Automatic Government Salary Increase (Full-time employees)

Note: The steps and illustrations shown below relate to the Salary Increase for the year 2025. The same steps must be followed to perform the Salary Increase for 2026.

After applying the updates, Sicorax HRMS Payroll automatically creates the Government Salary Increase scales for Full-Time employees. To view the scales, and to perform the automatic Government Salary Increase calculations, follow the steps below:

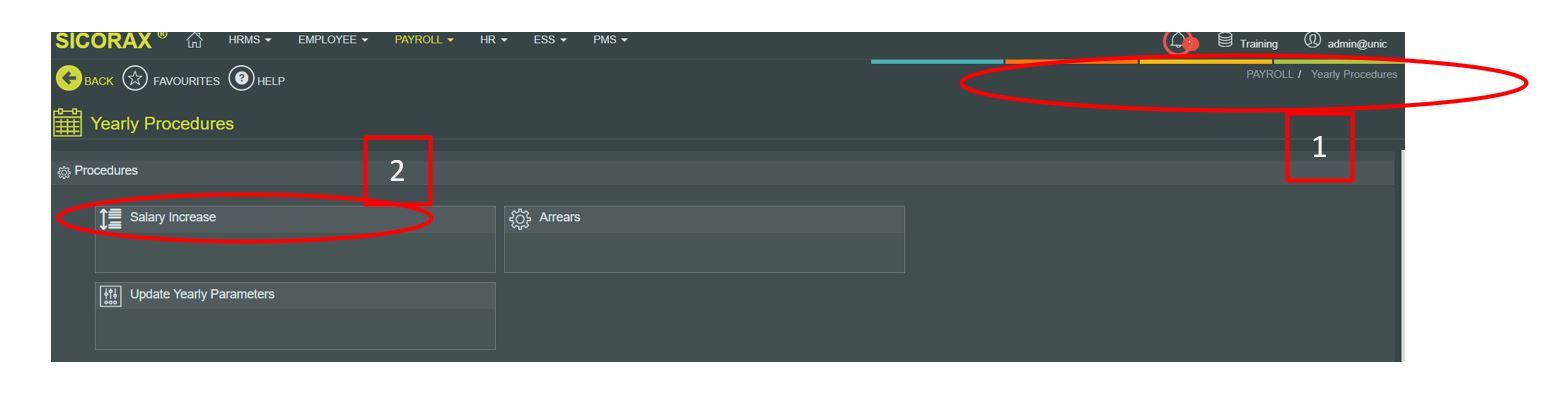

- Step 1: Go to Payroll/early Procedures

- Step 2: Click Salary Increase

- Step 3: Click Select Company

- Step 4: Select the company

- Step 5: Click Configuration

- Step 6: Complete the section Salary increase method:

- Should you need to configure the Company Salary Increase kindly contact our Support Team via Contact Sicorax Support

Things to consider for the Salary increase method:

- By default Salary increase is applied on Basic salary

Rounding method:

- Set the rounding type and rounding value for the required paytype

- For a Daily type employee the increase will be applied to his daily basic and rounded as specified

- For a Monthly type employee the increase will be applied to his monthly basic and rounded as specified

* Step 7: Click Save

* Step 8: Click Calculate

- Step 9: Click View Calculations

- The automatic Government Salary Increase amount can be seen through the grid

- Step 10: To insert any Company Salary Increase, manually inserting the amount through the column Comp. Inc.

- Step 11: Click Save

- To view the average % increase

- Step 12: Click Average % increase

Average Increase is displayed on a monthly and yearly basis

- Step 13: Click Finalise

- Step 14: Click Finalse Salary Increase

- This step will create a Salary Increase transaction through Payments/Deductions

- Step 15: Click Confirm

- After the calculation is finalised, the company is automatically marked as completed.

How to verify the automatic Government Salary Increase and/or Company Salary Increase

