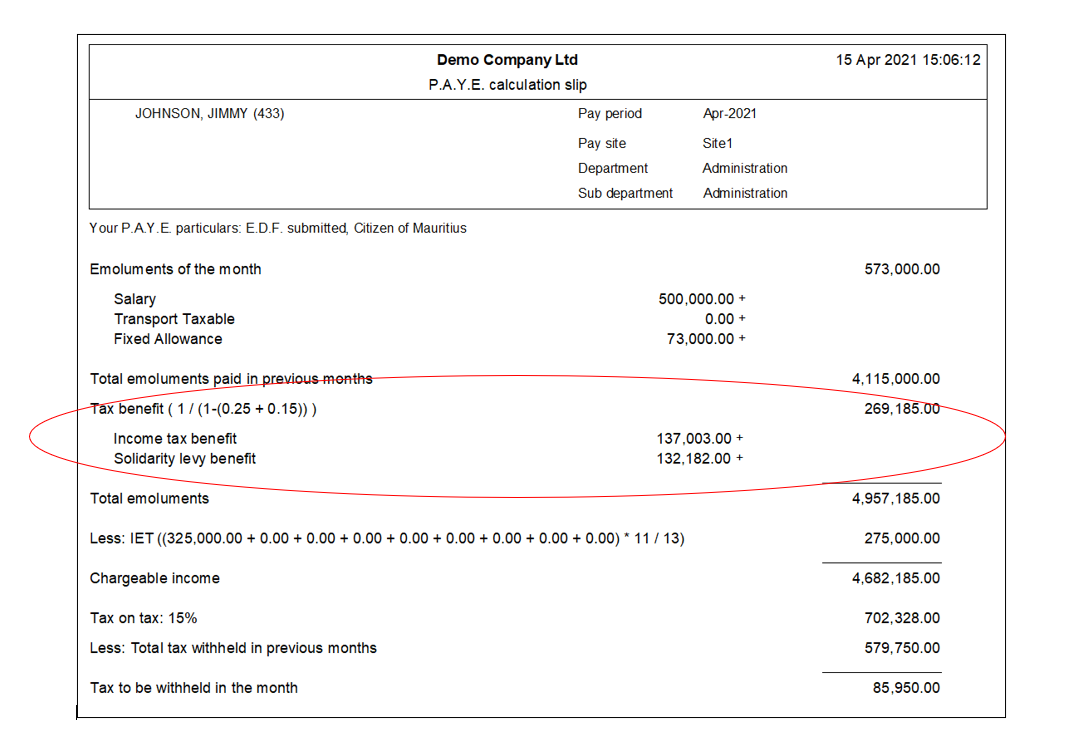

You will also find below an illustration of the PAYE Calculation Slip showing the Tax on Tax/Tax Benefit calculation