You are here: SKB Home » HRMS Payroll » Procedure Guide » Generate Employee PRGF Flag

This is an old revision of the document!

Generate Employee PRGF Flag

To generate and update employees PRGF Contribution flag, use the steps below. You must also generate and update employees Pension scheme flag as per MRA's requirement.

PRGF Flag indicates whether the employer contributes or not to the PRGF for the employee

Pension Scheme Flag indicates whether retirement benefits of the employee are payable under the Statutory Bodies Pension Funds Act; or in accordance with a private pension scheme.

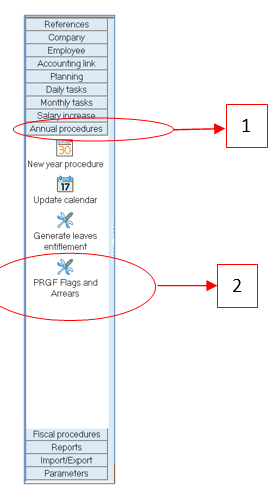

Step 1: Go to Annual Procedure

Step 2: Click PRGF Flags and Arrears icon

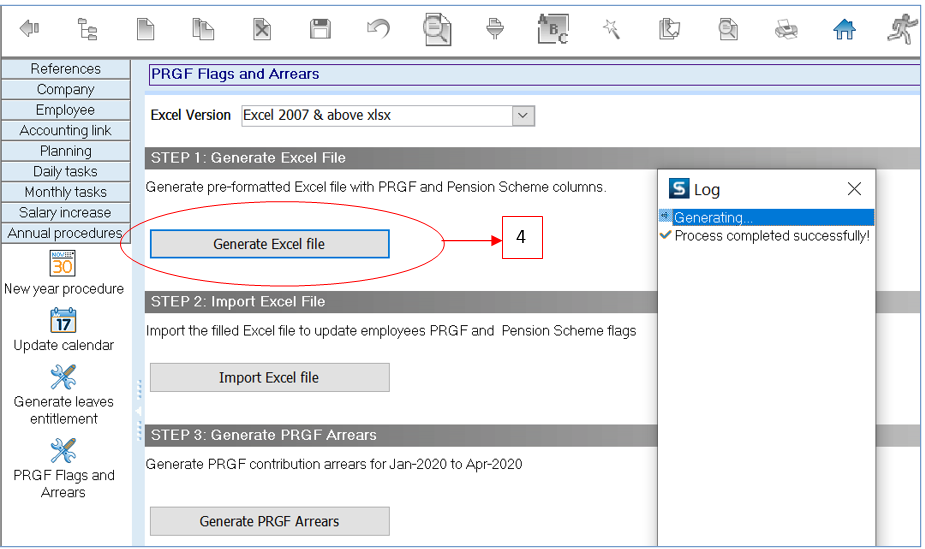

Step 3: Choose your Excel version

Go to step 1 - Generate Excel file

Step 4: Click Generate Excel file button

This operation generates an Excel file containing a list of employees where PRGF and Pension Scheme Flags must be updated

