Monthly MNS PAYE Return

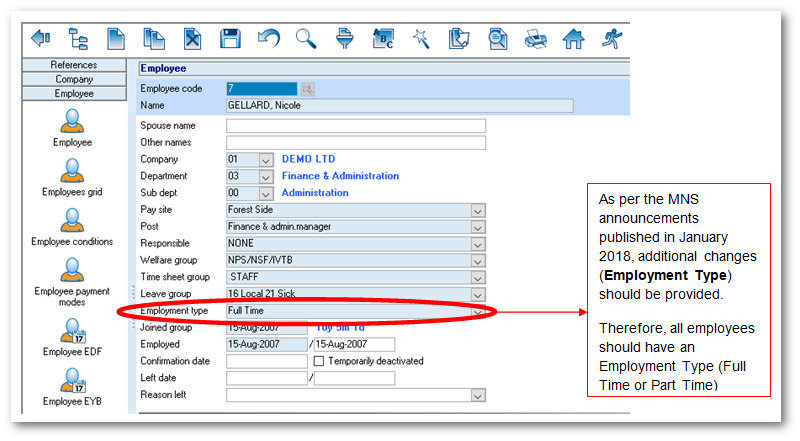

As per the MNS announcements published in January 2018, additional changes (Employment Type) should be provided. the changes are applicable as from period December 2017 (201712) again through a new csv file.

To export the Monthly MNS PAYE Return, use the steps below.

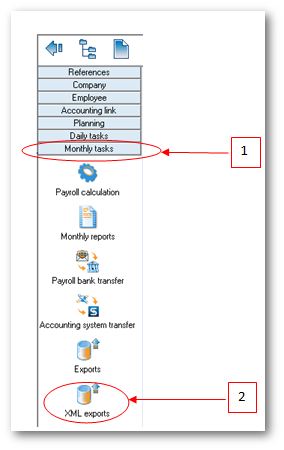

Step 1: Go to Monthly Tasks

Step 2: Click XML Exports icon

Step 3: Double-click Monthly MNS PAYE Return (Jan 2018) as per below illustration

Step 4: Insert the following criteria:

- Year: Choose calendar year from the list

- Start Period: Choose month from the list

- Company: Choose company from the list

- P/D to exclude from return: Select End of Year Bonus (13th month bonus) code(s) from the lookup icon (refer to the following illustrations for further explanation)

- Telephone number: Insert number, it should be equal to 7 numeric characters

- Mobile number: Insert number, it should start with the figure 5 and should consist of 8 numbers;

- Company Email address: Insert the contact email address of the company

- Name of Declarant: Insert the name, it should bear UPPER CASE letters and/or numeric characters (max 50 characters)

- File name: Insert file name, it should be less than 21 characters long

- Directory: Click lookup icon to browse and select the folder to which you want to export the file

Step 5: Click Export button from the toolbar

Above illustration: How to exclude End of Year Bonus from the Monthly MNS PAYE Return (Jan 2018)

Step 1: Click lookup icon

Step 2: Select End of Year Bonus payment code(s)

Step 2: Click Apply button

NB:(1) The file contains tax payers and non-tax payers and for those whose National ID is missing in the system a message will be shown in the log indicating invalid NID and the export file will be incomplete. You will need to update the NID in the Employee master file and export the file again (2) The log window indicates anomalies on the export file, e.g Value is required for P/D to exclude from return, invalid NID, wrongly inserted Name of Declarant, Telephone number, etc.

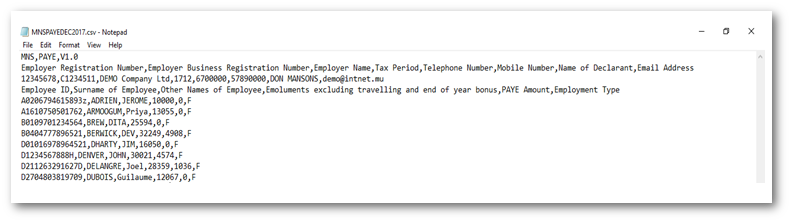

A sample of the csv file is shown below: