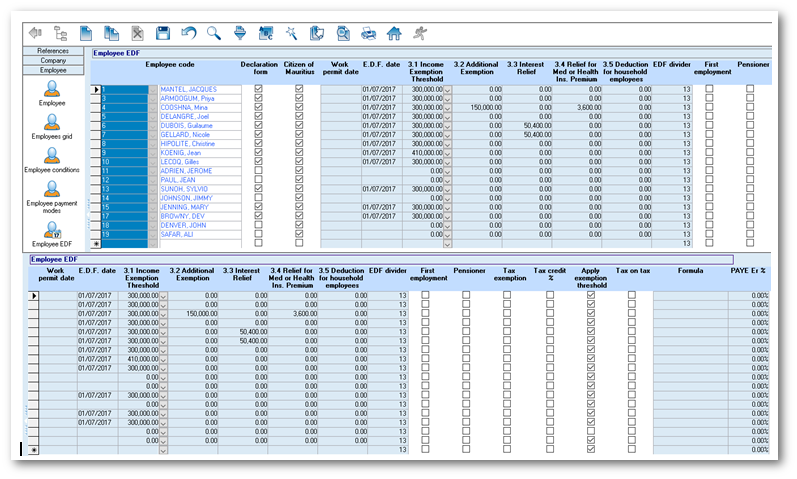

Activate employee EDF

Whenever a new employee record is created and saved, the employee's EDF record is automatically created as well. If the employee has submitted his EDF form, then the record should be activated.

- Step 1: Click on Menu Employees

- Step 2: Click on icon Employee EDF

EDF selection criteria

- Step 3: The current fiscal year is displayed automatically, click Apply

Employee EDF

- Step 4: Click on the checkbox to activate Declaration Form if the employee has filled his EDF form

- Step 5: Citizen of Mauritius: If the flag is activated, it indicates that the employee is Mauritian

- Step 6: Work Permit Date: This date applies to non-citizen only (i.e when Citizen of Mauritius flag is de-activated). The format is dd/mm/yyyy

- Step 7: E.D.F Date: It is the date indicated on the EDF form of the employee. Format is dd/mm/yyyy

- Step 8: Income Exemption Threshold: The EDF category of the employee (refer to the EDF form of the employee). The Total Tax Deduc. amount can be overwritten only if:

- The new EDF categories are known and applied during the 1st month of the fiscal year, i.e July OR

- The Government authorities officially declare new Income Exemption Threshold amounts

An EDF adjustment is done only when the employee changes Income Exemption Threshold category and/or Additional Exemption/Interest Relief/Relief for Med or Health Ins. Premium/Deduction for household employees.

- Step 9: Additional Exemption: Insert the amount as per EDF of employee. This amount represents the additional exemption in respect of dependent child pursuing undergraduate course.

- Step 10: Interest Relief: Insert the amount as per EDF of employee. This amount represents the interest relief on secured housing loan contracted by first time home owners.

- Step 11: Relief for Med or Health Ins. Premium: Insert the amount as per EDF of employee. A person may claim relief for premium or contribution payable for himself or his dependents in respect of whom Income Exemption

Threshold has been claimed at section 3.1 of the EDF form.

- Step 12: Deduction for household employees: Insert the amount as per EDF of employee. Where a person employs one or more household employees, he may claim a deduction of the wages paid to the household employees

up to a maximum of Rs 30,000, from his net income, provided he has duly paid the contributions payable under the National Pensions Act and the National Savings Fund Act. In the case of a couple, the deduction shall not, in the aggregate, exceed 30,000 rupees.

- Step 13: EDF Divider: The E.D.F divider 13 is displayed automatically

Additional columns:

- First Employment: Flag is activated when employee submits an EDF for the first time in the current fiscal year

- Pensioner: Flag is activated if employee is more than 60 years of age

- Tax Exemption: Flag is activated to force the system not to calculate tax for the employee

- Tax Credit %: Flag is activated if employee has 50% credit on tax

- Apply Exemption Threshold: Flag is activated by default and is used to verify the total taxable emoluments of the employee against the Income Exemption Threshold amount as per the fiscal year parameters. If total amount is equal to or exceeds the Income Exemption Threshold amount, then the employee is taxable

This flag may be deactivated for the purpose of Optional PAYE deduction as per MRA notice dated 01 August 2017. When an employee is deriving emoluments less than Rs 23, 077 or any annuity or pension he/she may, in a form approved by the Director-General, request the employer/payer to deduct income tax under PAYE from his emoluments, annuity or pension. The employer must on receipt of the application deduct PAYE at the rate of 15% from the payments and remit same to MRA.

- Tax on Tax: Flag is activated for employee who benefits from tax payment, i.e the employer pays his tax

- Formula: When 'Tax on Tax' flag is activated, the formula is displayed and can be modified

- PAYE Er %: The percentage tax the employer has to pay for the employee