EDF Adjustment (applicable after payroll closure of July)

- EDF adjustment can be performed using the following options:

- MRA E-EDF facility (EDF file is downloaded from the website of the MRA and imported through Sicorax Payroll)

- Manual input through Employee EDF.

MRA E-EDF Import (Not yet available on the website of the MRA for fiscal year 2022-2023)

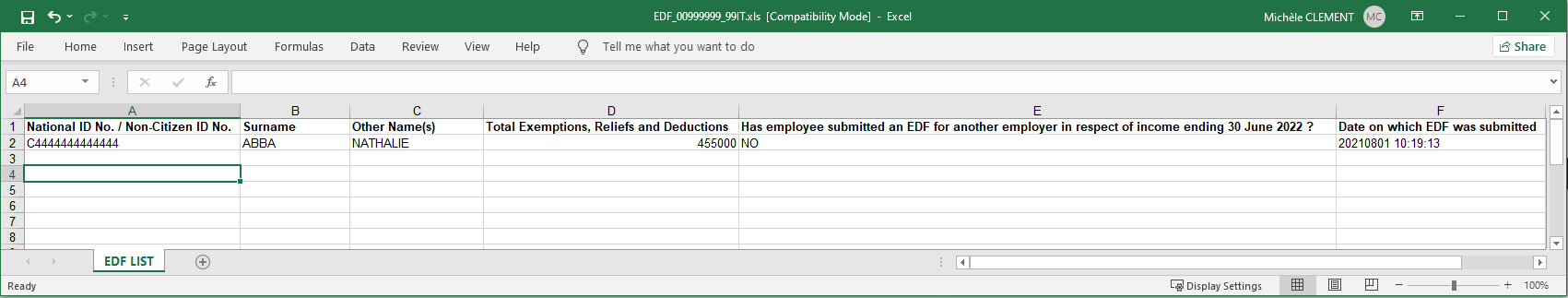

- Step 1: Download the EDF file from the website of the MRA - Ensure the file is valid and contains the necessary information - Should you need assistance regarding the download of the MRA E-EDF Excel file kindly contact the MRA

- An illustration of the file is shown below.

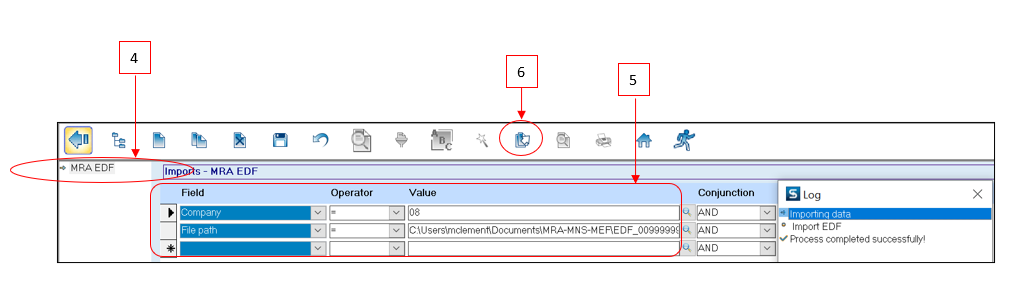

- Step 2: On Sicorax Payroll Go to Import/Export

- Step 3: Click Import icon

- Step 4: Double Click MRA EDF

- Step 5: Insert the criteria as illustrated below:

- Company: Choose the company from the list

- File Path: Browse the file location of the downloaded MRA E-EDF Excel file and select the file

- Step 6: Click Import button on the toolbar

View the imported MRA E-EDF records through Sicorax Payroll

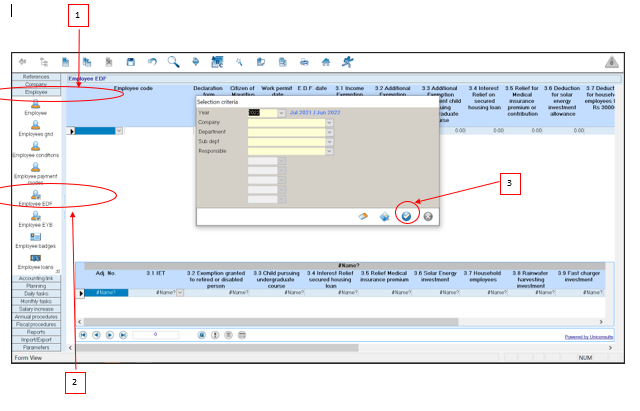

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

* Step 4: Select Employee

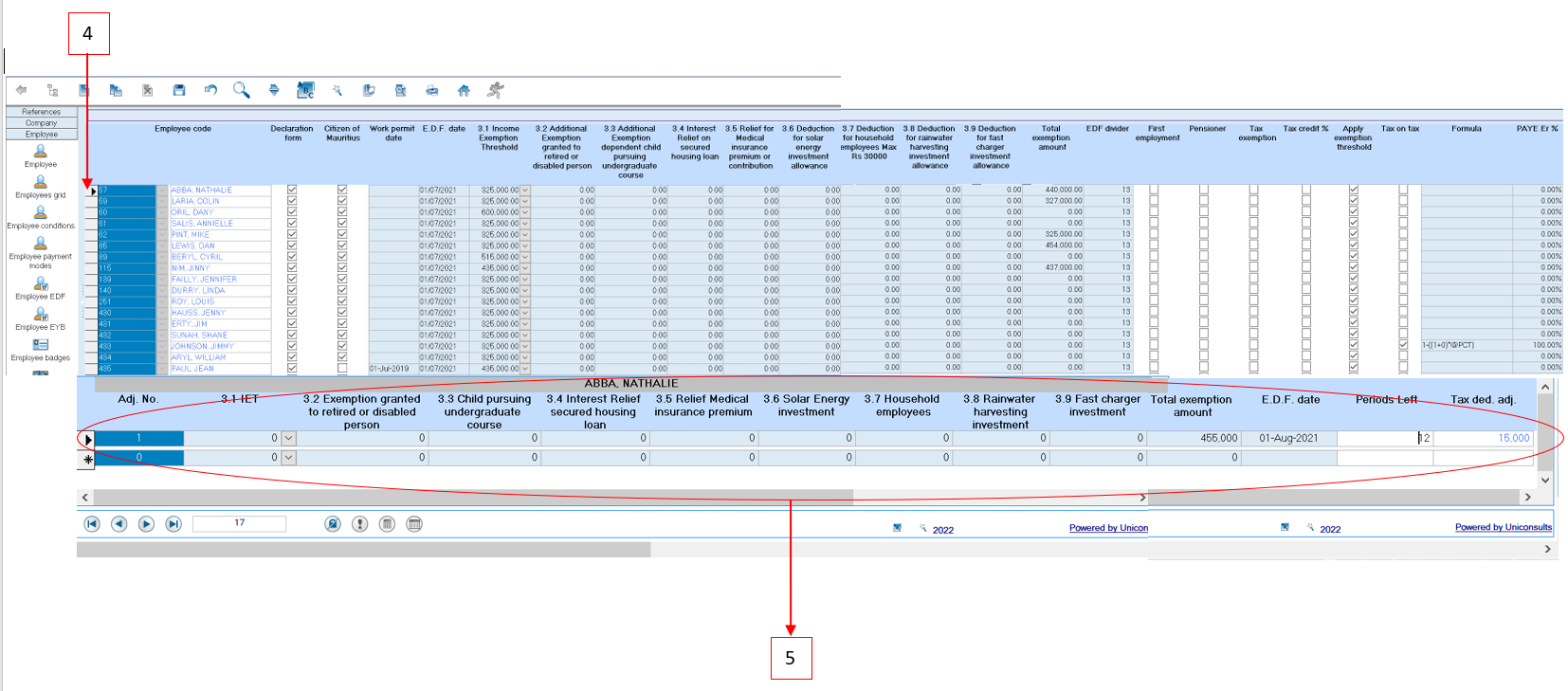

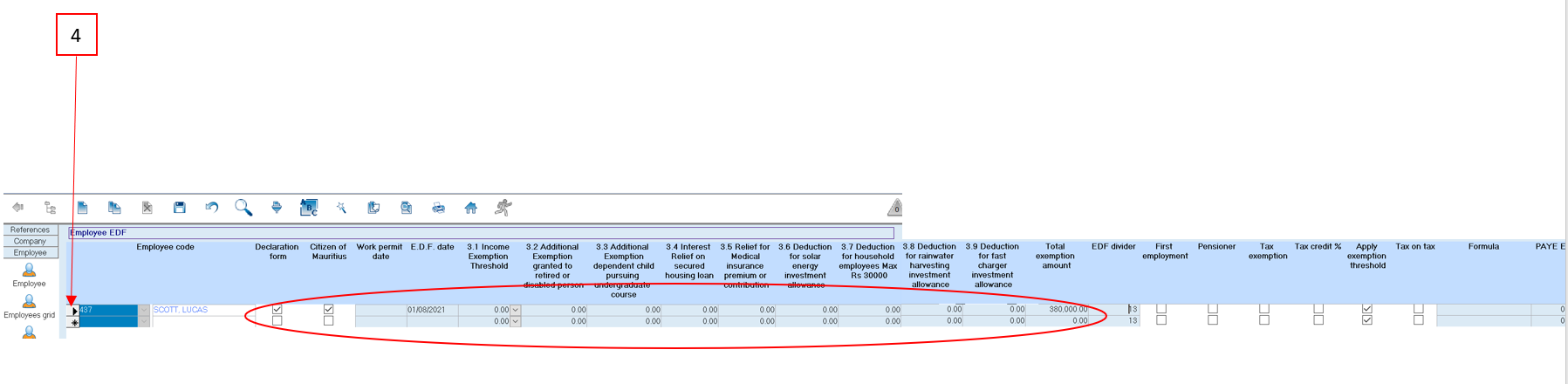

* Step 5: View the MRA EDF imported record as illustrated below - Scroll to the right-hand side of the adjustment menu to view till the end of the record

- Adj. No.: Displays the first EDF adjustment for the current fiscal year

- Total Exemption Amount: Displays the Total Exemption amount as per the MRA E-EDF file

- E.D.F Date: Date is automatically set by Sicorax Payroll during import (date falls within actual payroll calendar)

- Periods left: Displays the number of months left in the current fiscal year starting July, for which the Tax Deduction Adjustment will be applicable.

- Tax Ded. Adj.: Displays the difference between the Total Exemption amount and the Previous Total Exemption amount

The Tax Ded. Adj. can either be positive or negative depending on the difference between the Total Exemption amount and the Previous Total Exemption amount

Manual EDF Adjustment

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

- Step 4: Select Employee's record

- Step 5: Record the EDF adjustment as follows:

- Adj. No.: Remove 0 and insert 1 for the first EDF adjustment for the current fiscal year, press Enter or Tab

- 3.1 to 3.9: Remain 0, press Enter or Tab (Columns are not editable since the MRA requested only the Total Exemption amount)

- Total Exemption Amount: Insert the Total Exemption amount as per employee EDF form, press Enter or Tab

