Employee Declaration Form (EDF)

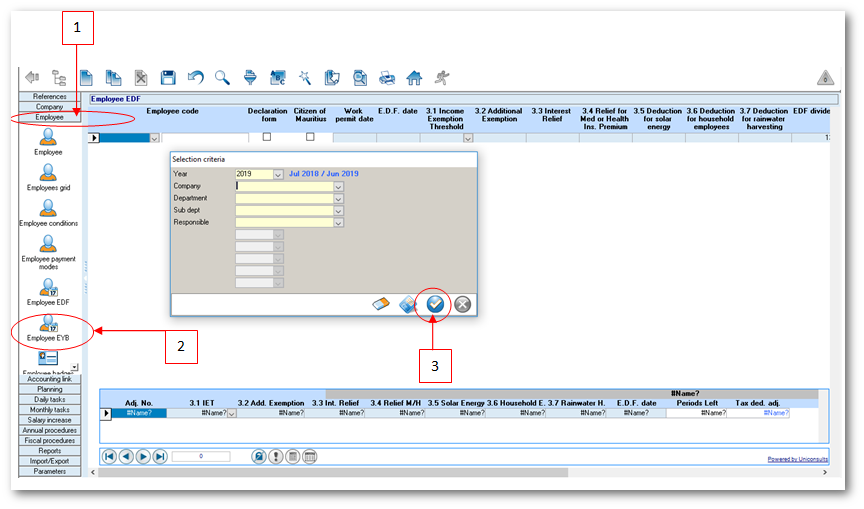

To view Employee EDF follow the below steps:

- Step 1: Go to Emplouee

- Step 2: Click Employee EDF icon

- Step 3: Click Apply

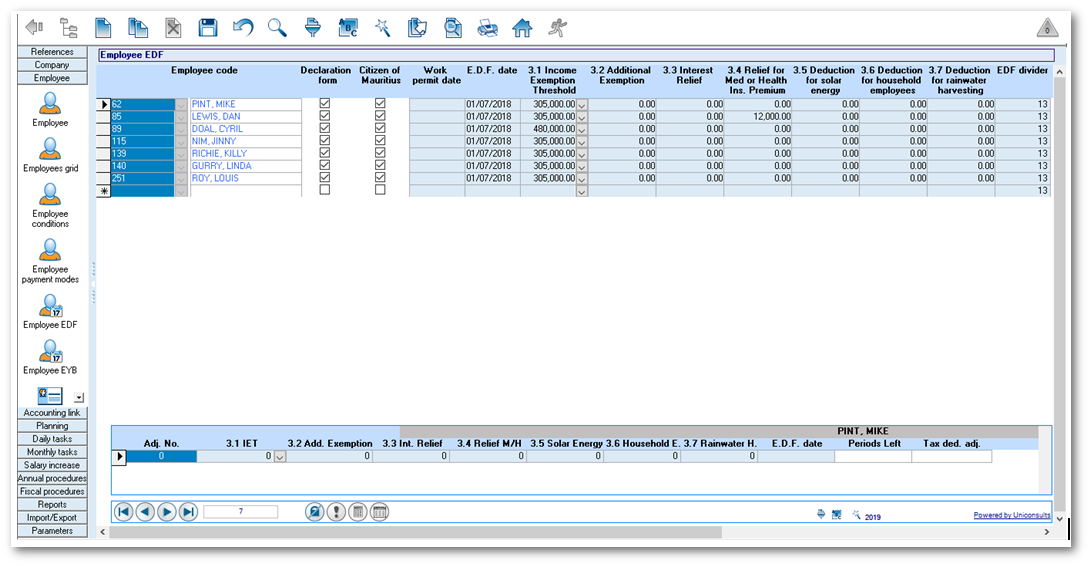

- Employee Code: Numeric existing employee codes. The employee name is displayed after the code

- Declaration Form: This flag indicates if the employee has submitted an EDF form or not

- Citizen of Mauritius: It indicates that the employee is Mauritian or non-citizen of Mauritius

- Work Permit Date: This date applies to non-citizen. Format is day/month/year

- E.D.F Date: It is the date indicated on the EDF form of the employee. Format is day/month/year

- 3.1 Income Exemption Threshold: The EDF category of the employee (refer to the EDF form of the employee). The amount can be overwritten only if:

- The new EDF categories are known and applied during the 1st month of the fiscal year, i.e July OR

- The Government authorities officially declare new Income Exemption Threshold amounts

