You are here: SKB Home » HRMS Payroll » Procedure Guide » Payroll Calculation - Solidarity Levy Calculation

Table of Contents

Payroll Calculation - Solidarity Levy Calculation

After the payroll calculation is performed, view the Solidarity Levy Tax Calculation Slip.

To view the Solidarity Levy Calculation, follow the steps below:

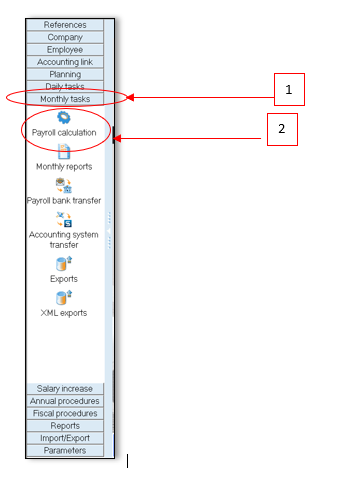

- Step 1: Click Monthly Tasks

- Step 2: Click Payroll Calculation icon

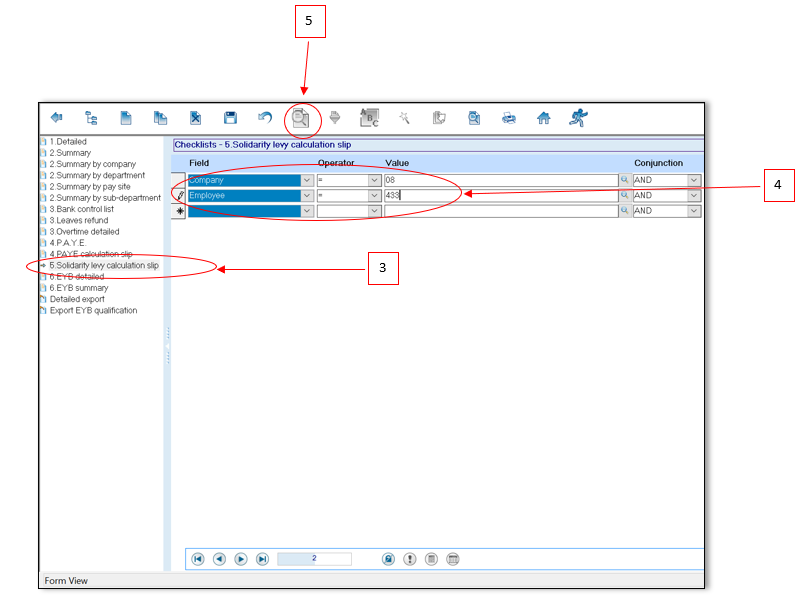

- Step 3: Double-Click Solidarity Levy Calculation Slip

- Step 4: Choose and Insert the necessary criteria as shown below

- Step 5: Click Preview on the toolbar

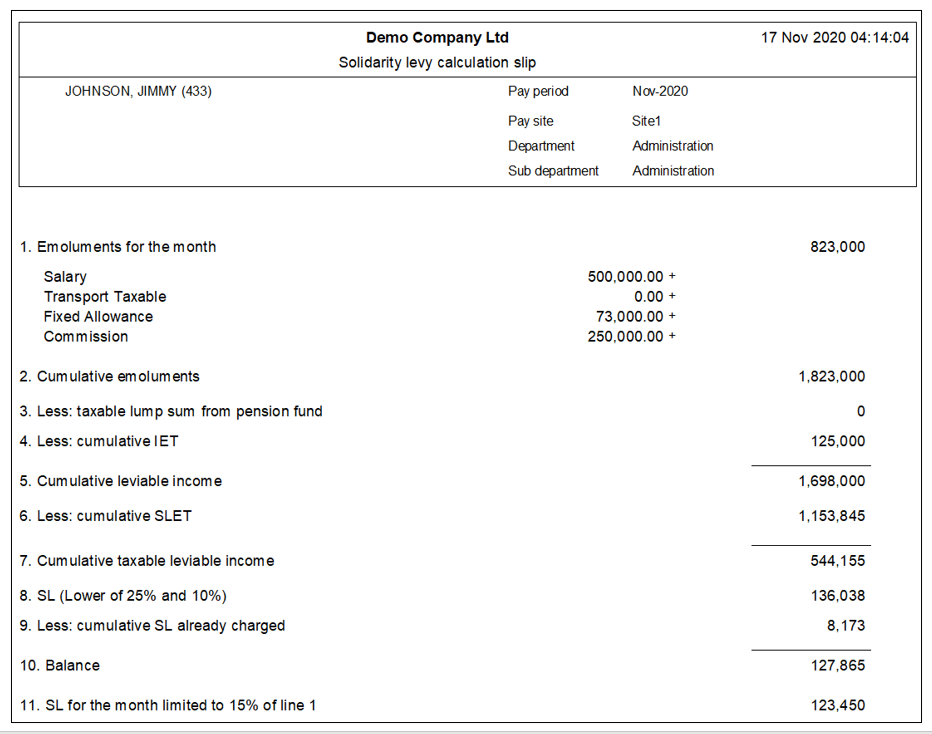

