CSG on End Of Year Bonus

As from 01 September 2021, the provisions of the Social Contributions and Social Benefits Act 2021 shall apply as follows:

- Prescribed Bonus: Where an end of year bonus prescribed under an enactment is paid to a participant, the bonus shall be treated separately as remuneration for an additional month and the participant and the employer shall, in respect of that additional month, pay the social contribution at the appropriate rate.

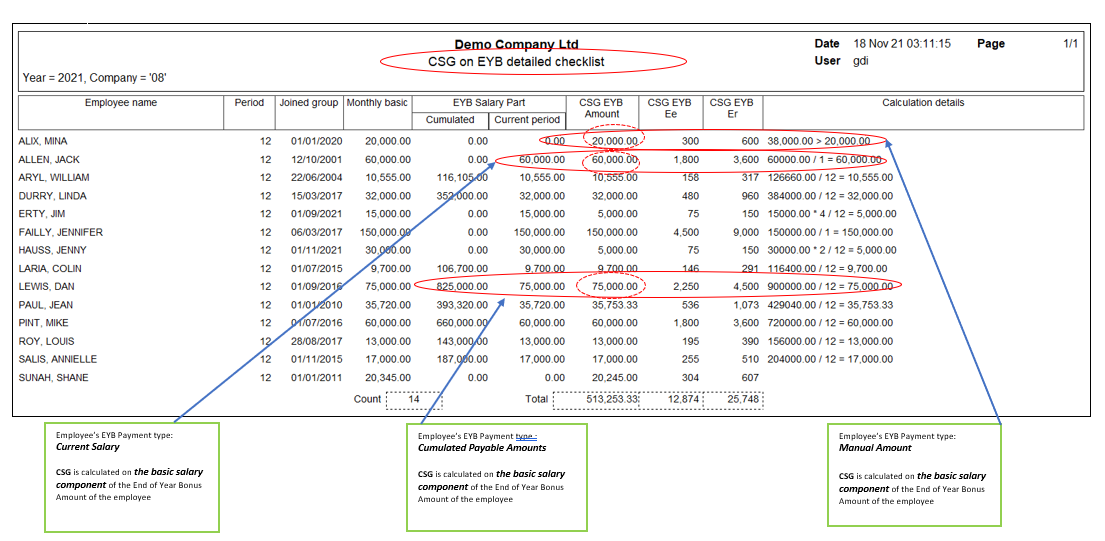

- As per the MRA, CSG is applicable on the basic salary component of the end of year bonus of the employee

- Below are illustrations of the calculation of the CSG on the EYB

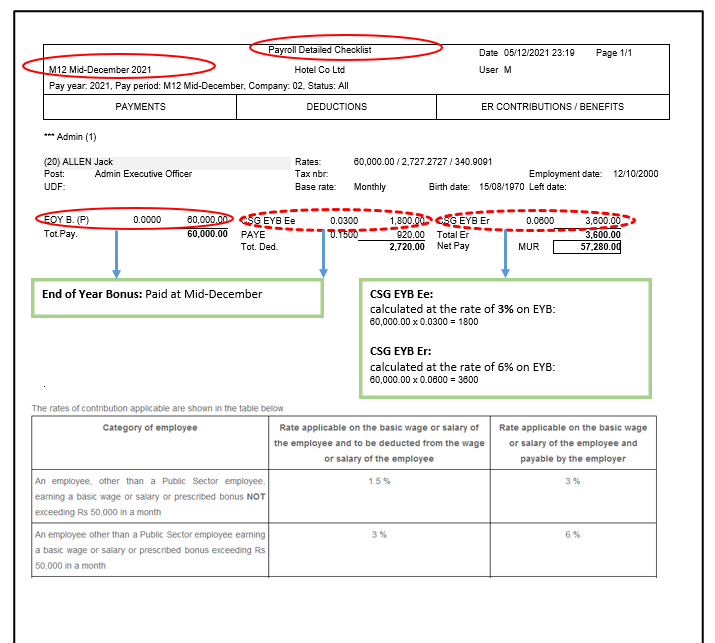

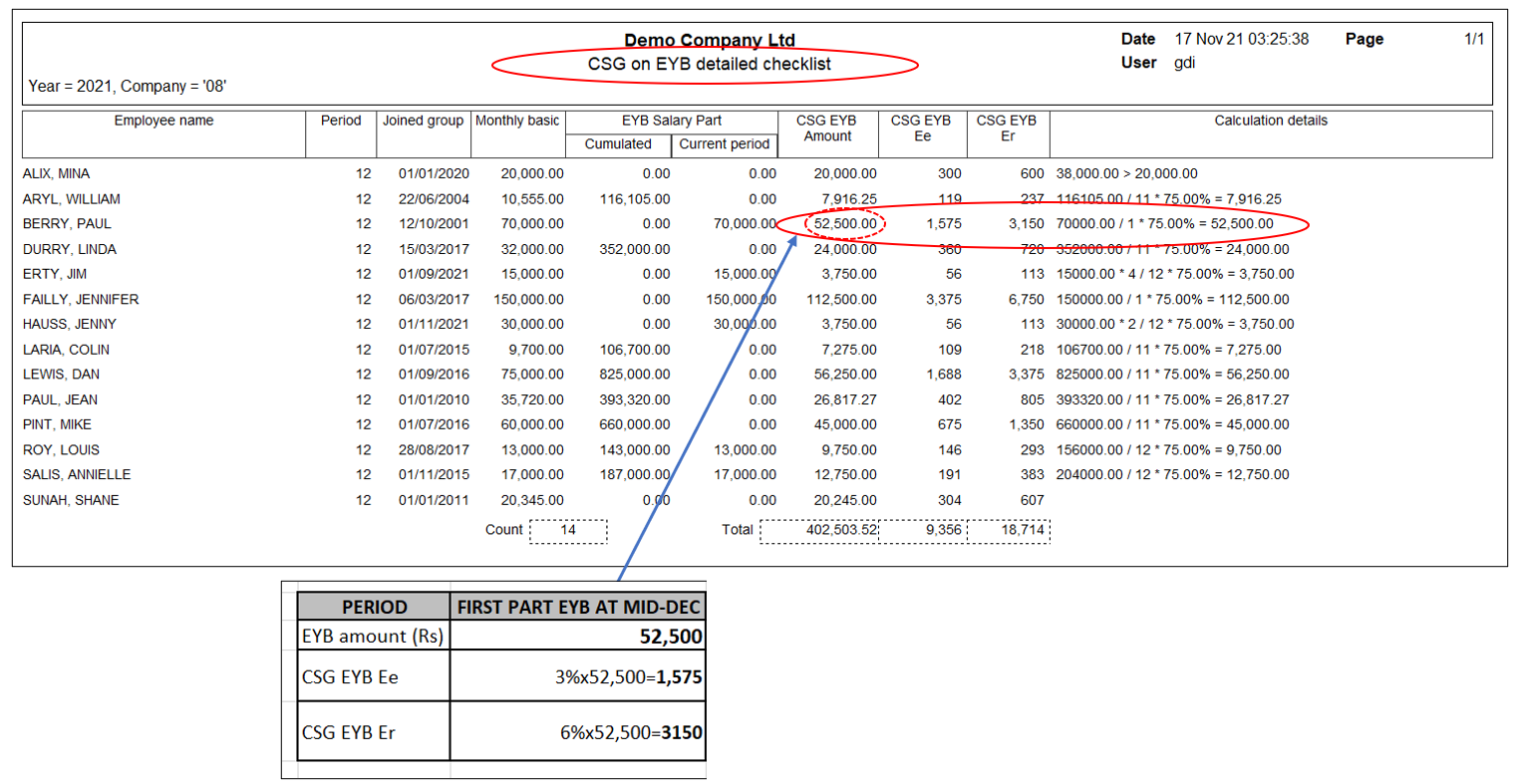

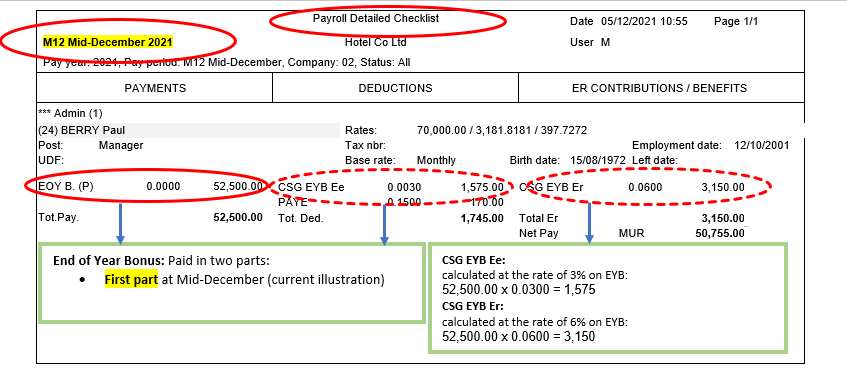

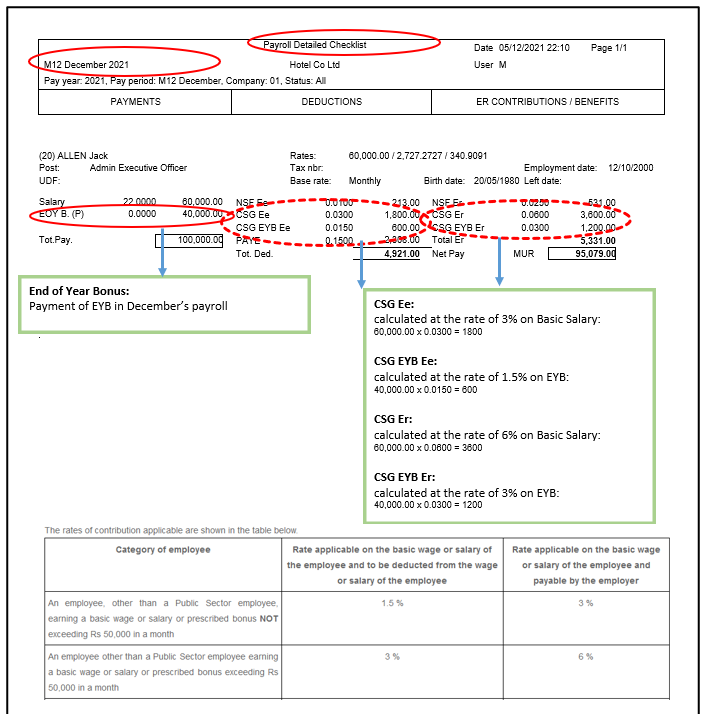

CSG on End Of Year Bonus where EYB paid at Mid-December

(Payments and deductions are cumulated from January to December together with December’s payroll transactions. End Of Year Bonus is paid on one-twelfth of the cumulated EYB earnings)

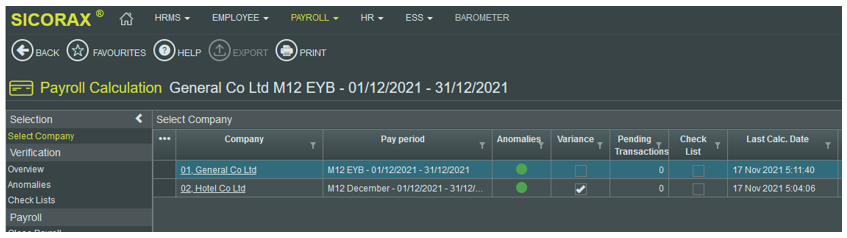

- After the EYB Configuration Wizard is completed and Payroll Calculation performed, go to checklist

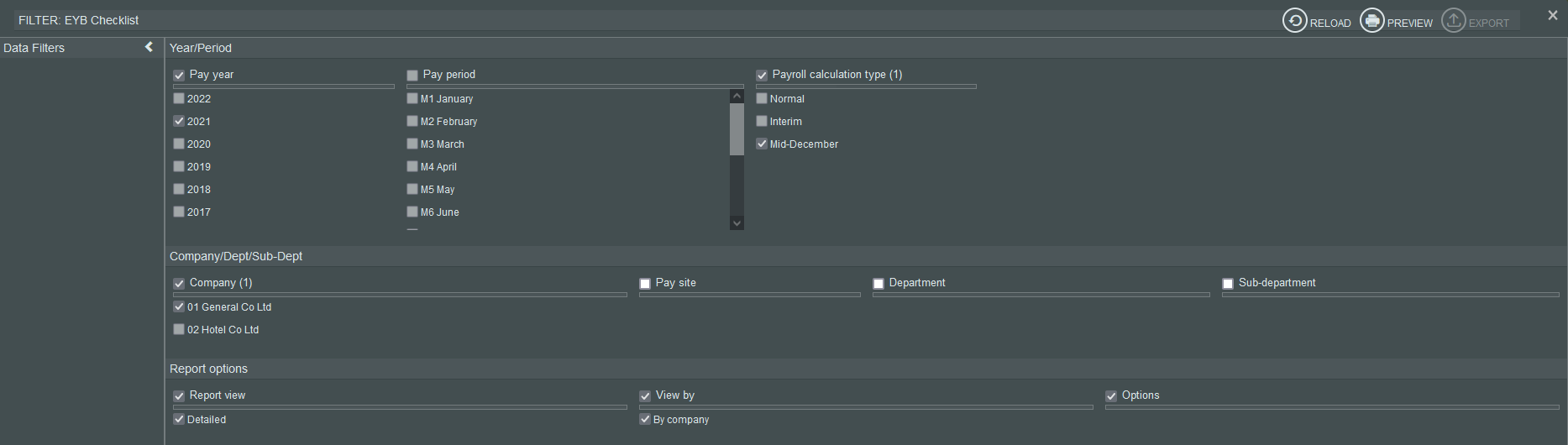

- Step 1: Click CSG on EYB Detailed

- Step 2: Check criteria as per below illustration

- Step 3: Click preview

- Below is an example of the EYB detailed checklist at Mid-December with CSG calculation details

- Below is an example of the payroll detailed checklist at Mid-December

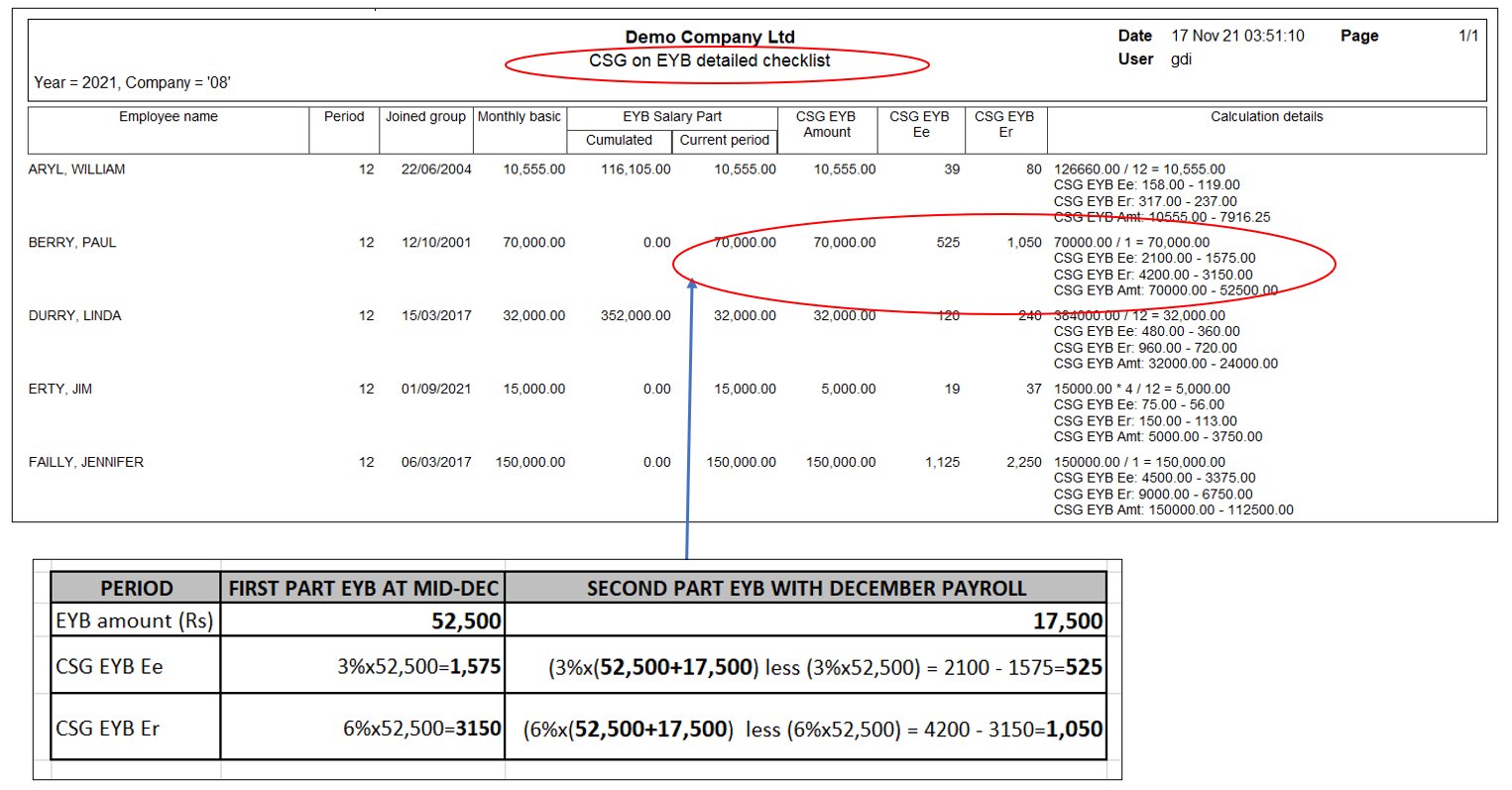

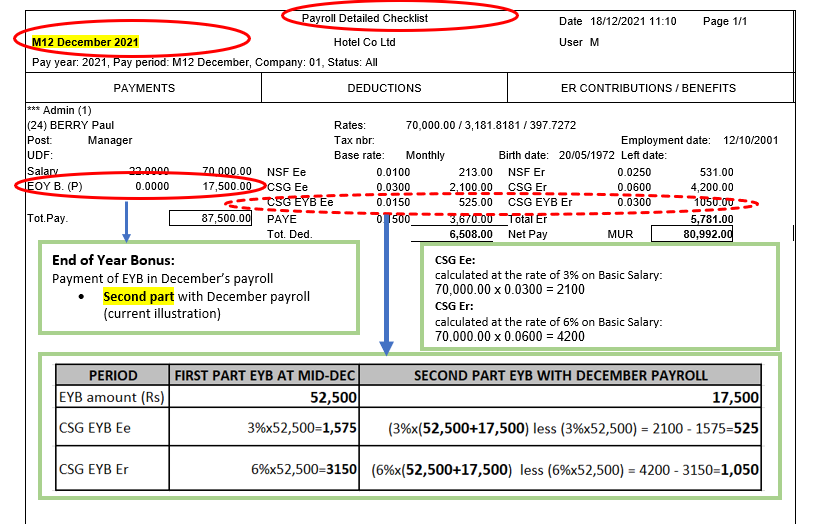

CSG on End Of Year Bonus where EYB is paid in two parts: First part at Mid-December and Second part with December's payroll

(Payments and deductions are cumulated to calculate EYB. The First part of the EYB is calculated on one-eleventh of the total cumulated EYB earnings from January to November. The Second part of the EYB is calculated on the total cumulated EYB earnings from January to December minus the first part of the End of Year Bonus amount.)

- After the EYB Configuration Wizard is completed for Mid-December and Payroll Calculation performed, go to Checklist

- Step 1: Click CSG on EYB Detailed

- Step 2: Click preview

- Below is an example of the EYB detailed checklist at Mid-December with CSG calculation details

- Below is an example of the payroll detailed checklist at Mid-December

- After Mid-December is closed and Payroll calculation performed for December payroll

- Step 1: Click Checklist

- Step 2: Click CSG on EYB Detailed

- Step 3: Click preview

- Below is an example of the EYB detailed checklist at December with CSG calculation details

- Below is an example of the payroll detailed checklist for the second part with December payroll

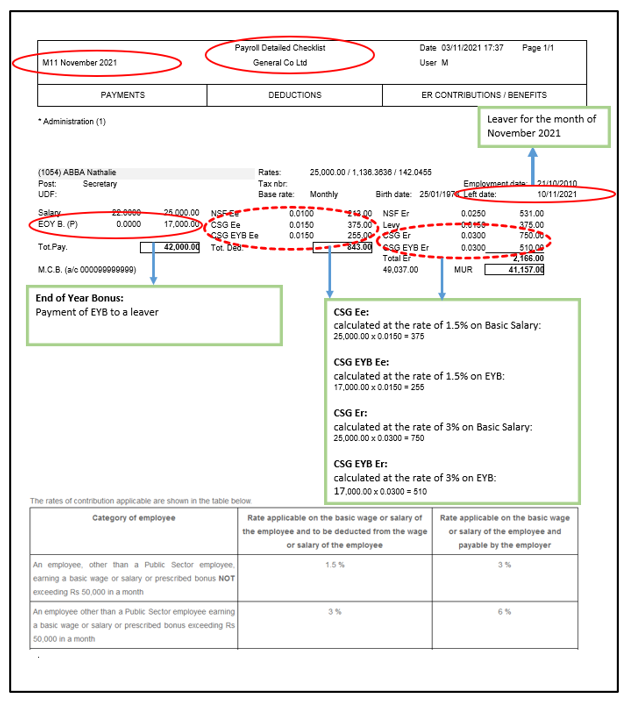

CSG on End Of Year Bonus where EYB is paid with December's payroll

(Payments and deductions are cumulated from January to December this year. End of Year Bonus is calculated on one-twelfth of the cumulated amount)