Compulsory verification before printing SOE and exporting ROE

Before printing the Statement of Emoluments and exporting the Return of Employees (MNS/MRA Yearly Returns), you must verify some information.

Also, you may want to check figures appearing on the SOE through payroll historic figures using the statistics module. Finally, you may want to view PAYE and/or Solidarity Levy figures for the fiscal period through the Income Tax Reconciliation Statement. To do so, see further below.

How to verify Company details and assign payroll items to SOE and ROE groups

To do so, use the following steps:

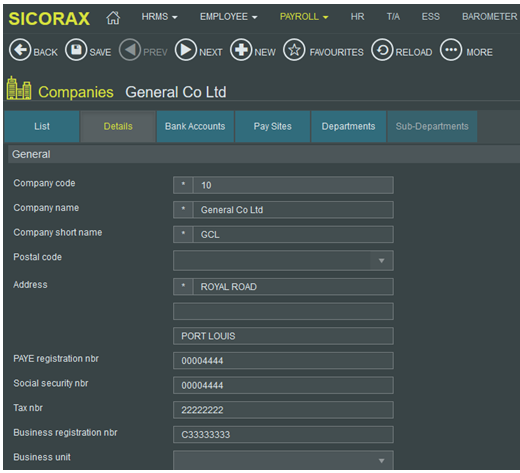

How to verify Company details

- Step 1: Go to Payroll

- Step 2: Click Settings

- Step 3: Click Companies

- Step 4: Select the company

- Step 5: Verify the PAYE nbr, Social Security nbr, Tax nbr, BRN

How to assign payroll items to SOE and ROE groups

- To amend the SOE and/or ROE group of your payroll items, send an email to hrms@uniconsults.mu with email title “Assistance SOE/ROE column”

- Payroll items must not be assigned to Tax(ROE)Column “Exempt Emoluments (MUR)”