- E.D.F Date: Insert EDF date (date must fall within the current payroll calendar), press Enter or Tab

- Periods left: Displays automatically the number of months left in the current fiscal year starting July, for which the Tax Deduction Adjustment will be applicable, press Enter or Tab.

- Tax Ded. Adj.: Displays automatically the difference between the Total Exemption amount and the Previous Total Exemption amount

* Step 6: Click Save button on the toolbar

The Tax Ded. Adj. can either be positive or negative depending on the difference between the Total Exemption amount and the Previous Total Exemption amount

MRA E-EDF Import(New Recruit)

New recruits created on Sicorax Payroll after payroll of July is closed, may have their EDF input manually through Employee EDF or imported using the MRA E-EDF import procedure. After completion of the manual input or import, it is compulsory to go through the new recruit's EDF record through Employee EDF to ensure additional flags are activated e,g First Employment Flag (Flag is activated when employee submits an EDF for the first time in the current fiscal year).

To view the new recruit's EDF and activate the necessary flags, follow the steps below: To view the new recruit's EDF and activate the necessary flags, follow the steps below:

- Step 1: Go to Employee

- Step 2: Click Employee EDF

- Step 3: Click Apply

- Step 4: Select Employee - The below illustrates a manual EDF input or an MRA E-EDF import

- Step 5: To activate the First Employment Flag (if needed)Scroll to the right-hand side of the menu to move till the end of the EDF record