Employee may request to deduct PAYE at a flat rate of 15% or 20% (Fiscal Year 2023-2024)

(i) Where an employee who derives emoluments exceeding Rs 30,000 in a month and HAS NOT SUBMITTED an EDF, the employee makes a request to the employer for PAYE to be withheld at the rate of 20%.

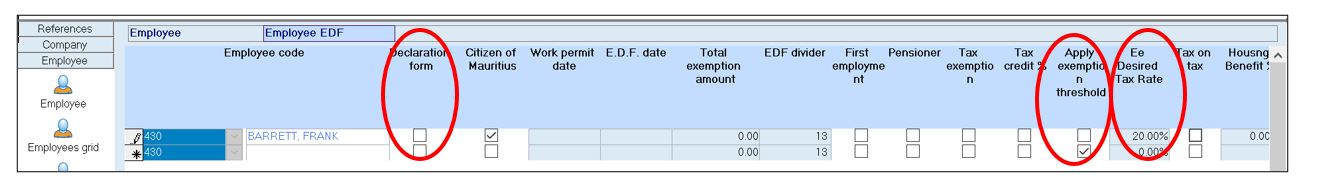

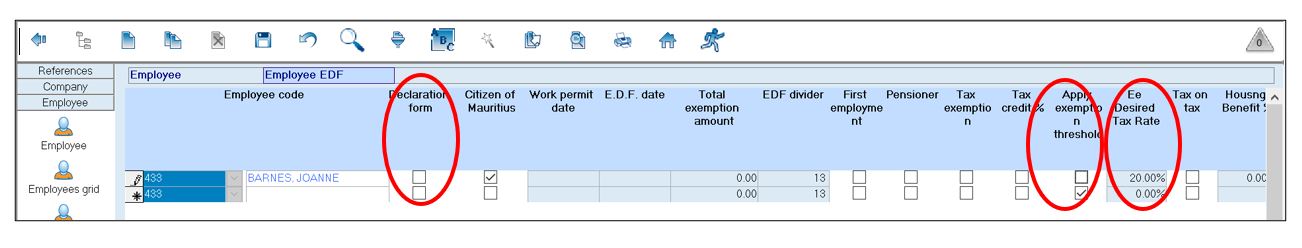

- Employee's EDF record

- Step 1: DO NOT ACTIVATE Declaration Form

- Step 2: Deactivate the “Apply Exemption threshold” flag

- Step 3: Insert the percentage for the Flat Rate of 15% or 20%

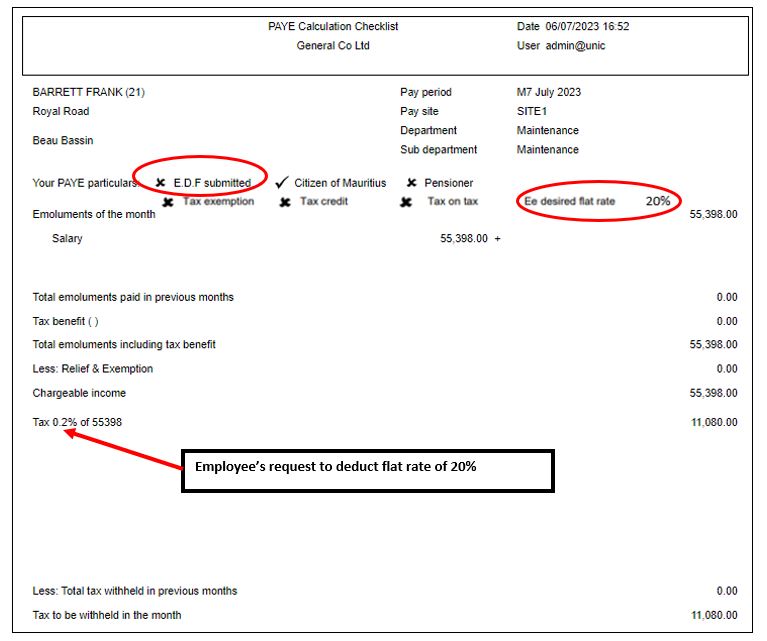

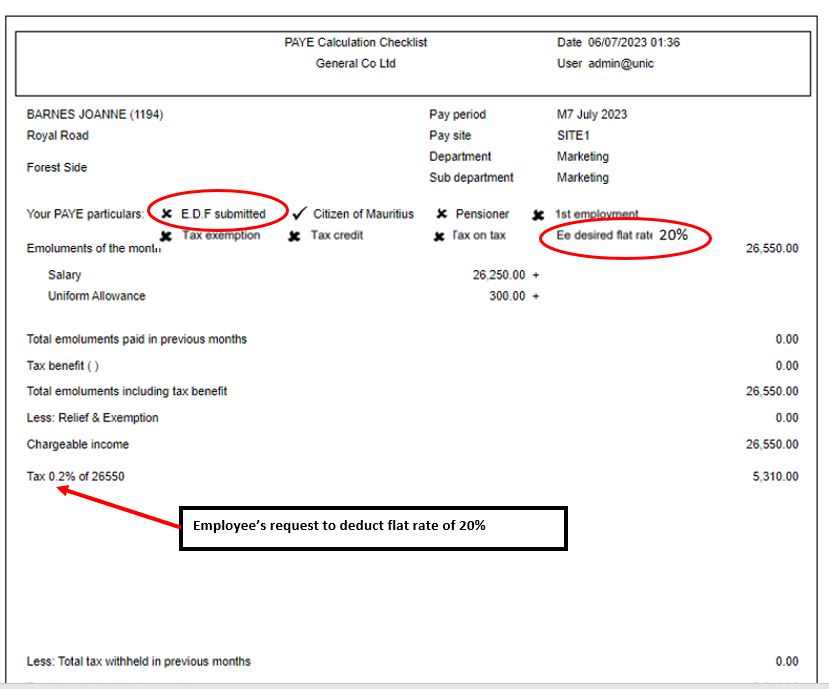

- Employee's PAYE calculation slip

(ii) Where an employee deriving emoluments not exceeding Rs 30,000 in a month and HAS NOT SUBMITTED an EDF, the employee makes a request to his employer or the person responsible for the payment of the emoluments for income tax to be withheld, to withhold PAYE at the rate of 15% or 20%

- Employee's EDF record

- Step 1: DO NOT ACTIVATE Declaration Form

- Step 2: Deactivate the “Apply Exemption threshold” flag

- Step 3: Insert the percentage for the Flat Rate of 15% or 20%

- Employee's PAYE calculation slip