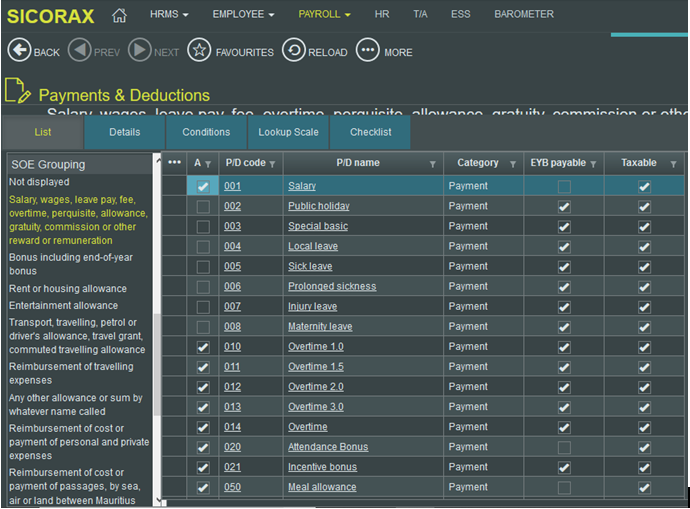

- Step 1: Go to Payroll

- Step 2: Click Settings

- Step 3: Click Payments/deductions

MRA Return Column

- Step 4: Click the MRA Return Column section

- Step 5: Click each group to verify the list of payment & deduction

SOE Grouping

- Step 4: Click the SOE Grouping section

- Step 5: Click each group to verify the list of payment & deduction

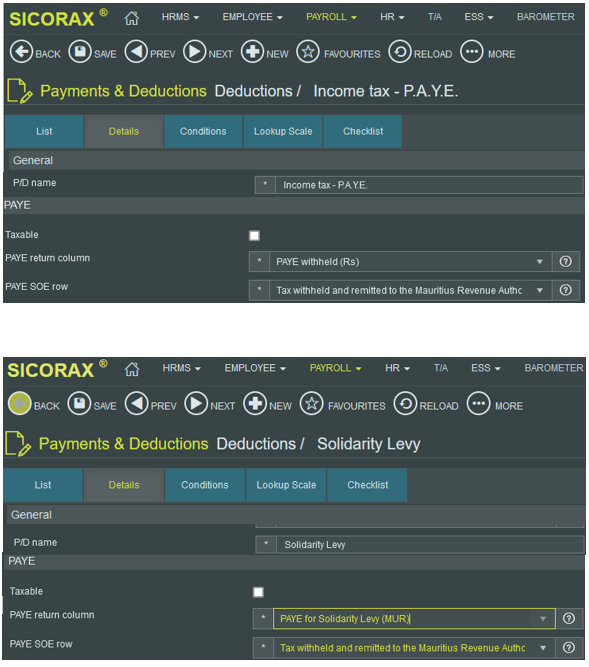

Below are illustrations of the SOE and ROE groups for payroll items PAYE and Solidarity Levy:

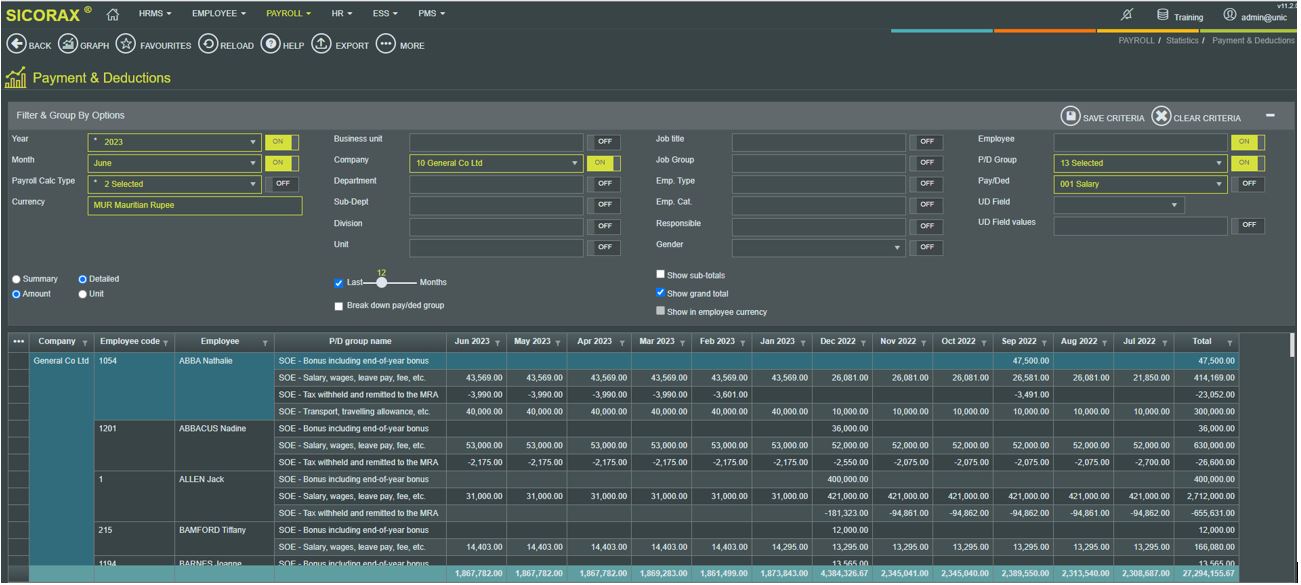

How to verify Payroll Historic figures appearing on the SOE using the Statistics Module

Using the Statistics module, the following steps will help you verify the figures of the Statement of Emoluments. By inserting the following criteria you will be able to analyse your payroll data from Jul-2022 to Jun-2023.