Solidarity Levy Calculation Slip

The MRA has introduced a new process in the calculation of the Solidarity levy: PAYE for Solidarity Levy limited to 15% of current month Emoluments. For more information, view the Solidarity Levy Calculation Checklist by considering the below conditions.

- SL (Lower of 25% and 10%): Checks 25% of line 7 (Cumulative Taxable Leviable Income)

- SL (Lower of 25% and 10%): Checks 10% of line 2 (Cumulative Emoluments)

- SL for the month limited to 15% of line 1 : Checks 15% of line 1 (Emoluments for the month)

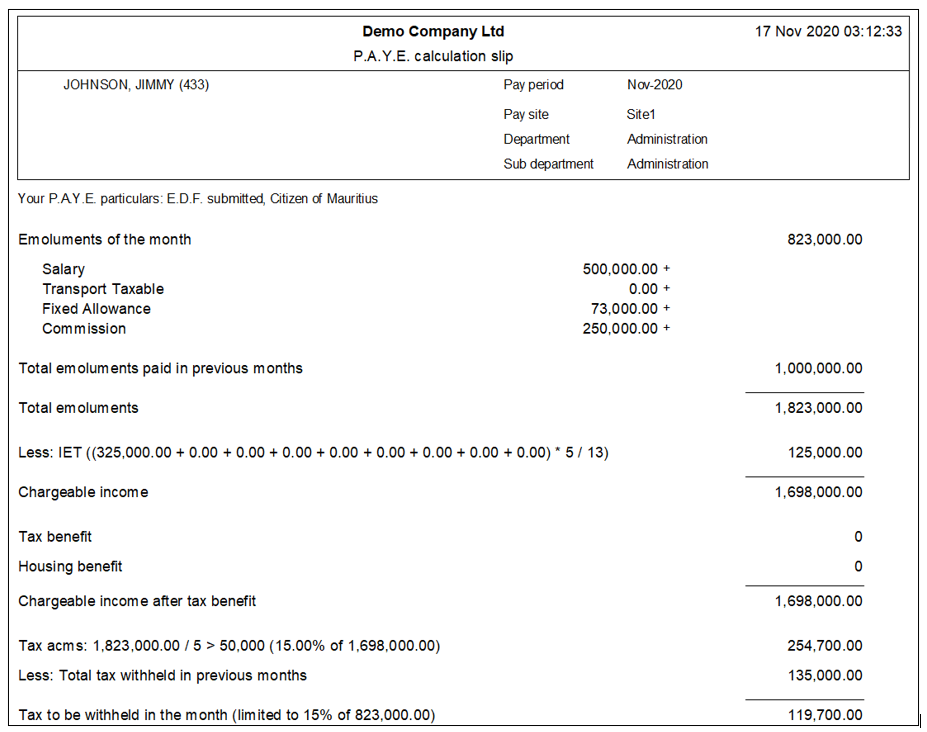

You will also find below an illustration of the PAYE Calculation Slip showing the Solidarity Levy Emoluments and the IET of the month