End of Year Bonus (Leavers)

With reference to the Workers' Rights Act 2019 - Section D - 54. End of Year Bonus (Leavers)

The calculation and payment of the End of Year Bonus to leavers MUST BE CALCULATED MANUALLY AND PAID IN THE MONTH THAT THE EMPLOYEE IS LEAVING.

The payment of the End of Year Bonus is not applicable to employees who have left before October 2019 but only applies to the below cases:

(1) Employees who resign as from the month of October 2019 after having been employed for at least 8 consecutive months (2) Employees whose employment is terminated and for whom the End of Year Bonus calculation must be performed only on the number of working months

To calculate the End of Year Bonus Earnings you are requested to go through the steps below:

- Step 1: Go to Payroll

- Step 2: Click Statistics

- Step 3: Click Payments & Deductions

End of Year Bonus Earnings (Summary)

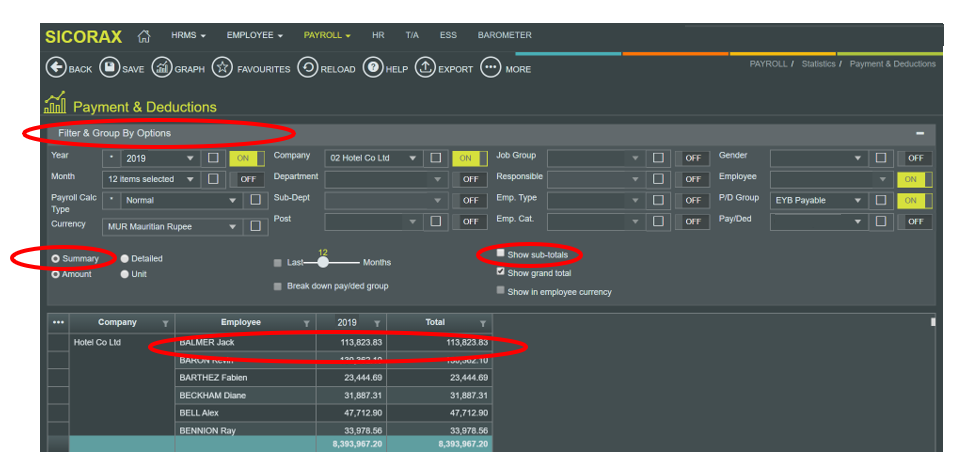

- Step 4: Set the necessary selection, filtering and grouping as illustrated below:

- Year choose 2019 activate ON

- Company choose The required company (in the illustration company 02 has been chosen) activate ON

- Employee activate ON

- PD Group choose EYB Payable activate ON

- Summary select

- Show Sub-Totals Unselect

- Step 5: Below is an illustration of the End of Year Bonus Earnings of all employees.

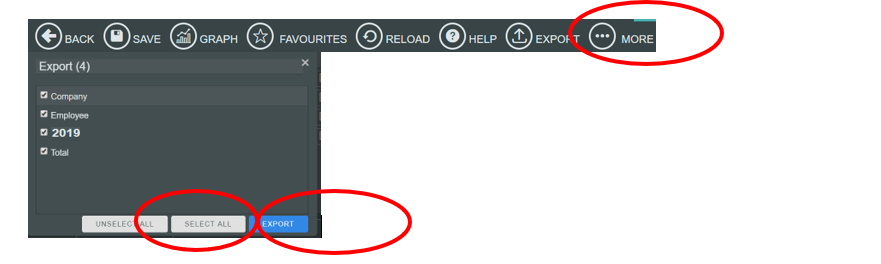

To facilitate the calculation, you may export the figures to Excel and apply the required calculation/formula to calculate the End of Year Bonus amount of the respective leavers as illustrated below:

End of Year Bonus Earnings (Detailed)

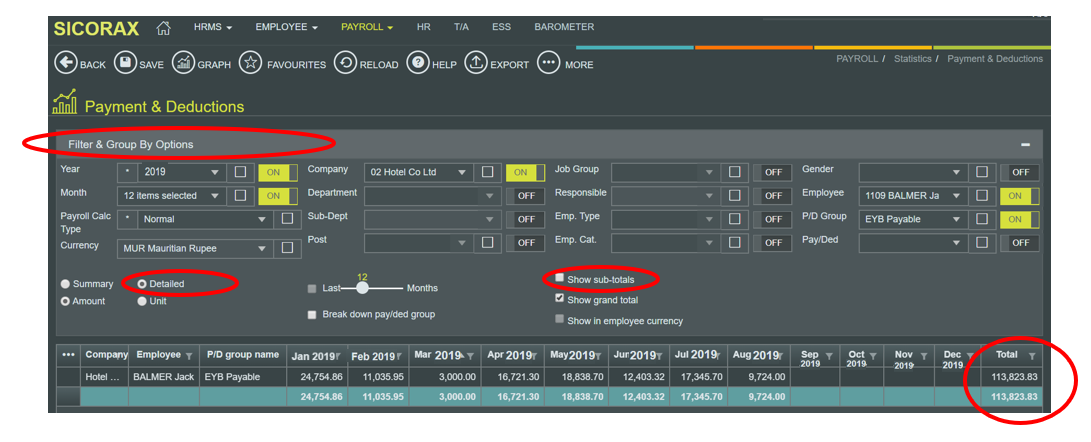

- To display the earnings on a monthly basis, set the necessary selection, filtering and grouping as illustrated below:

- Year choose 2019 activate ON

- Month activate ON

- Company choose The required company (in the illustration company 02 has been chosen) activate ON

- Employee activate ON or you may also Choose an employee

- PD Group choose EYB Payable activate ON

- Detailed select

- Show Sub-Totals Unselect

- Below is an illustration of the detailed EYB earnings of a leaver

To facilitate the calculation, you may export the figures to Excel and apply the required calculation/formula to calculate the End of Year Bonus amount of the respective leavers

End of Year Bonus (Manual Input)

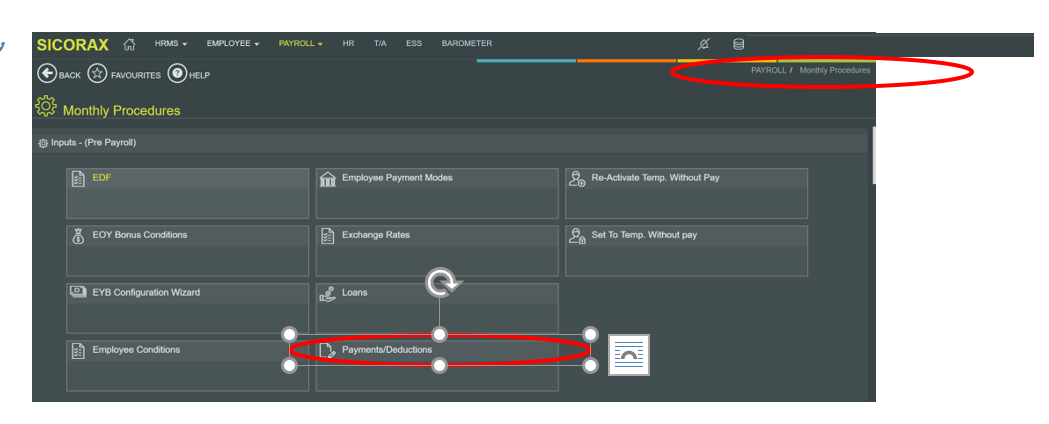

To insert the End of Year Bonus amount per employee you are requested to go through the steps below:

- Step 1: Go to Payroll

- Step 2: Click Monthly procedures

- Step 3: Click Payments/Deductions

- Step 4: Choose the employee and insert the payment code 100 with the necessary amount as illustrated below

- Step 5: Click Save