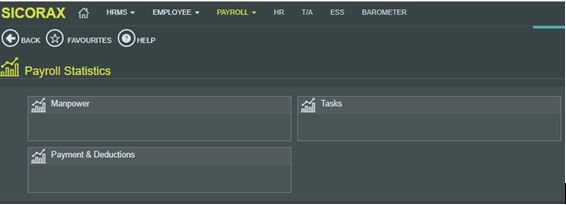

- Step 1: Go to Payroll

- Step 2: Click Statistics

- Step 3: Click Payments/deductions

- Step 4: Set the necessary selection, filtering and grouping as illustrated below:

- Year choose 2023 activate ON

- Month choose June activate ON

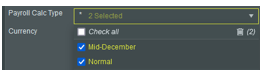

- Payroll Calc Type Select Normal and Mid-December activate ON (It is compulsory to select Mid-December for the End of Year Bonus figures to be considered in the display)

- Company choose The required company (in the illustration company 01 has been chosen) activate ON

- Employee activate ON

- PD Group choose all the 13 SOE groups activate ON

- Pay/Ded choose 001 Salary

- Detailed select

- Last 12 months select

- Show Grand Total select

- Step 5: Below is an illustration of the detailed payroll historic figures from July 2022 to June 2023. You are requested to verify the data as illustrated below

- Note: The PD Group name column is the same as the groups appearing on the Statement of Emoluments, you are therefore requested to verify and compare the totals

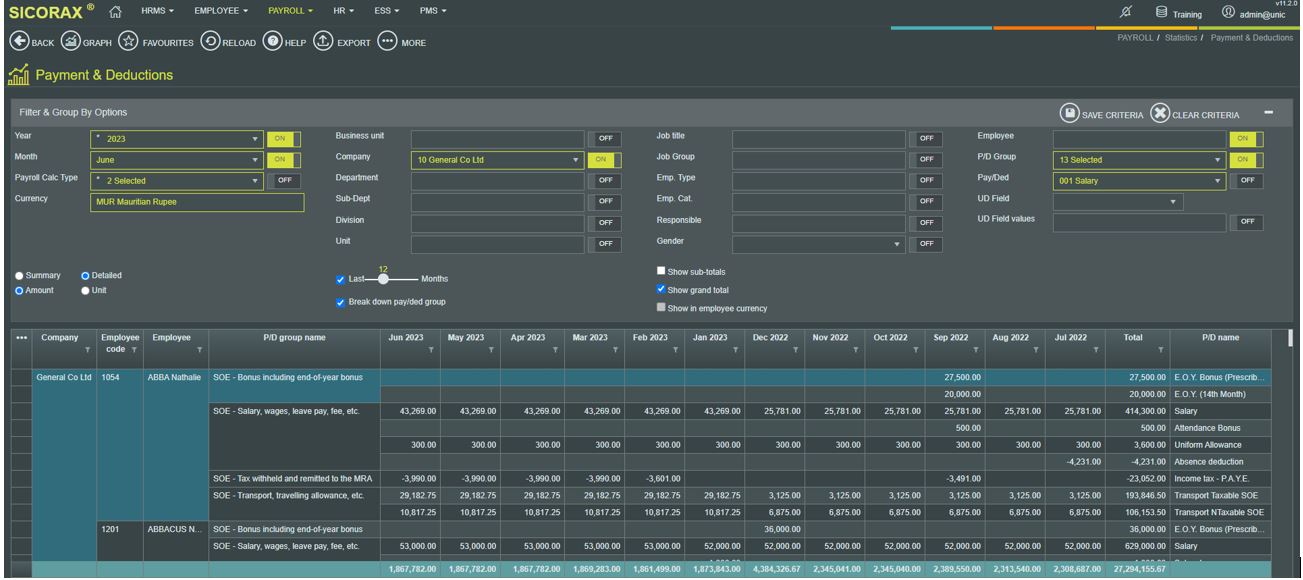

Break down of the PD Group

- To display the breakdown of the PD Group set the necessary selection, filtering and grouping as illustrated below

- Year choose 2023 activate ON

- Month choose June activate ON

- Payroll Calc Type Select Normal and Mid-December activate ON (It is compulsory to select Mid-December for the End of Year Bonus figures to be considered in the display)

- Company choose The required company (in the illustration company 01 has been chosen) activate ON