Government Salary Increase

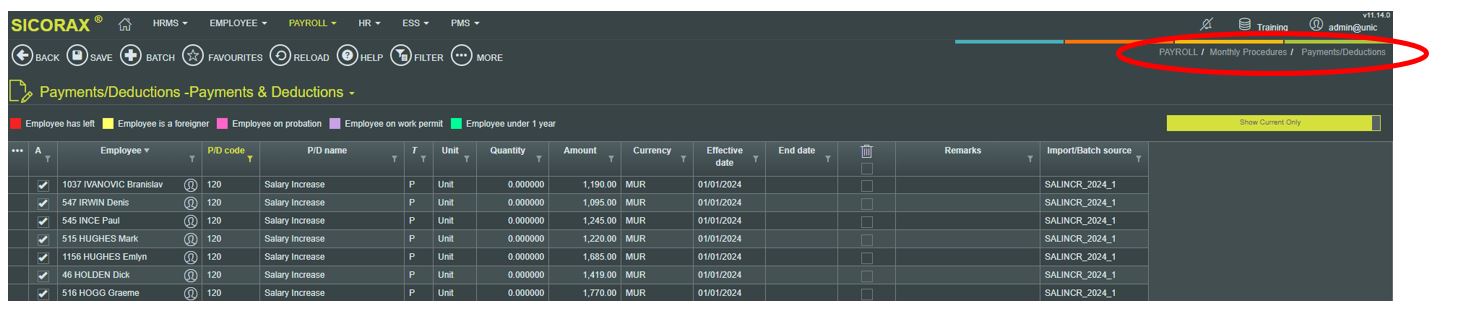

- Go to Payments/Deductions

- Filter the column PDCode for 120 as illustrated above to view the Government Salary Increase transaction

Company Salary Increase

- Filter the column PDCode for 121 as illustrated above to view the Company Salary Increase transaction

Salary Increase Excel Import

Note: The steps and illustrations shown below relate to the Salary Increase Excel Import for the year 2024. The same steps must be followed to perform the Salary Increase Excel Import for 2026.

Salary increase amount can also be imported using an Excel file as shown below.

To import the Salary Increase Excel file, follow the steps below:

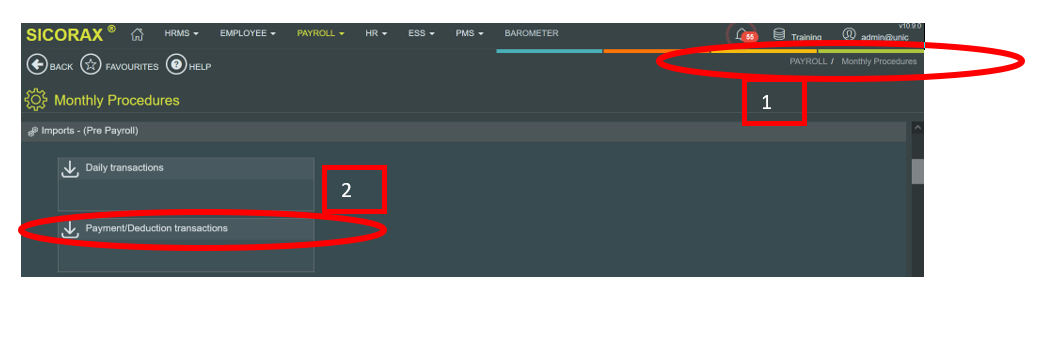

* Step 1: Go to Payroll/Monthly Procedures/Import-Pre-Payroll

* Step 2: Click Payments/Deductions transactions

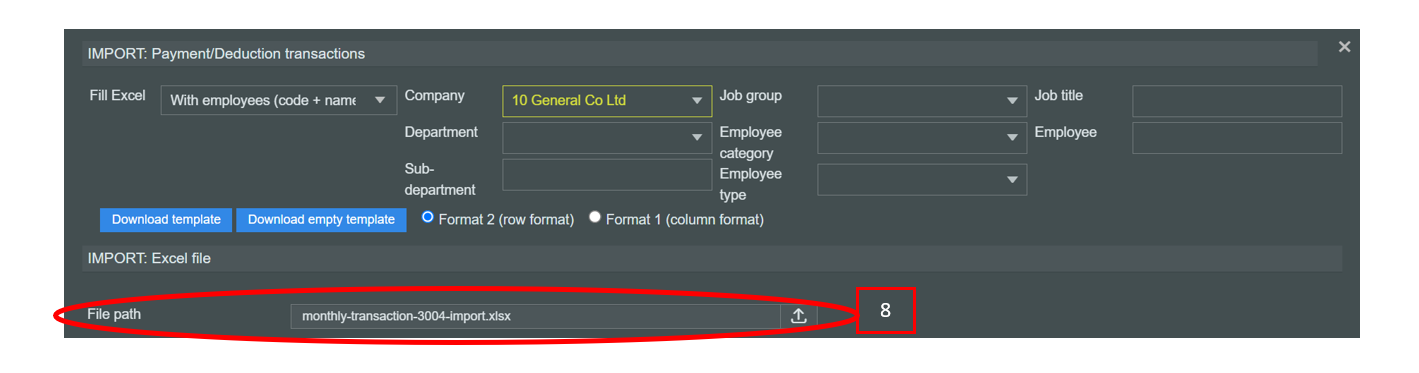

* Step 3: Choose the necessary criteria

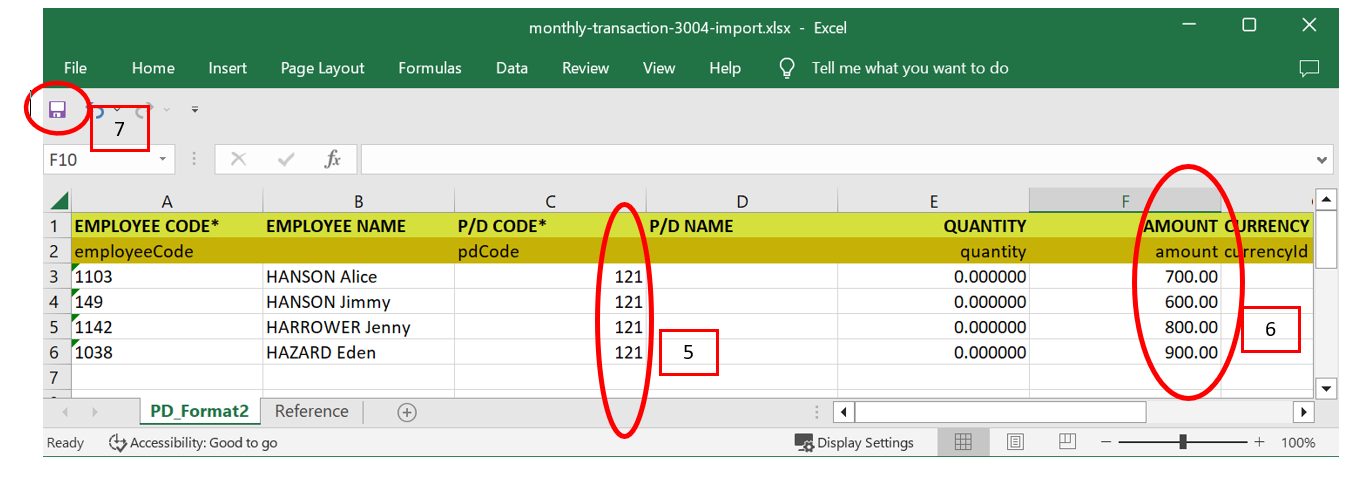

* Step 4: Click download template

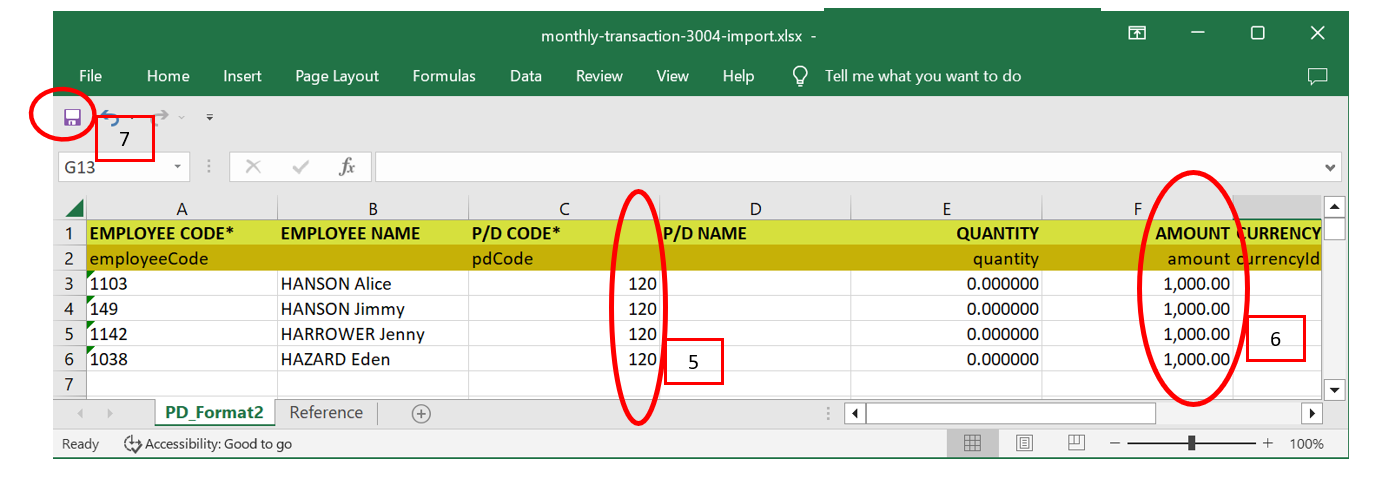

* Step 5: Insert pdcode 120

* Step 6: Insert amount

* Step 7: Click Save

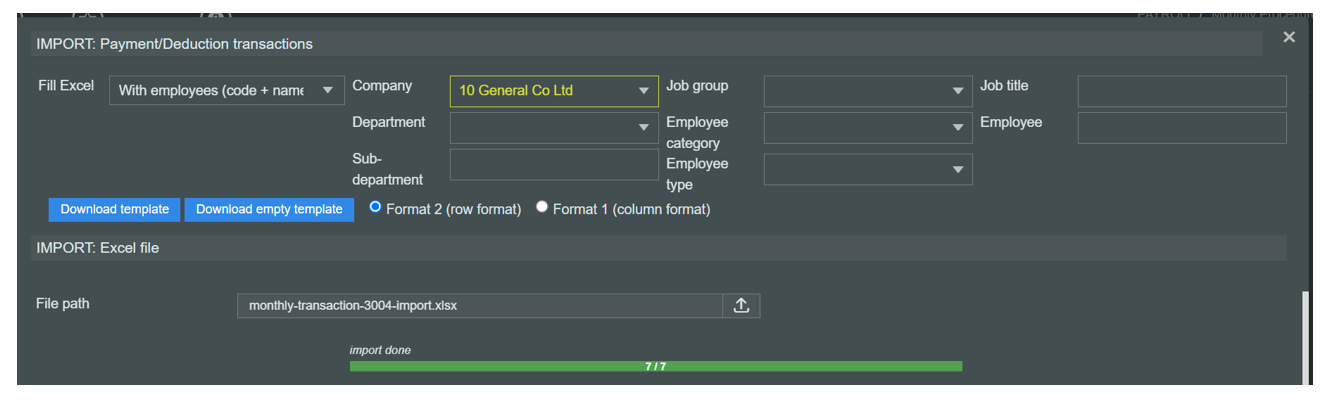

* Step 8: choose import file

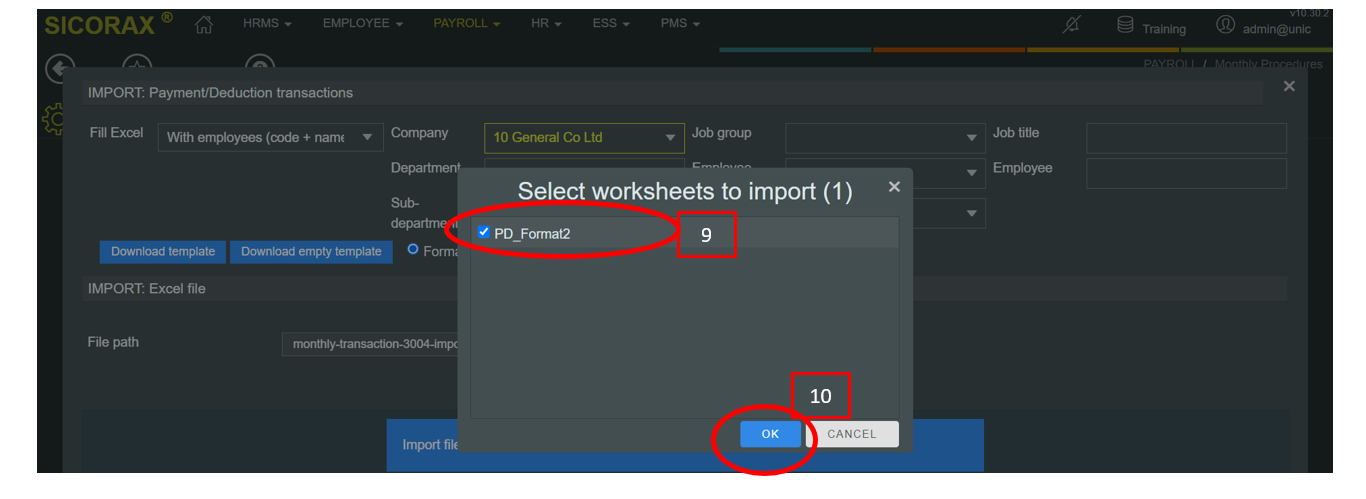

* Step 9: Select worksheet

* Step 10: Click Ok

* Step 11: Close window after successful import

* Step 12: Go to Payments/Deductions to verify the imported salary increase figures

Company Salary Increase

* Should you want to separate the Government Salary Increase from the Company Salary Increase, a different PDCODE e.g 121 must be used (other than PDCODE 120).

* Below is an illustration where the Government Salary Increase is separated from the Company Salary Increase

* Note: Should you want to record the total of the Government Salary Increase and the Company Salary Increase using a single PDCODE, kindly use the PDCODE 121.