You are here: SKB Home » HRMS Payroll » Procedure Guide » Prerequisites for Monthly PRGF Return

Prerequisites for Monthly PRGF Return

Before exporting the Monthly MRA PRGF Return, the following must be completed

Update PRGF Payment & Deduction indicator flag (DO NOT PROCEED)

PRGF Payment & Deduction indicator flag (also known as PRGF flag) must be updated with regards to the calculation of PRGF Contribution.

The calculation is based on Monthly Remuneration where Monthly Remuneration is defined as monthly basic wage, payment for extra work performed and any productivity bonus and attendance bonus paid to a worker.

To update the payments & deductions which are related to the PRGF flag, go through the below steps.

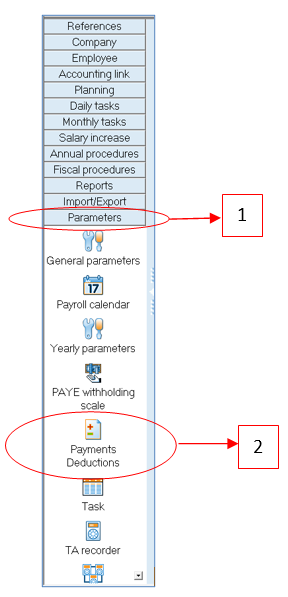

Step 1: Go to Parameters

Step 2: Click Payments Deductions icon

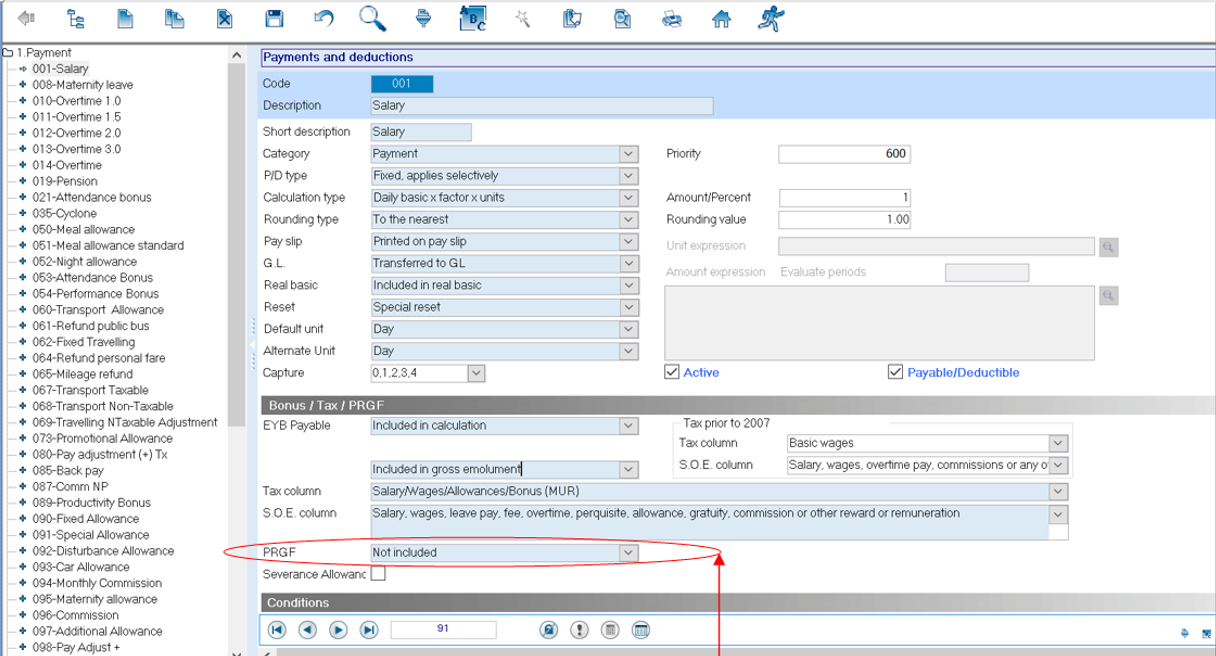

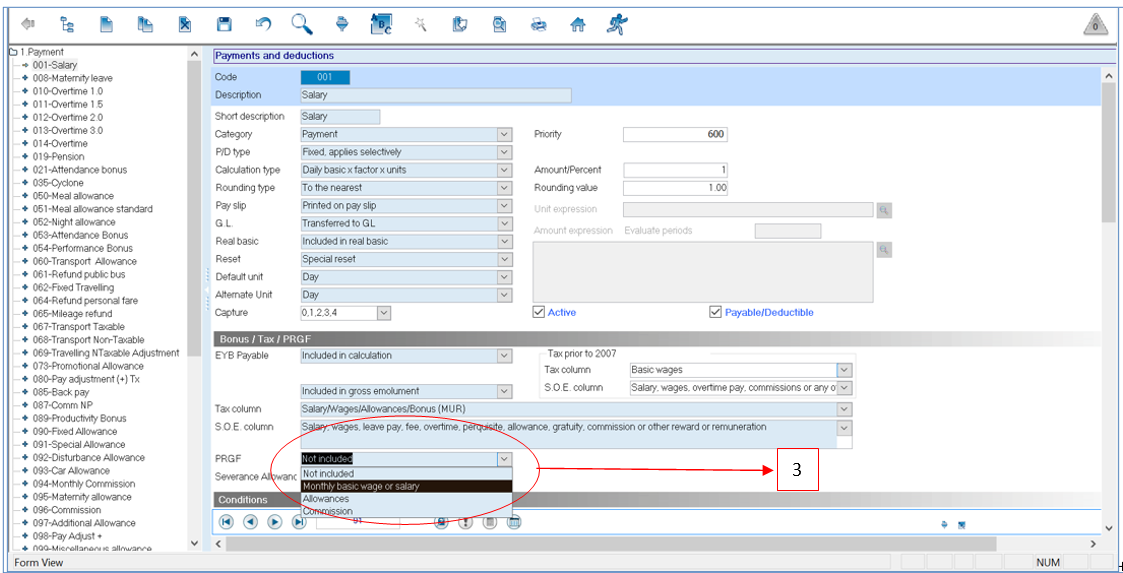

A new flsg PRGF has been added with a list of values

Step 3: For the payment salary, choose the PRGF value from the list

Step 4: Click save

Step 5: Click Yes

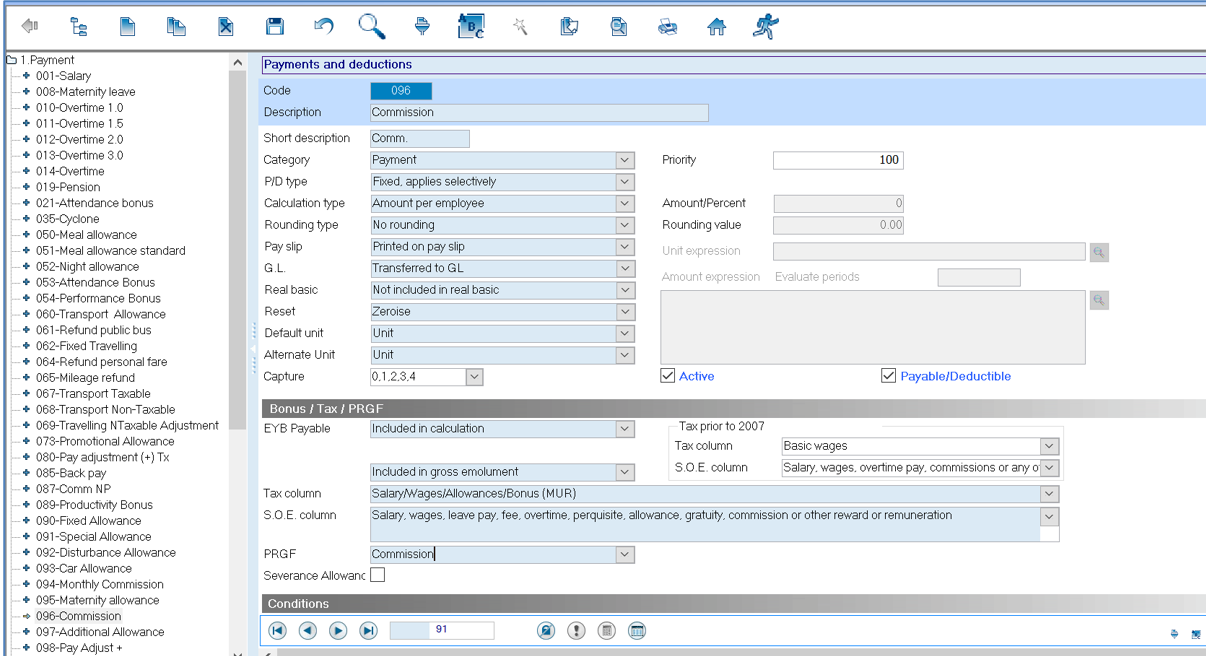

Repeat steps 3 to 5 for payments & deductions which are related to the PRGF flag. You will find below additional examples for Commission and Allowances