The status of the generated file is displayed through the log

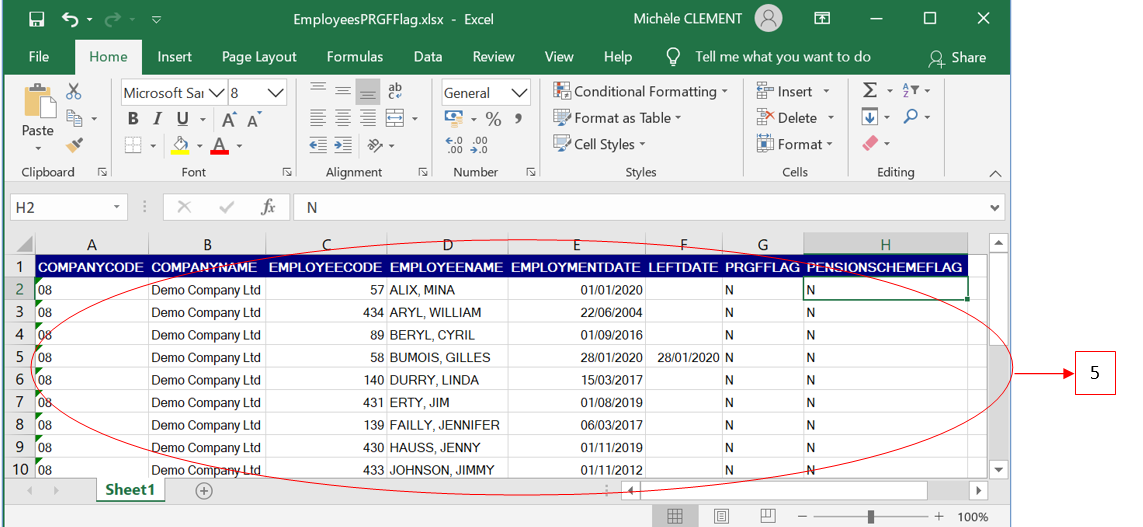

Step 5: Click Generate Excel file button

The Excel file provides a list of

active employees and

Leavers as from Jan 2020

Save the file to a location

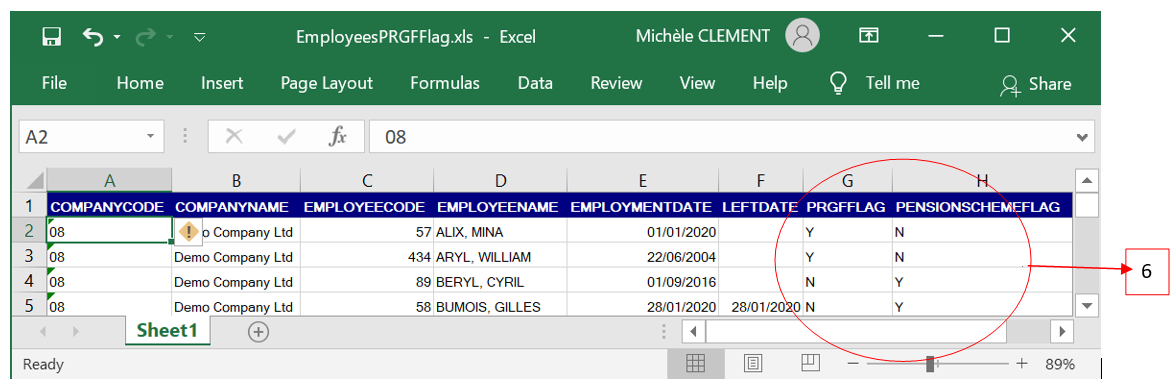

Step 6:Update columns PRGF Flag and Pension Scheme Flag

- Pension Scheme Flag with values Y (YES) or N (NO) - Pension Flag indicates whether retirement benefits of the employee are payable under the Statutory Bodies Pension Funds Act; or in accordance with a private pension scheme.

- PRGF Flag with values Y (YES) or N (NO) - PRGF Flag indicates whether the employer contributes or not to the PRGF for the employee.

However, the PRGF Fund is applicable to all workers of the private sector, excluding:

- (i) A worker drawing a basic wage of more than Rs200,000 a month;

- (ii) A migrant worker or a non-citizen; and

- (iii) A worker whose retirement benefits are payable under the Statutory Bodies Pension Fund Act or in accordance with a private pension scheme

To help you with the above flags, please find below some possible values:-

- A worker drawing a basic wage of more than Rs200,000 a month

Pension Scheme flag (Yes) PRGF flag (No) or Pension Scheme flag (No) PRGF flag (No)

- A migrant worker or a non-citizen

Pension Scheme flag (Yes) PRGF flag (No) or Pension Scheme flag (No) PRGF flag (No)

- Retirement benefits of the employee are payable under a Private pension scheme

Pension Scheme flag (Yes) PRGF flag (No)

- Retirement benefits of the employee are payable under the Statutory Bodies Pension Funds Act

Pension Scheme flag (Yes) PRGF flag (No)

- Retirement benefits of the employee are payable neither under Private pension scheme nor under Statutory Bodies Pension Funds Act

Pension Scheme flag (No) PRGF flag (Yes)

