Apply Employee Declaration Form Adjustment

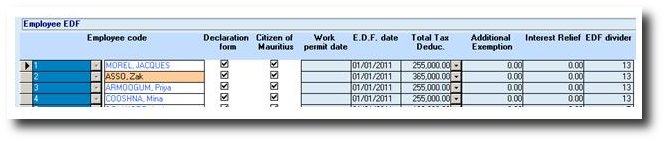

An employee EDF record is automatically created as soon as a new employee record is saved. The employee EDF record can be modified at any time during the fiscal year. If however the record does not exist, it should be created.

Create a new EDF or modify an existing EDF

- Employee Code: Numeric existing employee codes can be chosen from the drop down list or typed manually. The employee name will be displayed after saving the record

- Declaration Form: This flag should be activated only if the employee has submitted an EDF form

- Citizen of Mauritius: If the flag is activated, it indicates that the employee is Mauritian

- Work Permit Date: This date applies to non-citizen only (i.e when Citizen of Mauritius flag is de-activated. Format is dd/mm/yyyy

- E.D.F Date: It is the date indicated on the EDF form of the employee. Format is dd/mm/yyyy

- Total Tax Deduc.: It is the Income Exemption Threshold amount and depends on the EDF category of the employee (refer to the EDF form of the employee). The Total Tax Deduc. amount can be overwritten only if:

- a change is notified as from the 1st month of the fiscal year OR

- the Government authorities officially declare new Income Exemption Threshold amounts

- Additional Exemption: This is the amount found on employee EDF - for those having children pursuing undergraduate course

- Interest Relief: This is the amount found on employee EDF - for those having contracted a house loan (first time home owners)

An EDF adjustment is done only when the employee changes Income Exemption Threshold category, i.e there is a change in the number of dependents of the employee.

An EDF adjustment is done only when the employee changes Income Exemption Threshold category, i.e there is a change in the number of dependents of the employee.

- EDF Divider: The E.D.F divider 13 is displayed automatically

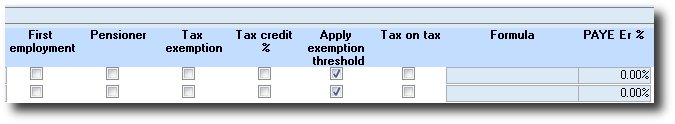

- First Employment: Flag is activated when employee submits an EDF for the first time in the current fiscal year

- Pensioner: Flag is activated if employee is more than 60 years of age

- Tax Exemption: Flag is activated to force the system not to calculate tax for the employee

- Tax Credit %: Flag is activated if employee has 50% credit on tax

- Apply Exemption Threshold: Flag is activated by default and is used to verify the total taxable emoluments of the employee against the Income Exemption Threshold amount as per the fiscal year parameters. If total amount is equal to or exceeds the Income Exemption Threshold amount, then the employee is taxable

- Tax on Tax: Flag is activated for employee who benefits from tax payment, i.e the employer pays his tax

- Formula: When 'Tax on Tax' flag is activated, the formula is displayed and can be modified

- PAYE Er %: The percentage tax the employer has to pay for the employee

Apply Employee Declaration Form (EDF) Adjustment

An EDF adjustment is done when the employee changes Income Exemption Threshold category, i.e there is a change in the number of dependents of the employee and this, as from the 2nd month of the fiscal year

The pointer must be positioned on the employee EDF record first then, input the following in the EDF adjustment form:

- Adj. No.: Input the numeric sequence of the adjustment

- Total Tax Deduc.: Input the new E.D.F amount as per the new E.D.F Category

- Additional Exemption.: Input the same amount found on top of screen for this same employee (if there is an amount - else this would be zero)

- Interest Relief.: Input the same amount found on top of screen for this same employee (if there is an amount - else this would be zero)

- E.D.F Date: Input the date specified on the new E.D.F form

- Periods left: The number of periods left over the current fiscal year as from the adjustment date is displayed automatically

- Tax Ded. Adj.: The difference between the previous and new E.D.F amounts is displayed automatically and it can be either a positive or a negative amount

Additional Information

The Income Exemption threshold, E.D.F divider and other parameters vary according to each fiscal year. See below to refer to the Yearly Parameters

The Income Exemption threshold, E.D.F divider and other parameters vary according to each fiscal year. See below to refer to the Yearly Parameters

The employees EDF list should be input for each fiscal year and can be automatically copied from the previous fiscal year to the new fiscal year at the beginning of the year. Refer to the New Fiscal Year Procedure

The employees EDF list should be input for each fiscal year and can be automatically copied from the previous fiscal year to the new fiscal year at the beginning of the year. Refer to the New Fiscal Year Procedure