- 3.2 Additional Exemption

- 3.3 Interest Relief

- 3.4 Relief for Med or Health Ins. Premium

- 3.5 Deduction for solar emery investment allowance

- 3.6 Deduction for household employees

- 3.7 Deduction for rainwater harvesting investment allowance

- EDF Divider: The E.D.F divider value 13 is displayed automatically

- First Employment: Flag is activated when employee submits an EDF for the first time in the current fiscal year

- Pensioner: Flag indicates if employee is more than 60 years of age or not

- Tax Exemption: Flag is activated to force the system not to calculate tax for the employee

- Tax Credit %: Flag is activated if employee has 50% credit on tax

- Apply Exemption Threshold: Flag is activated by default and is used to verify the total taxable emoluments of the employee against the Income Exemption Threshold amount as per the fiscal year parameters. If total amount is equal to or exceeds the Income Exemption Threshold amount, then the employee is taxable

This flag may be deactivated for the purpose of Optional PAYE deduction as per MRA notice dated 01 August 2017.It is deactivated when an employee deriving emoluments less than Rs 23, 077 or any annuity or pension may, in a form approved by the Director-General, request the employer/payer to deduct income tax under PAYE from his emoluments, annuity or pension. The employer must on receipt of the application deduct PAYE at the rate of 15% from the payments and remit same to MRA.

- Tax on Tax: Flag is activated for employee who benefits from tax payment, i.e the employer pays his tax

- Formula: When 'Tax on Tax' flag is activated, the formula is displayed and can be modified

- PAYE Er %: The percentage tax the employer has to pay for the employee

Employee Declaration Form (EDF) Adjustment

An EDF adjustment is performed only when the employee changes Income Exemption Threshold category and/or Additional Exemption/Interest Relief/Relief for Med or Health Ins. Premium/Deduction for solar energy or household employees or rainwater harvesting

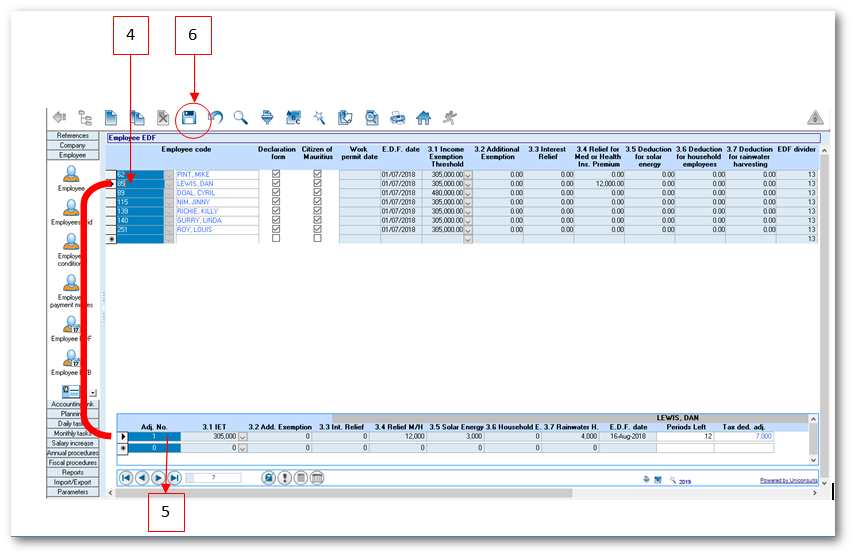

To perform an EDF adjustment follow the below steps:

- Repeat Steps 1 to 3 used to view Employee EDF

- Step 4: Select Employee

- Step 5: Insert Adjustment no. 1 and insert any new figures as per his new EDF

- Note: In the case of unchanged Income Exemption Threshold, keep the same figures in column 3.1 of the adjustment menu

- Step 6: Click Save

- Adj. No.: Numeric

- 3.1 Income Exemption Threshold, 3.2 Additional Exemption, 3.3 Interest Relief, 3.4 Relief for Med or Health Ins. Premium and 3.5 Deduction for solar enery, 3.6 Deduction for household employees, 3.7 Deduction for rainwater harvesting: are updated according to section 3 of the new EDF form which has been filled by the employee

- E.D.F Date: The date specified on the new E.D.F form

- Periods left: The number of periods left over the current fiscal year as from the adjustment date

- Tax Ded. Adj.: The difference between the previous and new E.D.F can be either a positive or a negative amount

Additional Information

The Income Exemption threshold, E.D.F divider and other parameters vary according to each fiscal year. See below

The Income Exemption threshold, E.D.F divider and other parameters vary according to each fiscal year. See below