- Employee activate ON

- PD Group choose all the 13 SOE groups activate ON

- Pay/Ded choose 001 Salary

- Detailed select

- Last 12 months select

- Break down pay/ded group select

- Show Grand Total select

- Below is an illustration of the break down

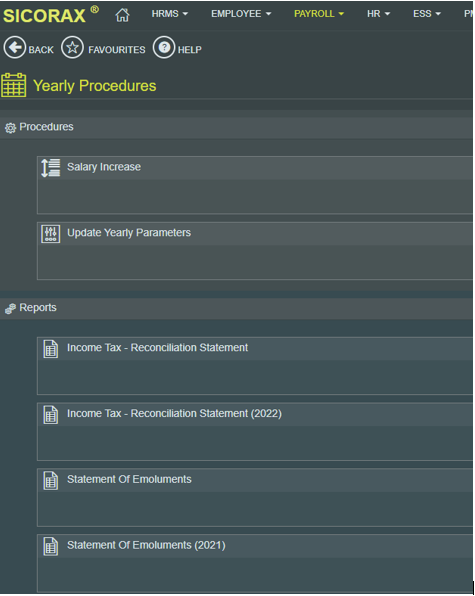

How to verify PAYE and/or Solidarity Levy figures for the fiscal period using the Income Tax Reconciliation Statement

The Income tax reconciliation statement is used to verify the monthly PAYE and/or Solidarity Levy which have been retained during the fiscal year. The figures should tally with the Yearly PAYE return.

Use the following steps to preview/print the reconciliation statement:

- Step 1: Go to Payroll

- Step 2: Click Yearly Procedures

- Step 3: Click Income tax reconciliation statement (2022)