After the Excel file is updated, Save and close the file

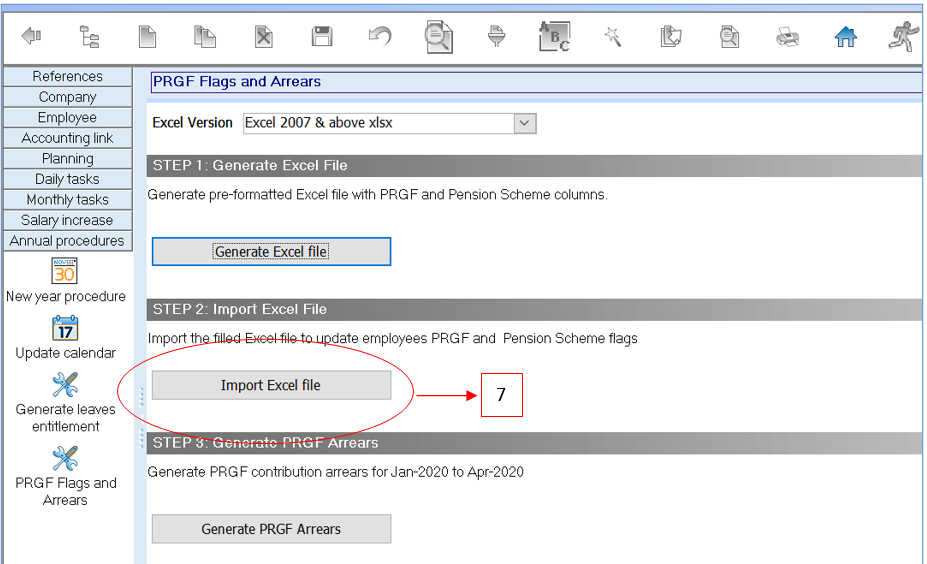

Go to step 2 – Import Excel file

Step 7:Click import Excel file button

The status of the generated file is displayed through the log

Step 8:Browse the Excel file location

Select the file

Click OK

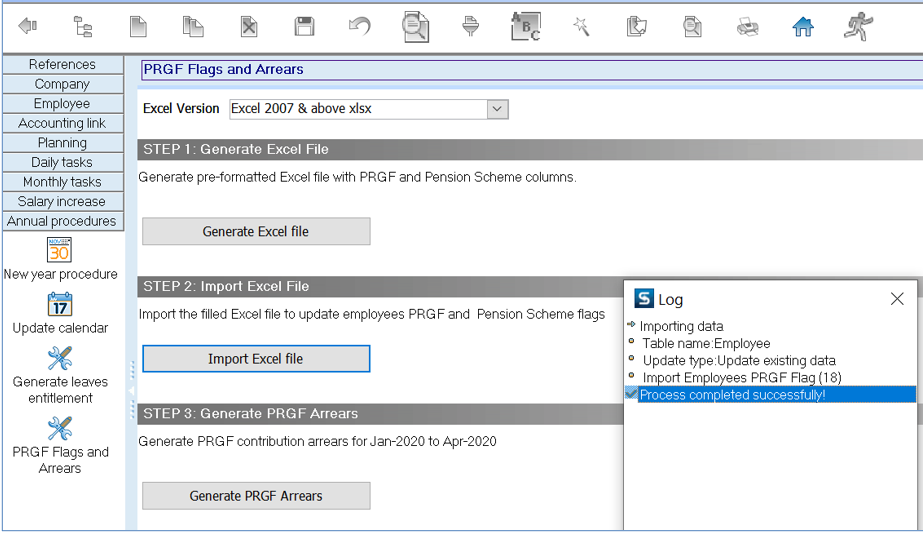

The status of the imported file is displayed through the log

The above operation:

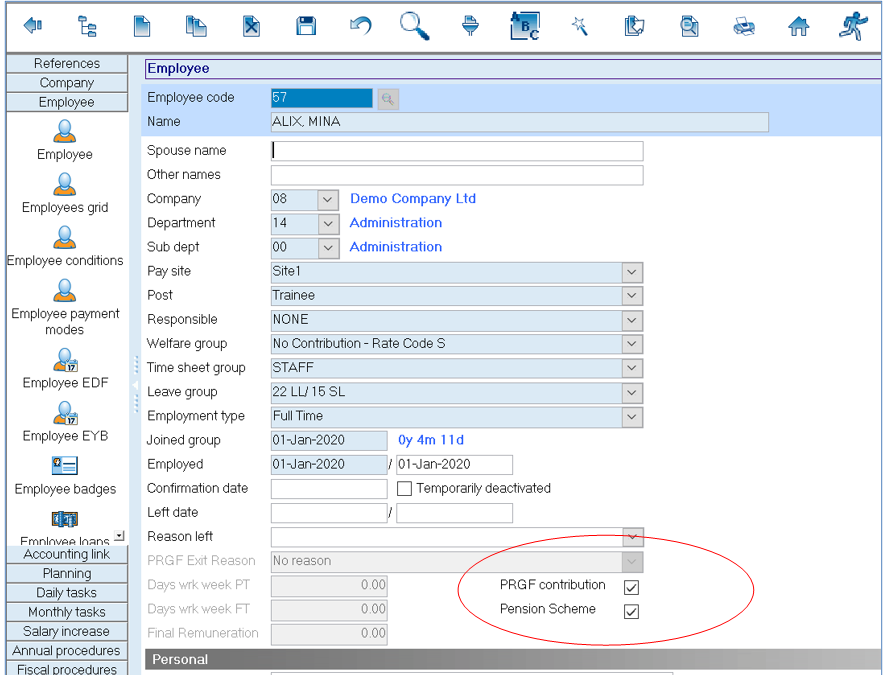

Updates the PRFG Contribution and Pension Scheme flags per employee through the Employee Masterfile. To view the result, go to Employee as per illustration 1 below

Activates the PRGF Contribution per employee (where PRGF flag has been set to Y)

Illustration 1