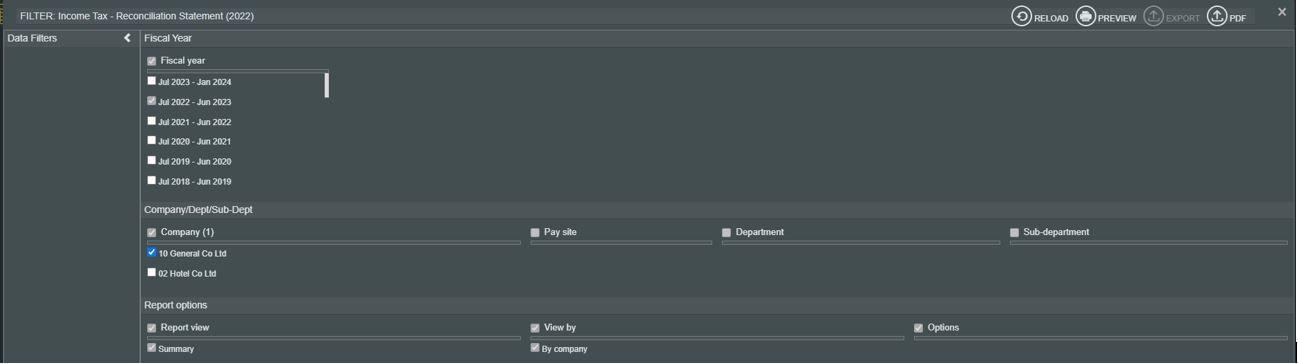

- Step 4: Set the criteria as illustrated

- Step 5: Click Preview

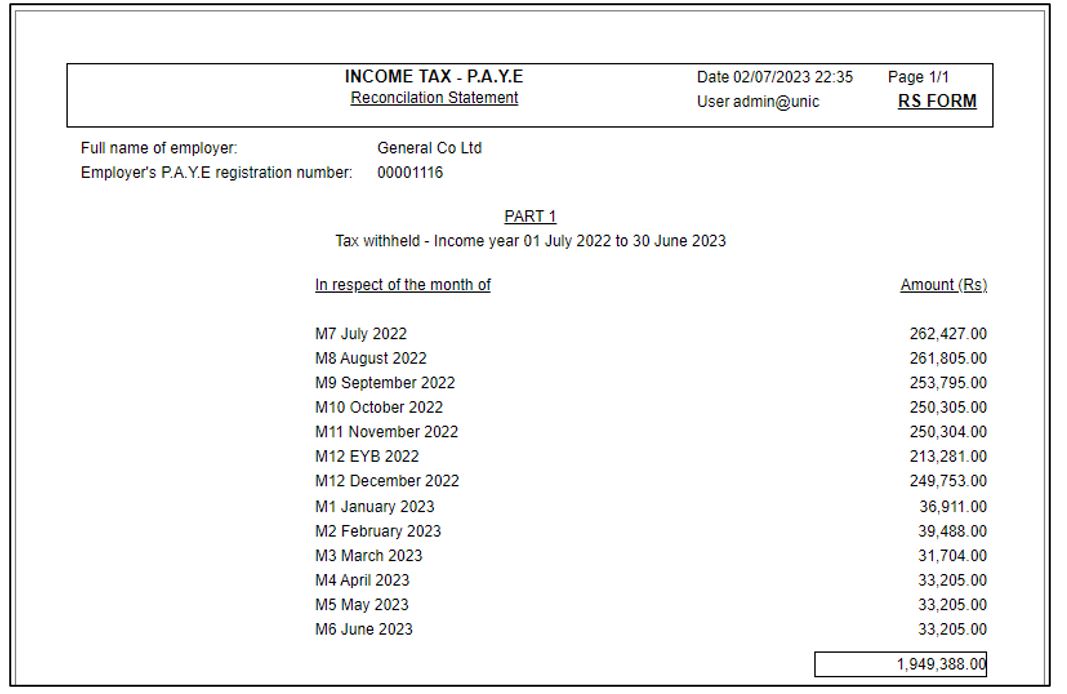

Below are illustrations of the Income tax reconciliation statement

The following illustrates the Income tax reconciliation statement for PAYE only:

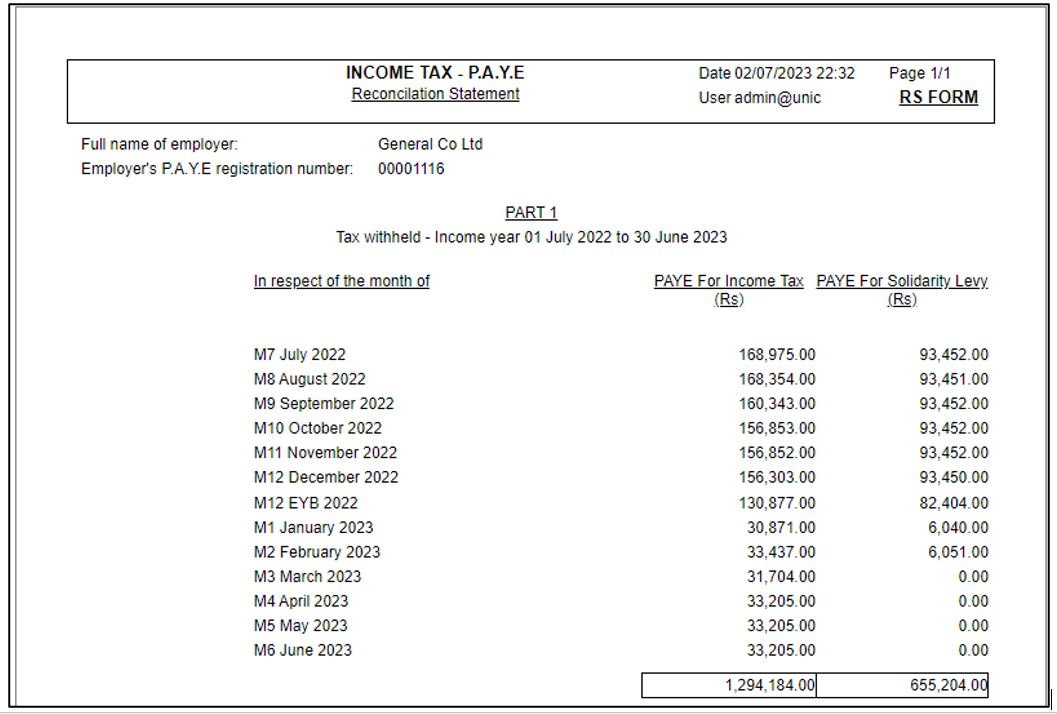

If Solidarity Levy is applicable, the following illustrates the Income tax reconciliation statement for PAYE and Solidarity Levy: